Document 1

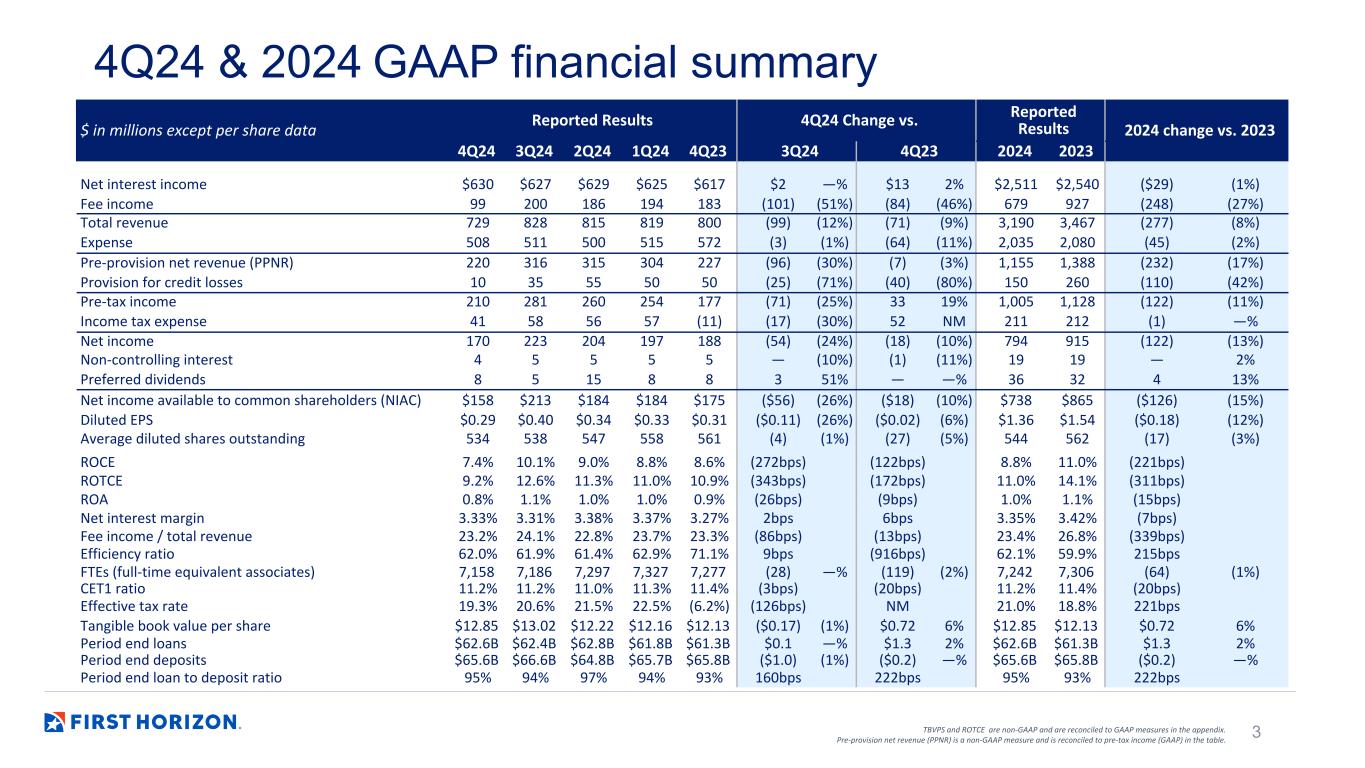

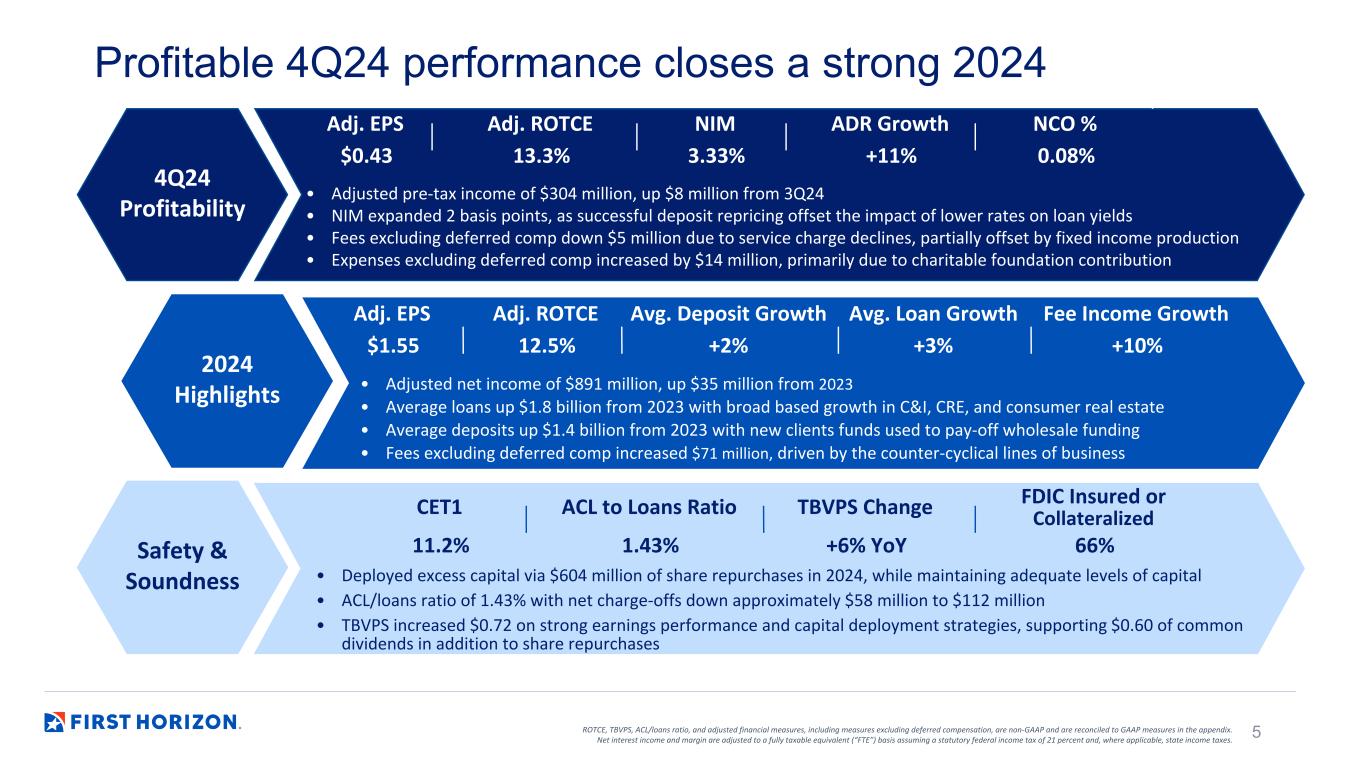

First Horizon Corporation Reports Full Year 2024 Net Income Available to Common Shareholders (NIAC) of $738 Million or EPS of $1.36; Adjusted NIAC increased 5% to $843 Million or $1.55, driven by continued exemplary credit performance, increased fee income generation, and strong margin*

Fourth Quarter 2024 Net Income Available to Common Shareholders of $158 Million or EPS of $0.29;

$228 Million or $0.43 on an Adjusted Basis, up 2% from the prior quarter.*

MEMPHIS, TN (January 16, 2025) – First Horizon Corporation (NYSE: FHN or “First Horizon”) today reported full year 2024 net income available to common shareholders ("NIAC") of $738 million or earnings per share of $1.36, compared with full year 2023 NIAC of $865 million or earnings per share of $1.54. 2024 results were reduced by a net $105 million after-tax or $0.19 per share of notable items compared with a net benefit of $59 million or $0.11 per share in 2023.

“Our fourth quarter and full-year 2024 results reflect focused execution of our strategic priorities,” said Chairman, President and Chief Executive Officer Bryan Jordan. “Strong client relationships and our attractive business mix positioned us to deliver earnings through a complex interest rate cycle. We successfully grew the business in 2024, driven by a strong net interest margin, improved counter-cyclical revenues, and declining net charge-offs. In the fourth quarter 2024, we delivered solid results with a two basis point expansion of net interest margin, a 6% increase in fixed income revenue, and 8 basis points of net charge-offs, starting 2025 with positive momentum."

“I continue to be inspired by our team’s dedication to creating value for our shareholders, clients, and communities and remain confident in our ability to continue to deliver profitable growth in 2025,” Jordan concluded.

Fourth quarter net income available to common shareholders was $158 million or earnings per share of $0.29, compared with third quarter 2024 NIAC of $213 million or earnings per share of $0.40. Fourth quarter 2024 results were reduced by a net $71 million after-tax or $0.13 per share of notable items compared with $11 million or $0.02 per share in third quarter 2024. Excluding notable items, adjusted fourth quarter 2024 NIAC of $228 million or $0.43 per share increased from $224 million or $0.42 per share in third quarter 2024.

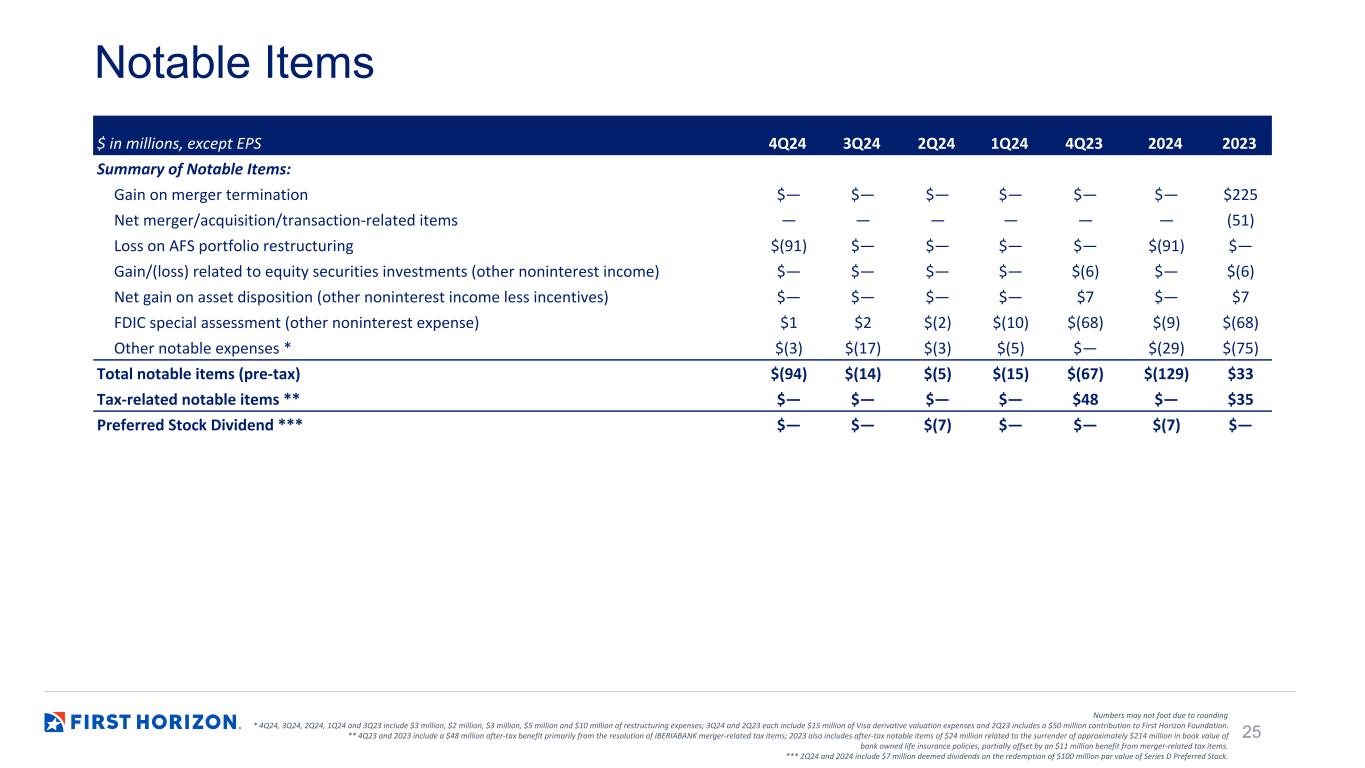

Notable Items

| Notable Items | |||||||||||||||||||||||||||||

| Unaudited ($ in millions, except per share data) | 4Q24 | 3Q24 | 4Q23 | 2024 | 2023 | ||||||||||||||||||||||||

| Summary of Notable Items: | |||||||||||||||||||||||||||||

| Gain on merger termination | $ | — | $ | — | $ | — | $ | — | $ | 225 | |||||||||||||||||||

| Net merger/acquisition/transaction-related items | — | — | — | — | (51) | ||||||||||||||||||||||||

| Loss on AFS portfolio restructuring | (91) | — | — | (91) | — | ||||||||||||||||||||||||

| Gain/(loss) related to equity securities investments (other noninterest income) | — | — | (6) | (6) | |||||||||||||||||||||||||

| Net gain on asset disposition (other noninterest income less incentives) | — | — | 7 | — | 7 | ||||||||||||||||||||||||

| FDIC special assessment (other noninterest expense) | 1 | 2 | (68) | (9) | (68) | ||||||||||||||||||||||||

| Other notable expenses | (3) | (17) | — | (29) | (75) | ||||||||||||||||||||||||

| Total notable items (pre-tax) | (94) | (14) | (67) | (129) | 33 | ||||||||||||||||||||||||

| Total notable items (after-tax) ** | (71) | (11) | (3) | (105) | 59 | ||||||||||||||||||||||||

| Numbers may not foot due to rounding. | |||||||||||||||||||||||||||||

** 4Q23 and 2023 include a $48 million after-tax benefit primarily from the resolution of IBERIABANK merger-related tax items; 2023 also includes after-tax notable items of $13 million comprised of $24 million related to the surrender of approximately $214 million in book value of bank owned life insurance policies, partially offset by an $11 million benefit from merger-related tax items. 2Q24 and 2024 include $7 million deemed dividends on the redemption of $100 million par value of Series D Preferred Stock. | |||||||||||||||||||||||||||||

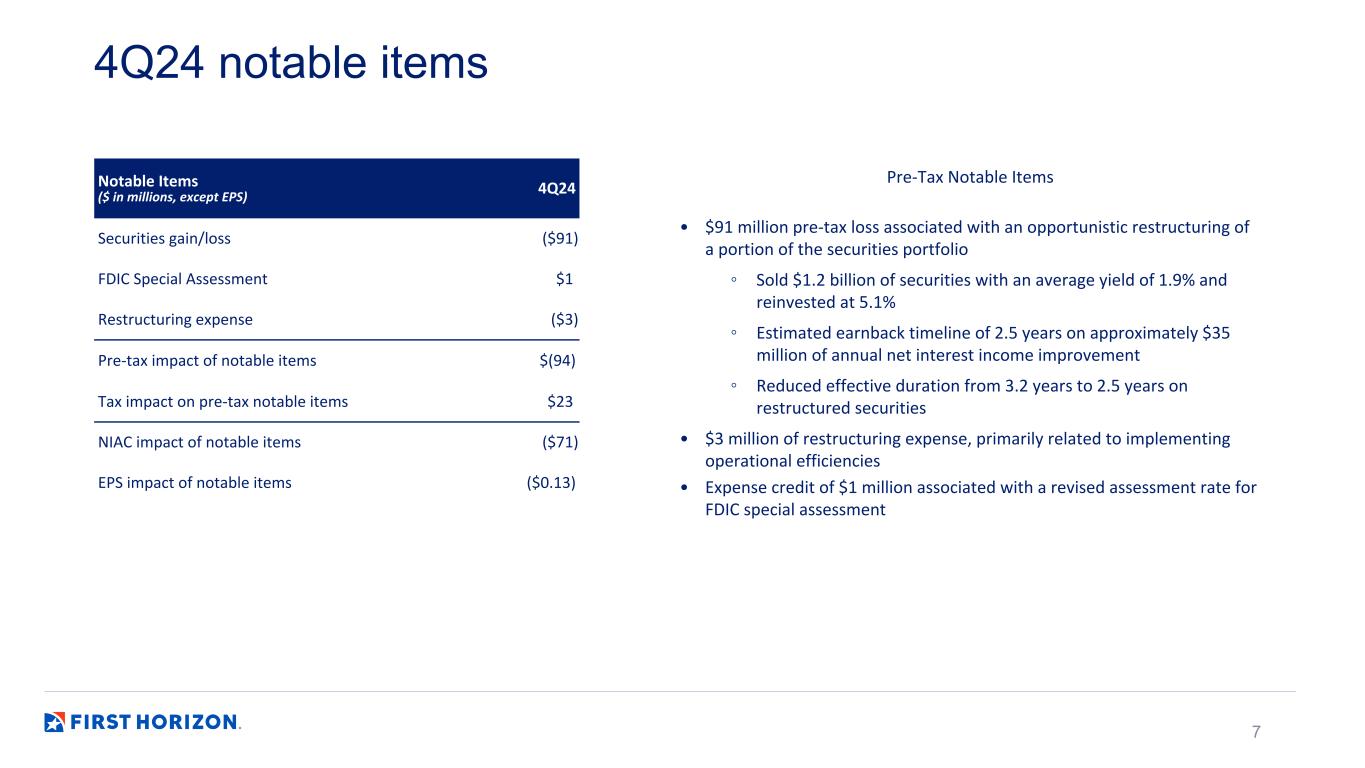

Fourth quarter pre-tax notable items include a $91 million loss on an opportunistic restructuring of a portion of the securities portfolio, $3 million of restructuring expense, and an expense credit of $1 million related to the FDIC special assessment.

During 2024, we reorganized our internal management structure and, accordingly, reclassified our reportable business segments. Prior to the 2024 reclassification, we operated through three business segments: (1) regional, (2) specialty, and (3) corporate. As a result of the 2024 reclassification, our reportable business segments now include: (1) commercial, consumer & wealth, (2) wholesale, and (3) corporate. In this release, segment information for prior periods has been reclassified to conform with our current segments.

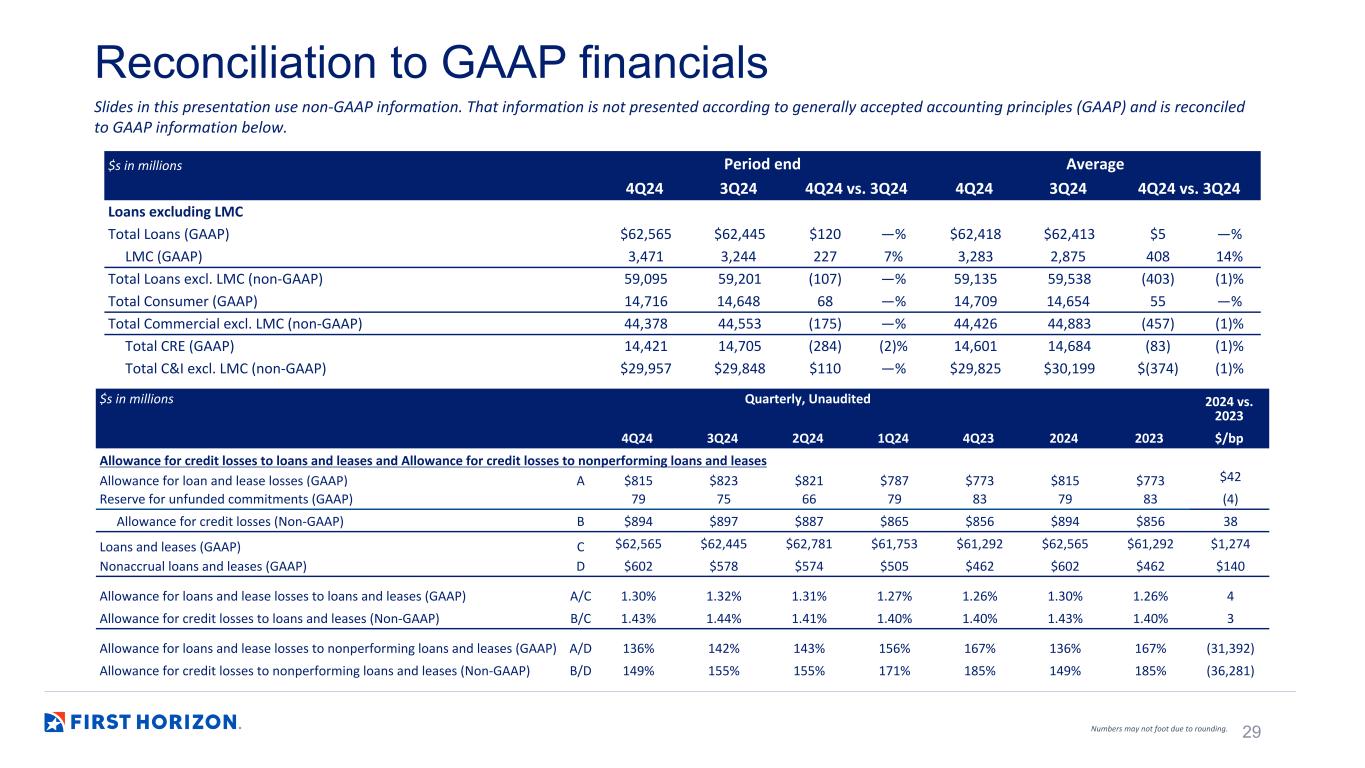

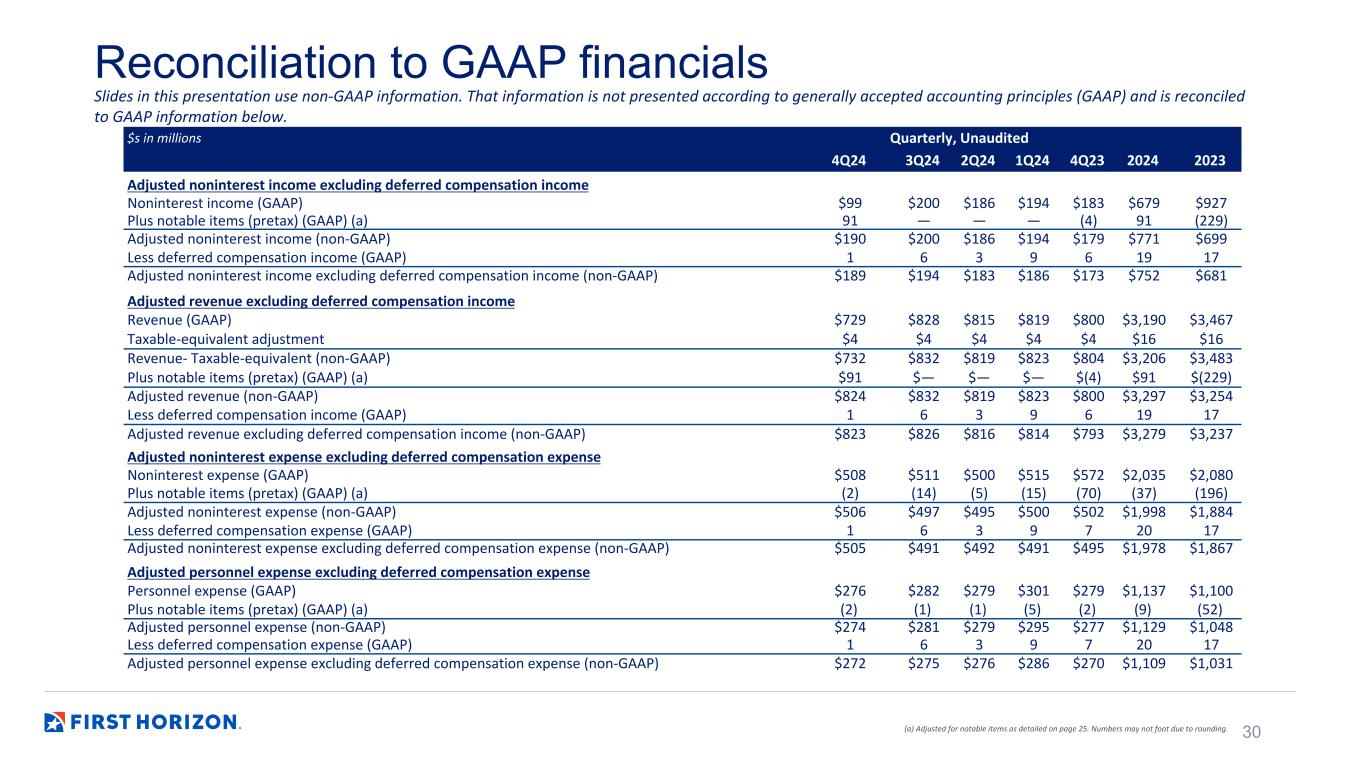

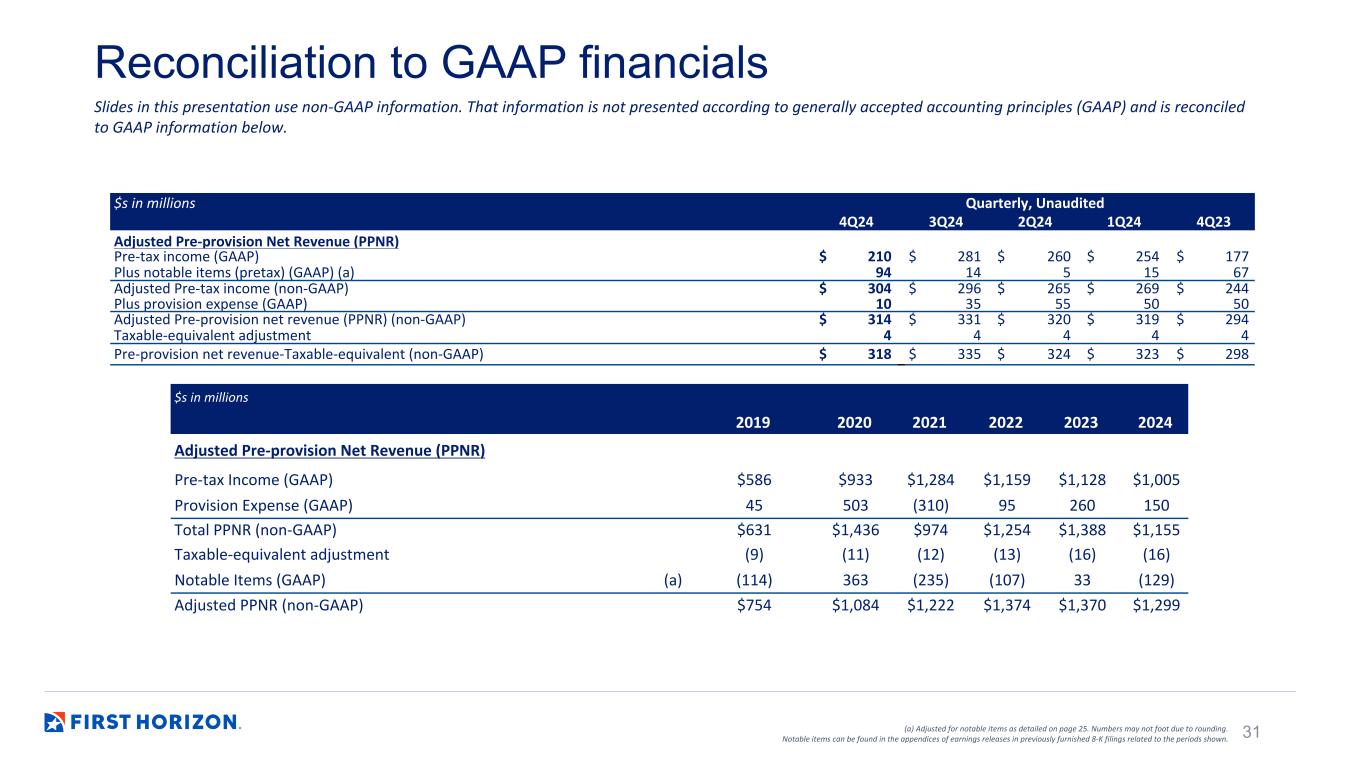

*ROTCE, PPNR, tangible book value per share, loans and leases excluding LMC, and "adjusted" results are non-GAAP financial measures; NII, total revenue, NIM and PPNR are presented on a fully taxable equivalent basis; references to loans include leases and EPS are based on diluted shares; capital ratios are preliminary. See page 6 for information on our use of non-GAAP measures and their reconciliation to GAAP beginning on page 22.

1

Full Year 2024 versus Full Year 2023

Net interest income

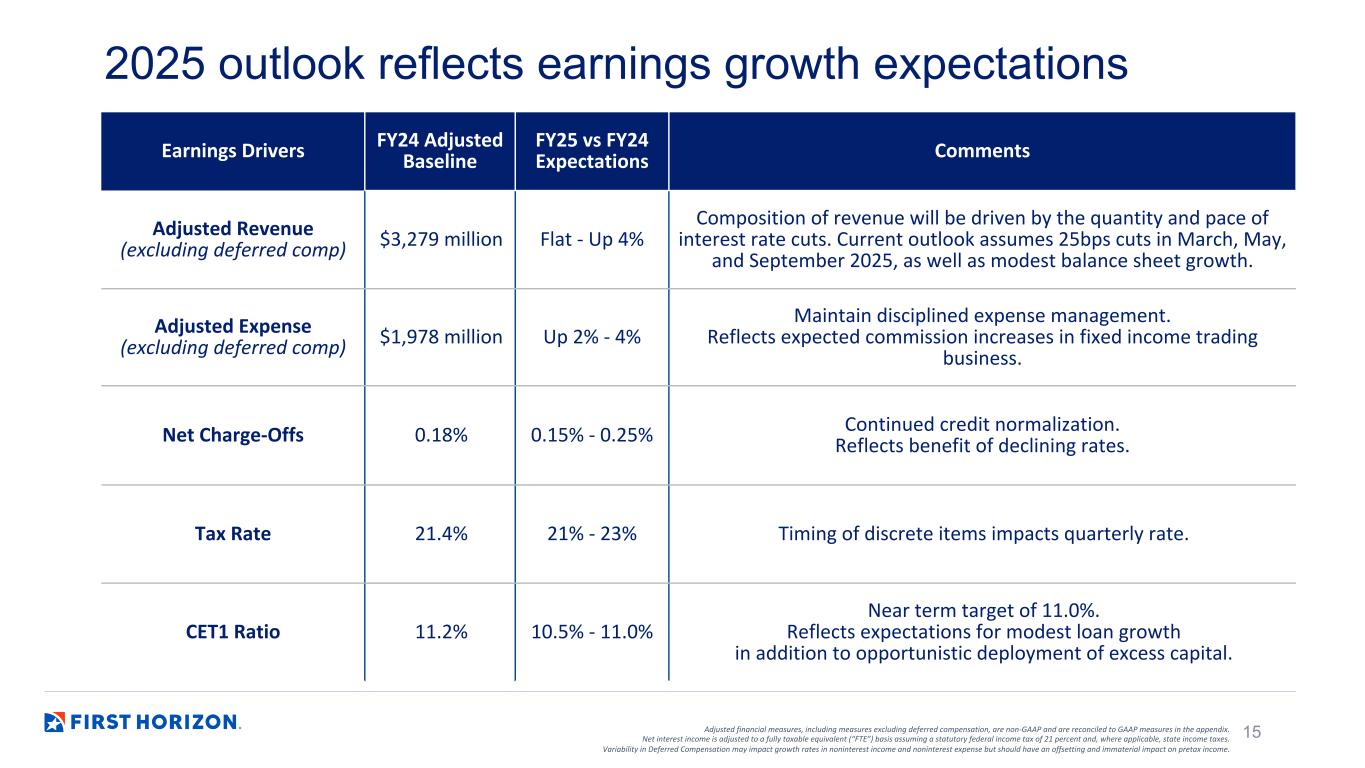

Net interest income (FTE) of $2.5 billion decreased $29 million. 2023 benefited from rising short-term rates, which began to reverse in the latter half of 2024. Higher loan yields and 3% average loan growth largely offset the increase in funding costs as the lag in deposit pricing diminished late in the cycle. Net interest margin declined modestly to 3.35%, down 7 basis points from the prior year.

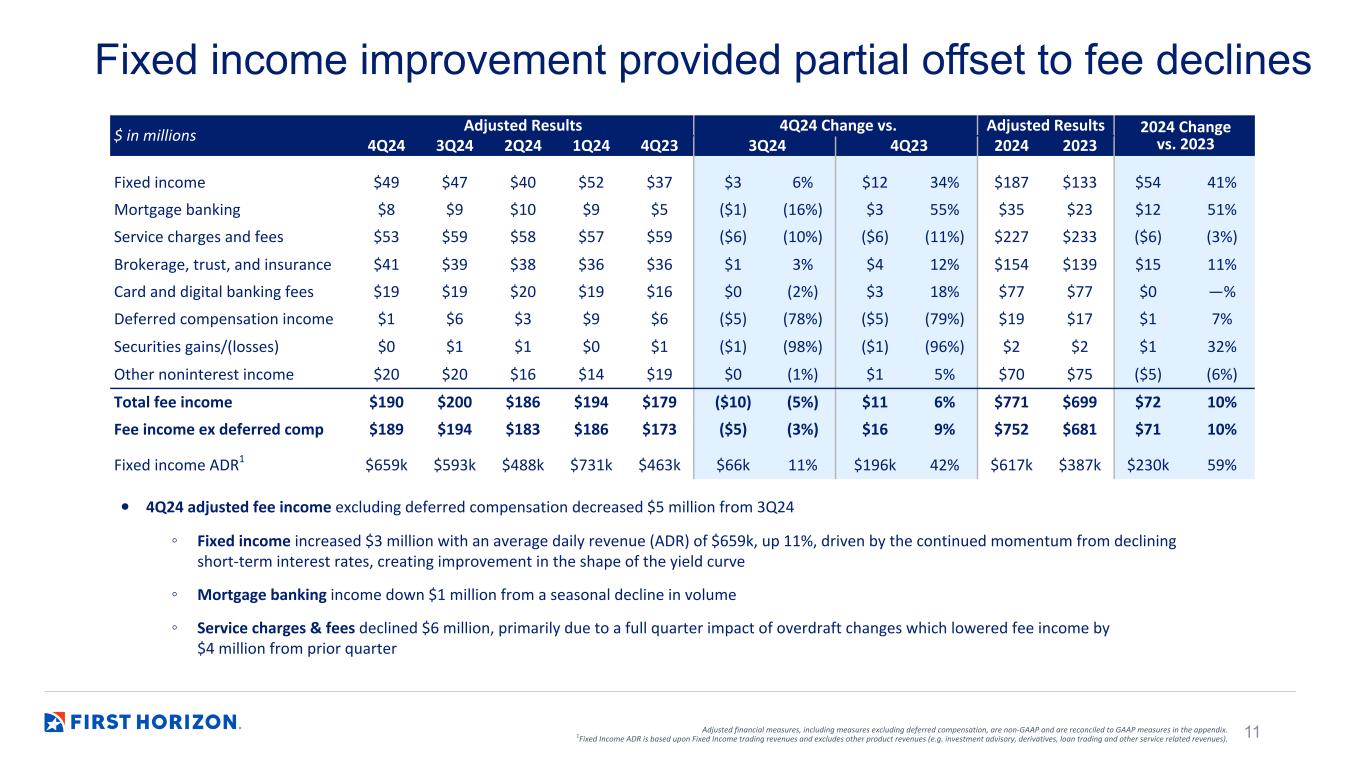

Noninterest income

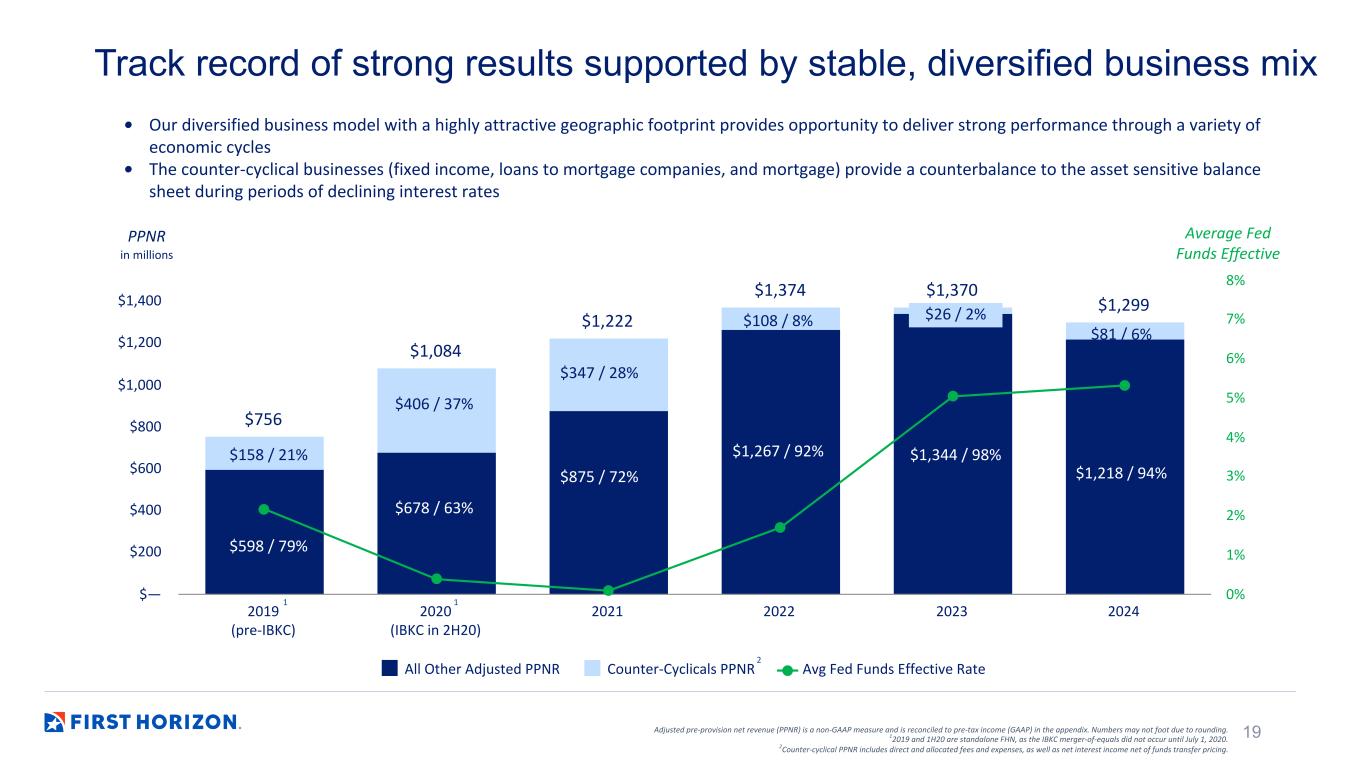

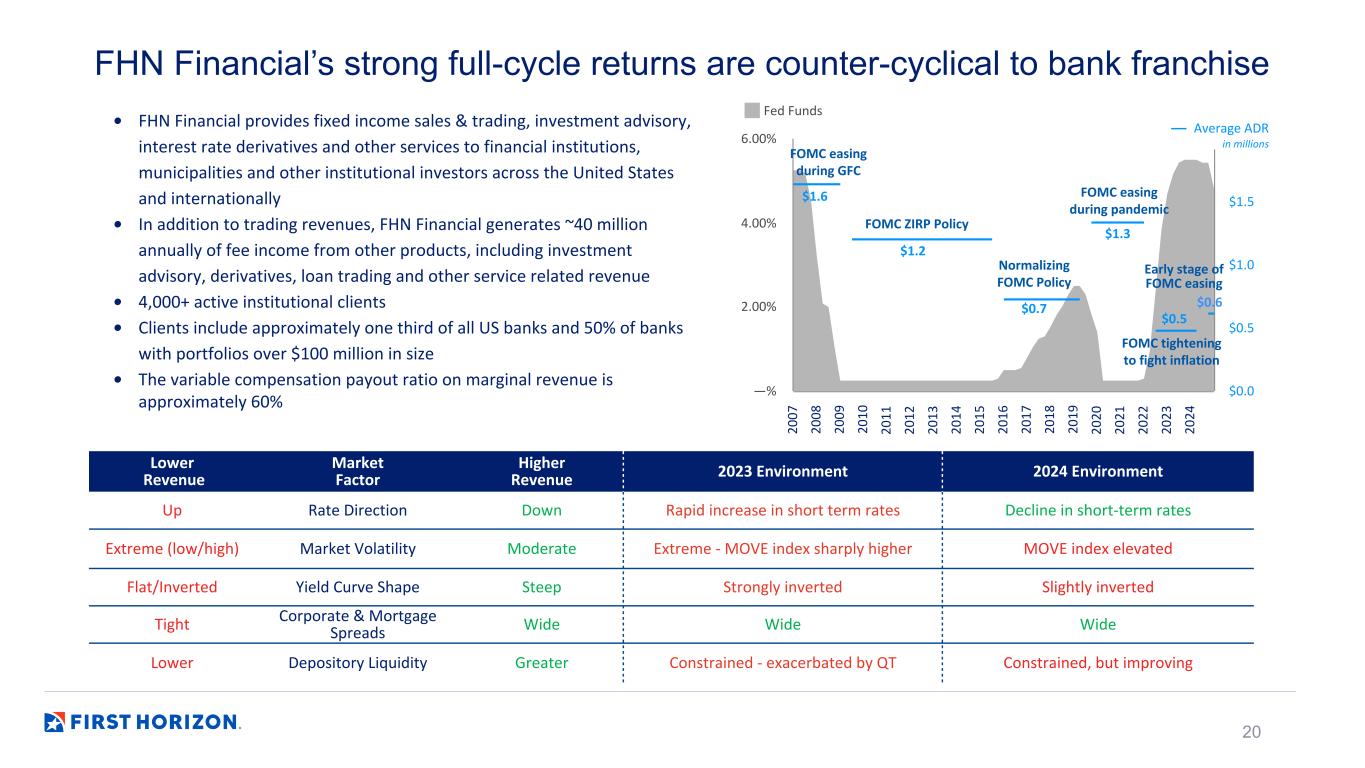

Noninterest income of $679 million decreased $248 million, largely driven by a $225 million merger termination fee in 2023. Adjusted noninterest income of $771 million increased $72 million as the counter-cyclical businesses improved from cycle lows in 2023: fixed income revenues increased by $54 million and mortgage banking revenues improved $12 million. Brokerage, trust, and insurance grew $15 million, which was partially offset by declines in service charges and other fees.

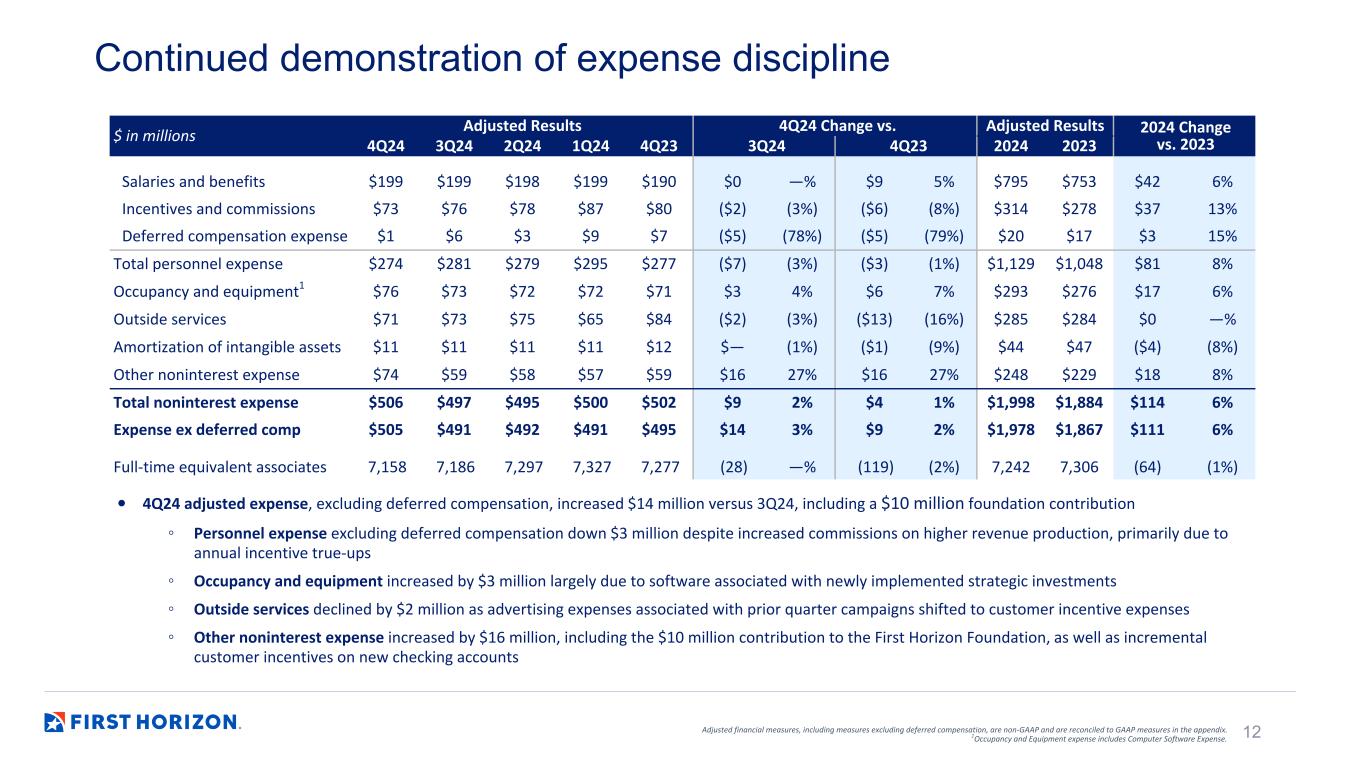

Noninterest expense

Noninterest expense of $2.0 billion decreased $45 million and included $37 million of notable items in 2024 and $196 million in 2023. Adjusted noninterest expense of $2.0 billion increased $114 million, driven by a $37 million increase in incentives on higher commission-based revenue, as well as strategic investments in personnel and technology.

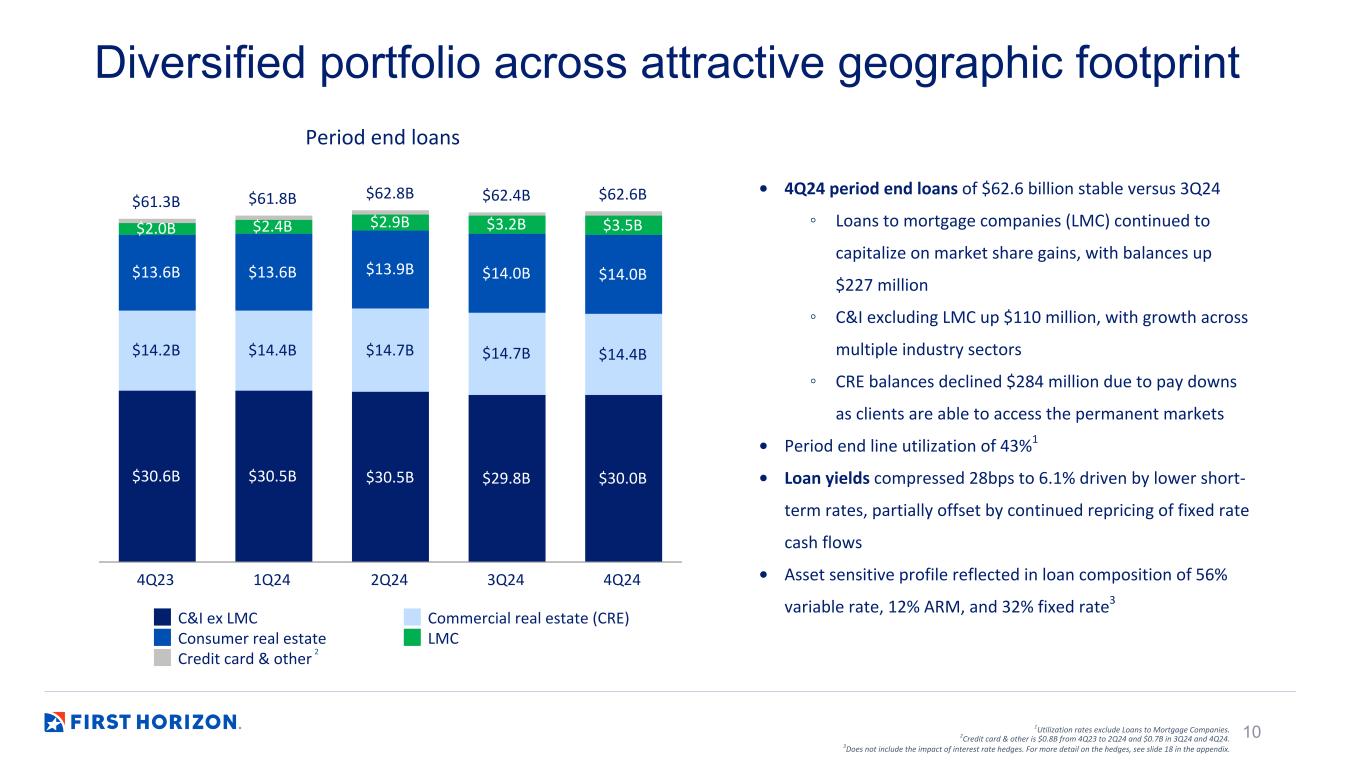

Loans and leases

Average loan and lease balances of $62.0 billion increased $1.8 billion, including $0.5 billion of growth in loans to mortgage companies (LMC) from market share gains and fund-up of existing commercial real estate loans. Period-end loans and leases were $62.6 billion, increasing $1.3 billion, with loans to mortgage companies up $1.4 billion from 2023 year end.

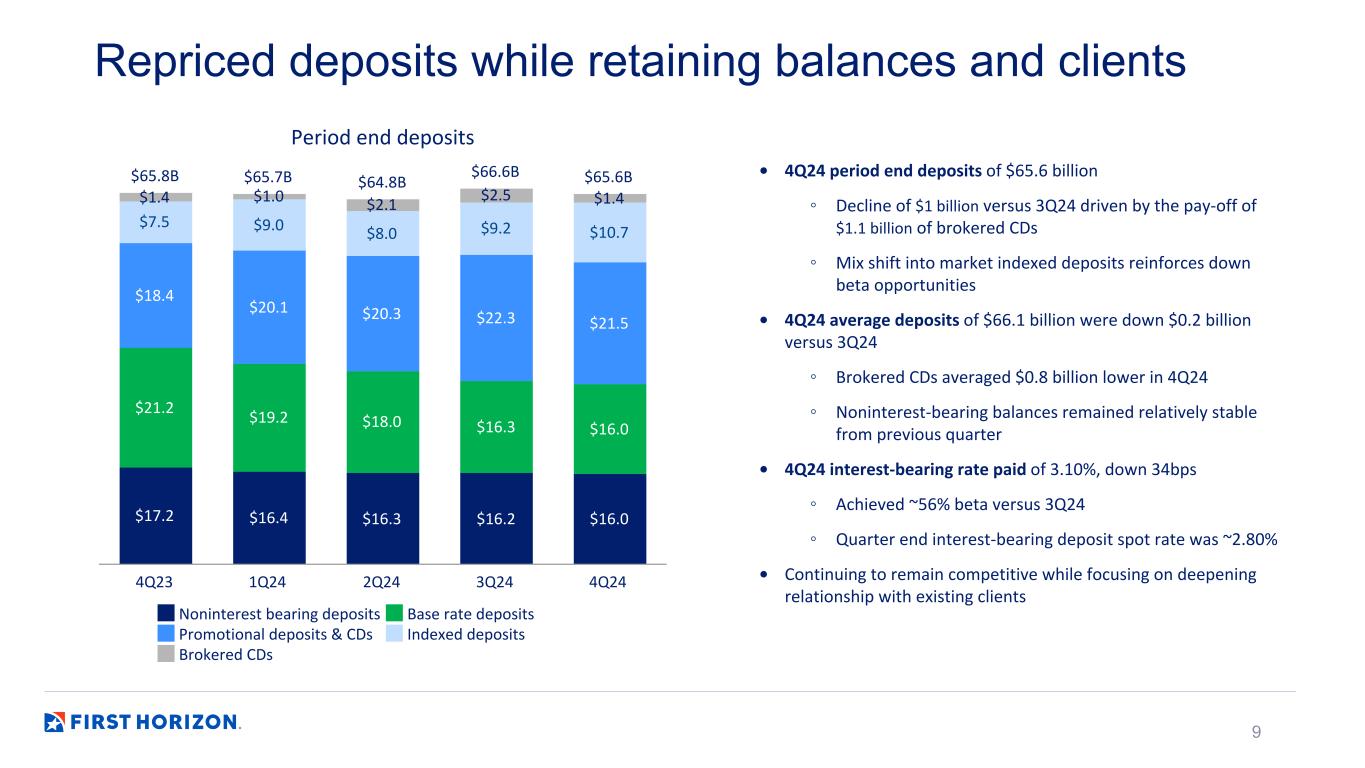

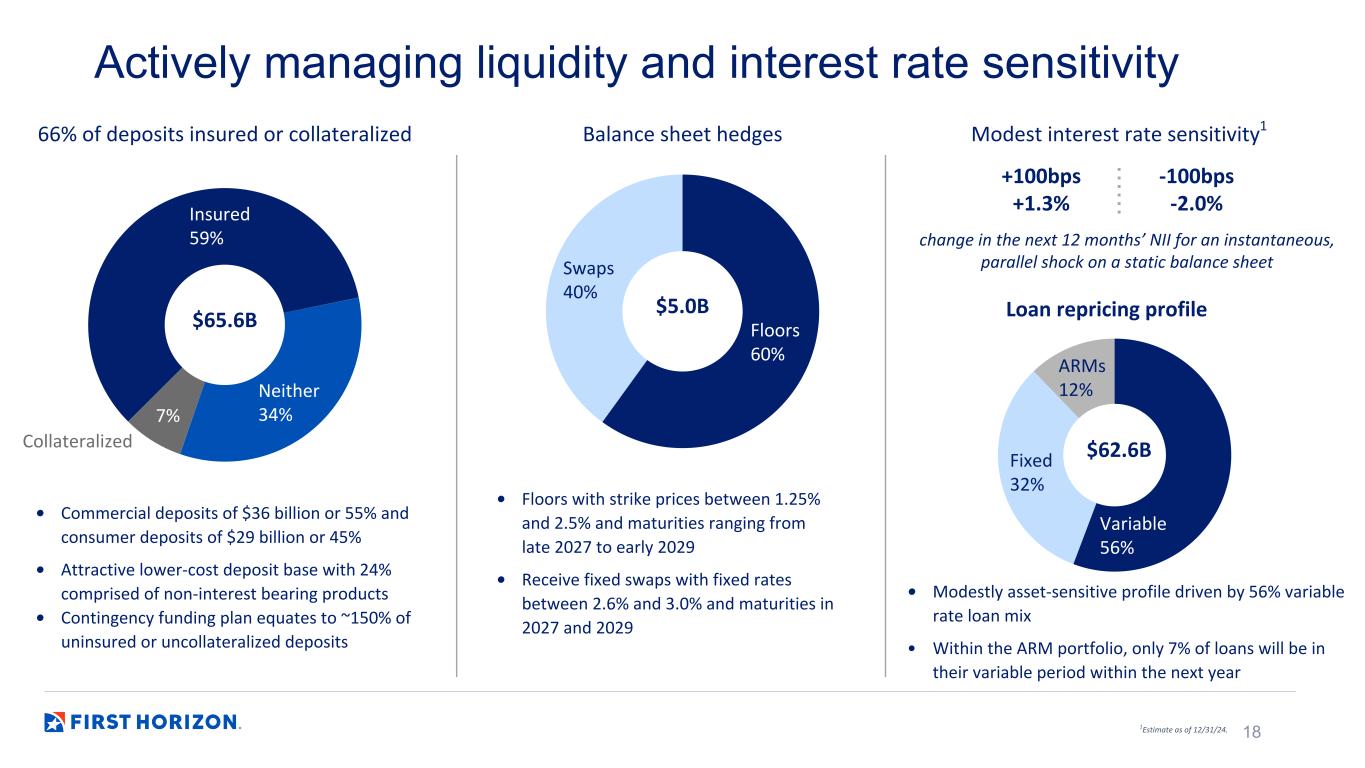

Deposits

Average deposits of $65.7 billion increased 2%, and period end deposits of $65.6 billion were flat compared to year end 2023. Deposit costs increased 50 basis points year-over-year, however the repricing efforts begun in late 2023 reduced the rate paid from 2.49% in 4Q23 to 2.34% in 4Q24.

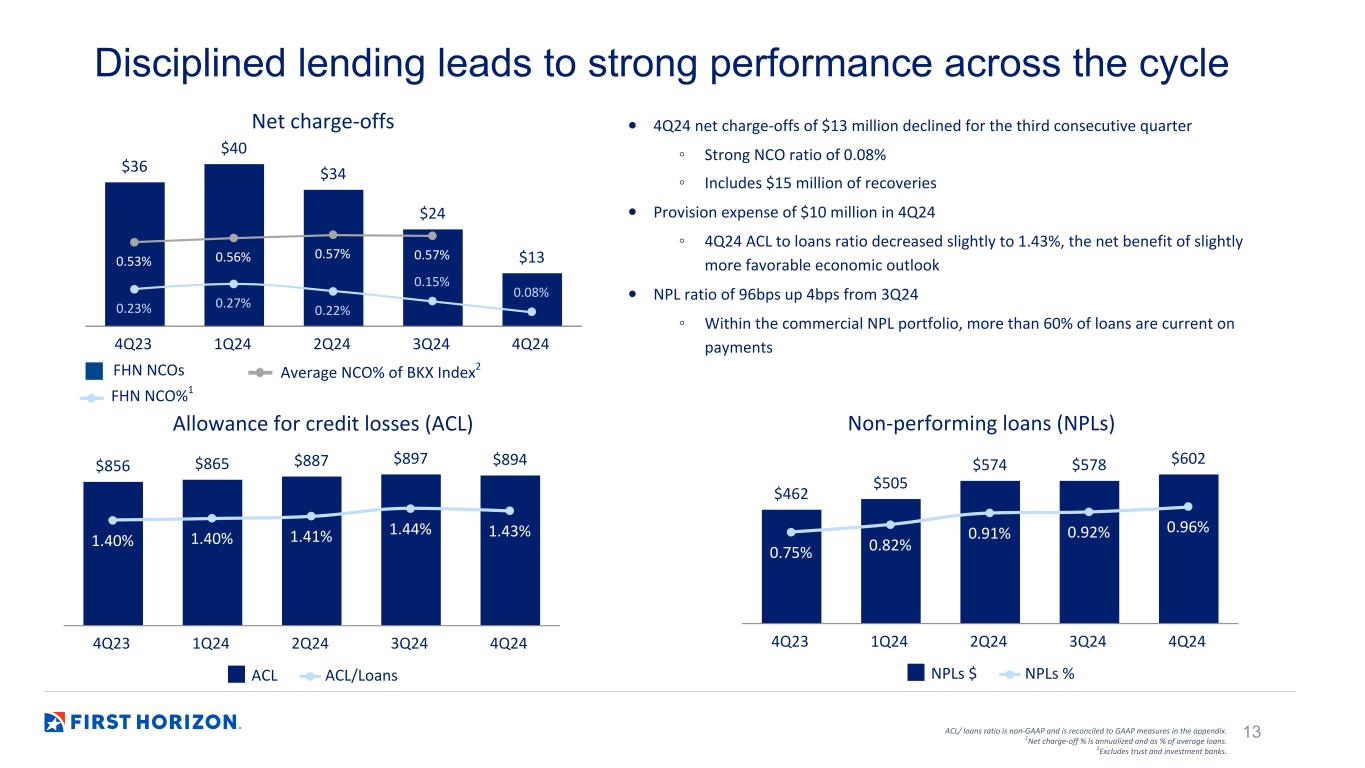

Asset quality

Provision expense of $150 million decreased from $260 million in 2023. Net charge-offs were $112 million or 0.18% versus $170 million or 0.28% in 2023. 2023 included a $72 million idiosyncratic credit loss on a single relationship in the third quarter. The ACL to loans ratio increased slightly to 1.43% from 1.40% in the prior year, largely driven by grade migration.

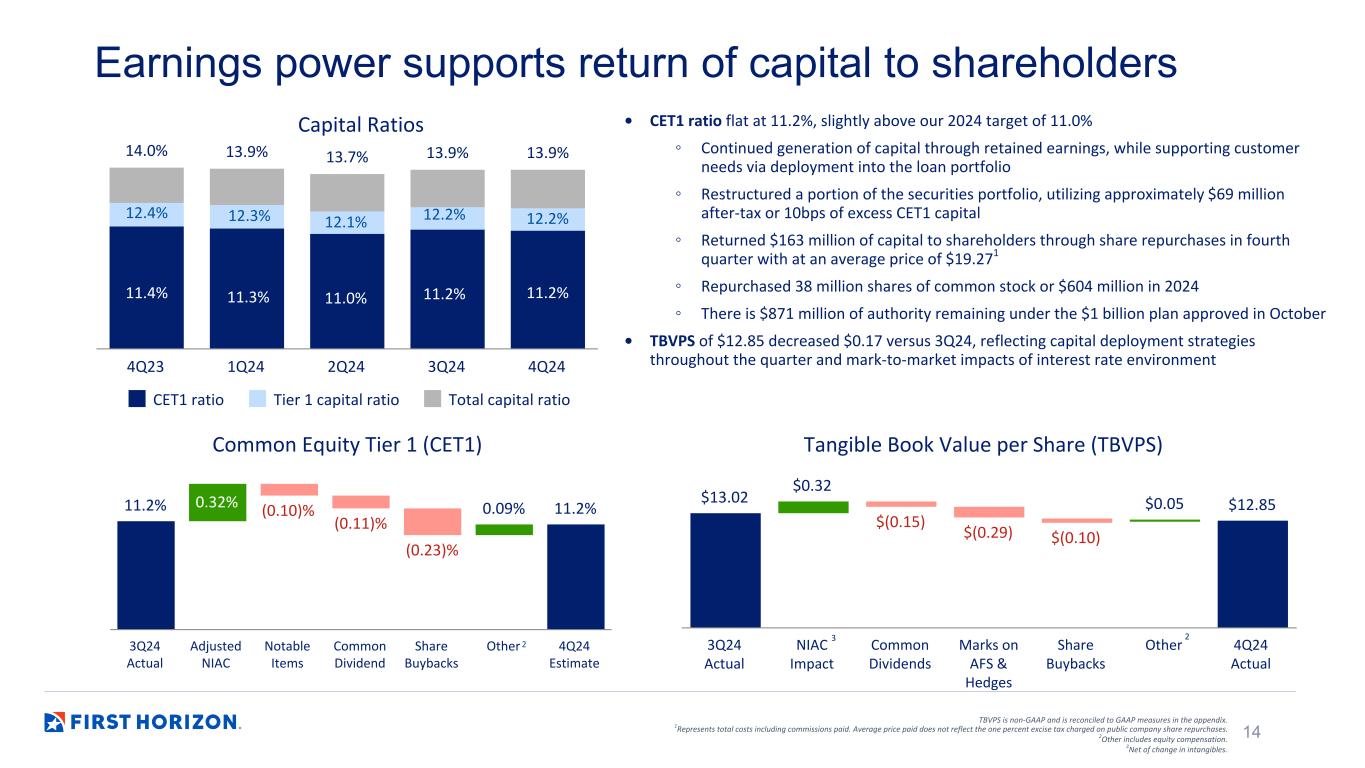

Capital

CET1 ratio was 11.2% and total capital ratio was 13.9% at year end 2024, down from 11.4% and 14.0%, respectively, at the end of 2023. Returned $604 million of capital to shareholders in 2024 through share repurchases at an average price of $15.98. Opportunistically restructured the securities portfolio, utilizing 10 basis points or $69 million of excess capital.

Income taxes

2024 effective tax rate was 21.0% compared with 18.8% in 2023. On an adjusted basis, the effective tax rate was 21.4% in 2024 and 21.8%in2023. 2023 included a $35 million net benefit from tax-related notable items, which included a $59 million benefit related to the resolution of merger-related tax items, partially offset by $24 million related to the surrender of approximately $214 million in book value of bank owned life insurance policies.

2

| SUMMARY RESULTS | ||||||||||||||||||||||||||

| Annual, Unaudited | ||||||||||||||||||||||||||

| ($s in millions, except per share and balance sheet data) | 2024 | 2023 | ||||||||||||||||||||||||

| $/bp | % | |||||||||||||||||||||||||

| Income Statement | ||||||||||||||||||||||||||

Interest income - taxable equivalent1 | $ | 4,367 | $ | 4,115 | $ | 251 | 6 | % | ||||||||||||||||||

Interest expense- taxable equivalent1 | 1,841 | 1,560 | 281 | 18 | ||||||||||||||||||||||

| Net interest income- taxable equivalent | 2,526 | 2,556 | (29) | (1) | ||||||||||||||||||||||

| Less: Taxable-equivalent adjustment | 16 | 16 | — | (1) | ||||||||||||||||||||||

| Net interest income | 2,511 | 2,540 | (29) | (1) | ||||||||||||||||||||||

| Noninterest income | 679 | 927 | (248) | (27) | ||||||||||||||||||||||

| Total revenue | 3,190 | 3,467 | (277) | (8) | ||||||||||||||||||||||

| Noninterest expense | 2,035 | 2,080 | (45) | (2) | ||||||||||||||||||||||

Pre-provision net revenue3 | 1,155 | 1,388 | (232) | (17) | ||||||||||||||||||||||

| Provision for credit losses | 150 | 260 | (110) | (42) | ||||||||||||||||||||||

| Income before income taxes | 1,005 | 1,128 | (122) | (11) | ||||||||||||||||||||||

| Provision for income taxes | 211 | 212 | (1) | — | ||||||||||||||||||||||

| Net income | 794 | 915 | (122) | (13) | ||||||||||||||||||||||

| Net income attributable to noncontrolling interest | 19 | 19 | — | 2 | ||||||||||||||||||||||

| Net income attributable to controlling interest | 775 | 897 | (122) | (14) | ||||||||||||||||||||||

| Preferred stock dividends | 36 | 32 | 4 | 13 | ||||||||||||||||||||||

| Net income available to common shareholders | $ | 738 | $ | 865 | $ | (126) | (15) | |||||||||||||||||||

Adjusted net income4 | $ | 891 | $ | 856 | $ | 35 | 4 | % | ||||||||||||||||||

Adjusted net income available to common shareholders4 | $ | 843 | $ | 806 | $ | 37 | 5 | % | ||||||||||||||||||

| Common stock information | ||||||||||||||||||||||||||

| EPS | $ | 1.36 | $ | 1.54 | $ | (0.18) | (12) | % | ||||||||||||||||||

Adjusted EPS4 | $ | 1.55 | $ | 1.43 | $ | 0.12 | 8 | % | ||||||||||||||||||

Diluted shares8 | 544 | 562 | (17) | (3) | % | |||||||||||||||||||||

| Key performance metrics | ||||||||||||||||||||||||||

Net interest margin6 | 3.35 | % | 3.42 | % | (7) | bp | ||||||||||||||||||||

| Efficiency ratio | 62.06 | 59.91 | 215 | |||||||||||||||||||||||

Adjusted efficiency ratio4 | 60.64 | 57.93 | 271 | |||||||||||||||||||||||

| Effective income tax rate | 21.03 | 18.82 | 221 | |||||||||||||||||||||||

| Return on average assets | 0.97 | 1.12 | (15) | |||||||||||||||||||||||

Adjusted return on average assets4 | 1.09 | 1.05 | 4 | |||||||||||||||||||||||

| Return on average common equity (“ROCE") | 8.8 | 11.0 | (221) | |||||||||||||||||||||||

Return on average tangible common equity (“ROTCE”)4 | 11.0 | 14.1 | (311) | |||||||||||||||||||||||

Adjusted ROTCE4 | 12.5 | 13.3 | (77) | |||||||||||||||||||||||

| Noninterest income as a % of total revenue | 23.44 | 26.83 | (339) | |||||||||||||||||||||||

Adjusted noninterest income as a % of total revenue4 | 23.33 | % | 21.43 | % | 190 | bp | ||||||||||||||||||||

| Balance Sheet (billions) | ||||||||||||||||||||||||||

| Average loans | $ | 62.0 | $ | 60.2 | $ | 1.8 | 3 | % | ||||||||||||||||||

| Average deposits | 65.7 | 64.3 | 1.4 | 2 | ||||||||||||||||||||||

| Average assets | 81.8 | 81.7 | 0.1 | — | ||||||||||||||||||||||

| Average common equity | $ | 8.4 | $ | 7.9 | $ | 0.5 | 7 | % | ||||||||||||||||||

| Asset Quality Highlights | ||||||||||||||||||||||||||

Allowance for credit losses to loans and leases4 | 1.43 | % | 1.40 | % | 3 | bp | ||||||||||||||||||||

| Nonperforming loan and leases ratio | 0.96 | % | 0.75 | % | 21 | bp | ||||||||||||||||||||

| Net charge-off ratio | 0.18 | % | 0.28 | % | (10) | bp | ||||||||||||||||||||

| Net charge-offs | $ | 112 | $ | 170 | $ | (58) | NM | |||||||||||||||||||

| Capital Ratio Highlights (current quarter is an estimate) | ||||||||||||||||||||||||||

| Common Equity Tier 1 | 11.2 | % | 11.4 | % | (20) | bp | ||||||||||||||||||||

| Tier 1 | 12.2 | 12.4 | (21) | |||||||||||||||||||||||

| Total Capital | 13.9 | 14.0 | (10) | |||||||||||||||||||||||

| Tier 1 leverage | 10.6 | % | 10.7 | % | (5) | bp | ||||||||||||||||||||

Numbers may not foot due to rounding.

Certain previously reported amounts have been reclassified to agree with current presentation.

See footnote disclosures on page 21.

3

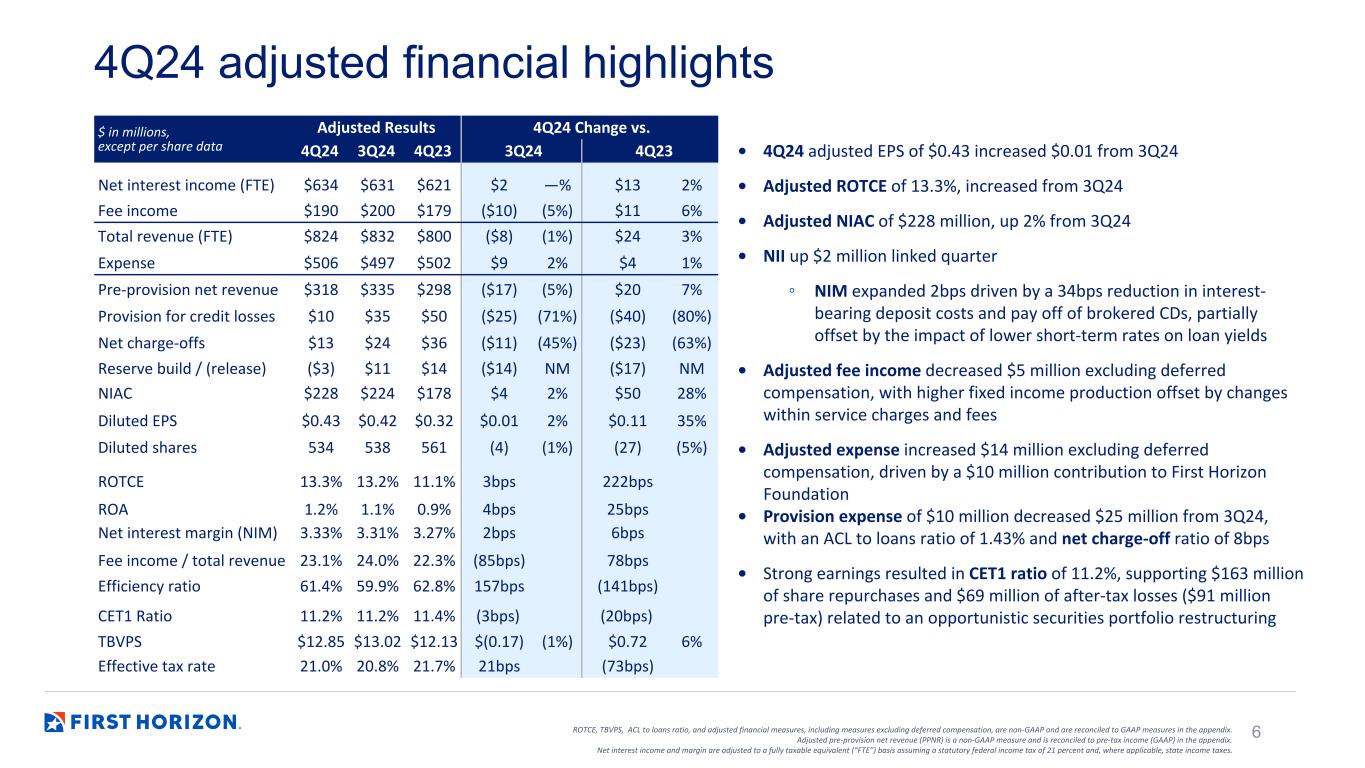

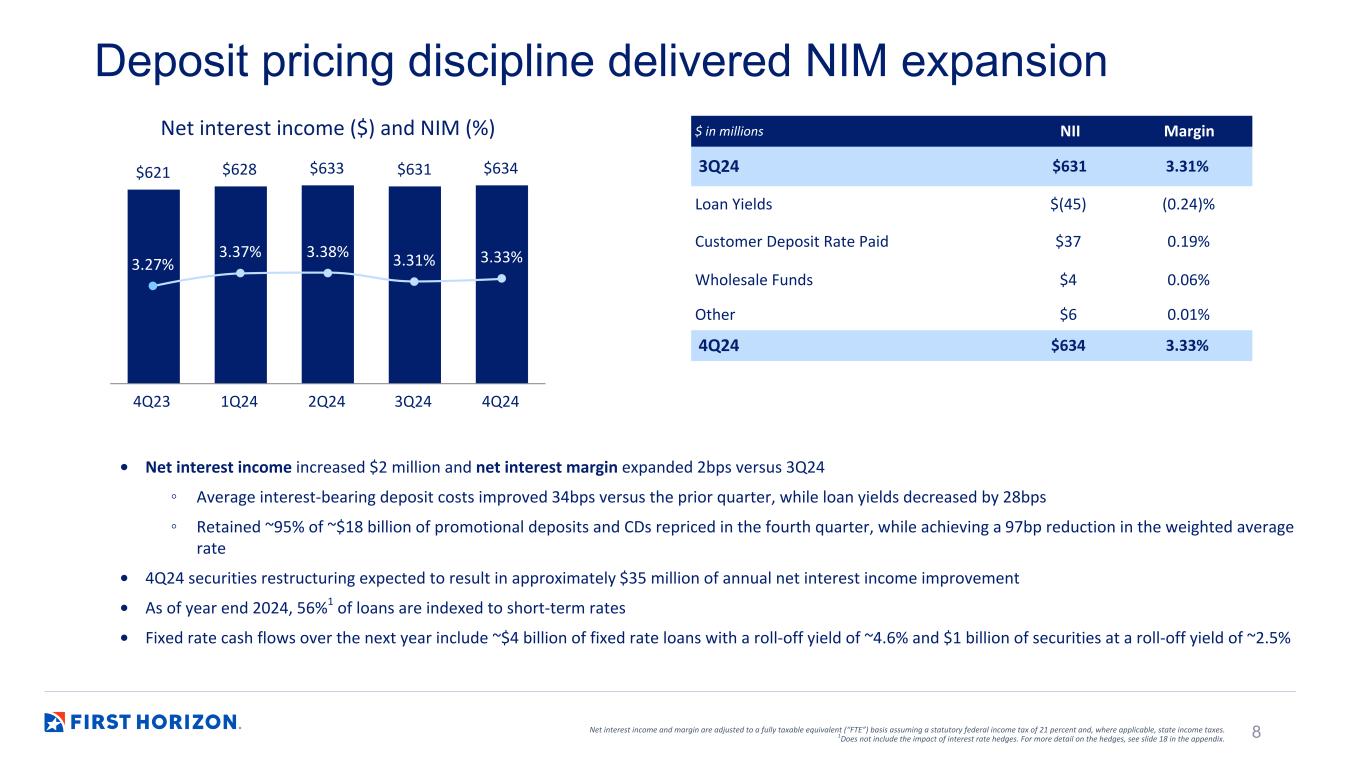

Fourth Quarter 2024 versus Third Quarter 2024

Net interest income

Net interest income (FTE) increased $2 million to $634 million and net interest margin of 3.33% increased 2 basis points. Both changes were driven by a 34 basis point reduction in interest-bearing deposit costs and pay off of brokered CDs, partially offset by the impact of lower short-term rates on loan yields.

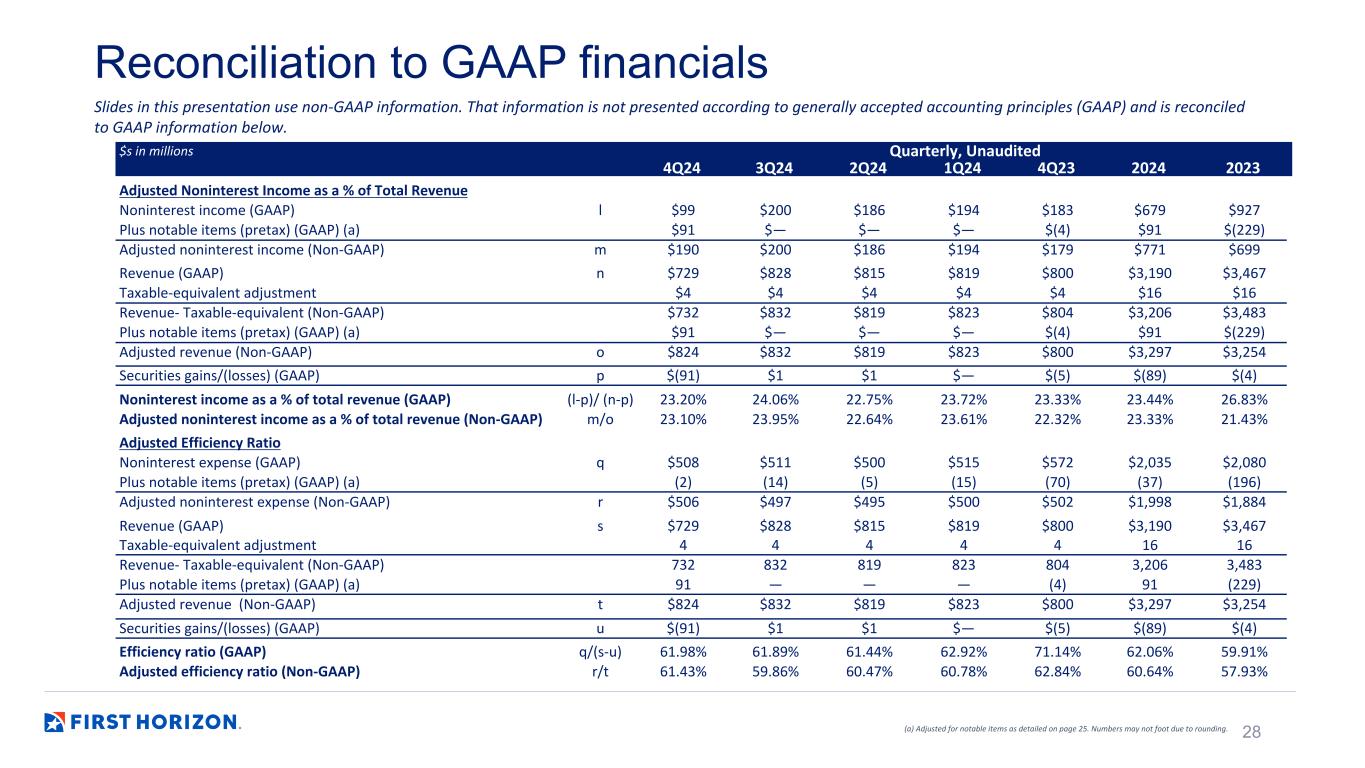

Noninterest income

Noninterest income decreased $101 million to $99 million, driven by a $91 million notable loss associated with an opportunistic restructuring of a portion of the securities portfolio. Adjusted noninterest income decreased by $10 million as service charges and fees were reduced by $6 million and deferred compensation income was $5 million lower.

Noninterest expense

Noninterest expense of $508 million decreased $3 million from the prior quarter. Fourth quarter notable items included a $1 million expense credit for the FDIC special assessment and $3 million of restructuring costs. Adjusted noninterest expense of $506 million increased $9 million, including $5 million lower deferred compensation. Personnel expense, excluding deferred compensation, was down $3 million as annual incentive true-ups offset increases to production-based incentives. Other noninterest expense increased by $16 million mainly due to a $10 million contribution to the First Horizon Foundation.

Loans and leases

Average loan and lease balances of $62.4 billion were flat compared to the prior quarter, while period-end balances were $62.6 billion, increasing $0.1 billion from third quarter 2024. Strong performance within loans to mortgage companies (LMC) and C&I was partially offset by reductions to CRE balances. Loan yields of 6.09% decreased 28 basis points driven by lower short-term rates, partially offset by continued repricing of fixed rate cash flows.

Deposits

Average deposits of $66.1 billion decreased $0.2 billion from third quarter 2024, which includes a pay down of $0.8 billion of brokered CDs. Period-end deposits of $65.6 billion declined $1.0 billion, driven by the pay-off of $1.1 billion of brokered CDs. Interest-bearing deposit cost of 3.10% decreased 34 basis points from the prior quarter, with a spot rate of approximately 2.80% at the end of the quarter.

Asset quality

Provision expense of $10 million decreased $25 million from the previous quarter. Net charge-offs were $13 million or 8 basis points, down from $24 million or 15 basis points in prior quarter. Nonperforming loans of $602 million increased $24 million, with the increases in consumer and commercial real estate exceeding the decline in C&I. The ACL to loans ratio decreased slightly from third quarter 2024 to 1.43%, driven by the net benefit of a slightly more favorable economic outlook.

Capital

CET1 ratio was 11.2%, stable from third quarter 2024 as $163 million of excess capital was returned to shareholders through the share repurchase program and $69 million of capital was utilized for an opportunistic securities portfolio restructuring.

Income taxes

The effective tax rate and the adjusted effective tax rate for fourth quarter 2024 were 19.3% and 21.0%, respectively, compared with an effective tax rate of 20.6% and adjusted tax rate of 20.8% in third quarter 2024.

4

| SUMMARY RESULTS | ||||||||||||||||||||||||||||||||||||||||||||

| Quarterly, Unaudited | ||||||||||||||||||||||||||||||||||||||||||||

| 4Q24 Change vs. | ||||||||||||||||||||||||||||||||||||||||||||

| ($s in millions, except per share and balance sheet data) | 4Q24 | 3Q24 | 4Q23 | 3Q24 | 4Q23 | |||||||||||||||||||||||||||||||||||||||

| $/bp | % | $/bp | % | |||||||||||||||||||||||||||||||||||||||||

| Income Statement | ||||||||||||||||||||||||||||||||||||||||||||

Interest income - taxable equivalent1 | $ | 1,071 | $ | 1,123 | $ | 1,090 | $ | (52) | (5) | % | $ | (19) | (2) | % | ||||||||||||||||||||||||||||||

Interest expense- taxable equivalent1 | 438 | 491 | 469 | (54) | (11) | (31) | (7) | |||||||||||||||||||||||||||||||||||||

| Net interest income- taxable equivalent | 634 | 631 | 621 | 2 | — | 13 | 2 | |||||||||||||||||||||||||||||||||||||

| Less: Taxable-equivalent adjustment | 4 | 4 | 4 | — | (5) | — | (6) | |||||||||||||||||||||||||||||||||||||

| Net interest income | 630 | 627 | 617 | 2 | — | 13 | 2 | |||||||||||||||||||||||||||||||||||||

| Noninterest income | 99 | 200 | 183 | (101) | (51) | (84) | (46) | |||||||||||||||||||||||||||||||||||||

| Total revenue | 729 | 828 | 800 | (99) | (12) | (71) | (9) | |||||||||||||||||||||||||||||||||||||

| Noninterest expense | 508 | 511 | 572 | (3) | (1) | (64) | (11) | |||||||||||||||||||||||||||||||||||||

Pre-provision net revenue3 | 220 | 316 | 227 | (96) | (30) | (7) | (3) | |||||||||||||||||||||||||||||||||||||

| Provision for credit losses | 10 | 35 | 50 | (25) | (71) | (40) | (80) | |||||||||||||||||||||||||||||||||||||

| Income before income taxes | 210 | 281 | 177 | (71) | (25) | 33 | 19 | |||||||||||||||||||||||||||||||||||||

| Provision for income taxes | 41 | 58 | (11) | (17) | (30) | 52 | NM | |||||||||||||||||||||||||||||||||||||

| Net income | 170 | 223 | 188 | (54) | (24) | (18) | (10) | |||||||||||||||||||||||||||||||||||||

| Net income attributable to noncontrolling interest | 4 | 5 | 5 | — | (10) | (1) | (11) | |||||||||||||||||||||||||||||||||||||

| Net income attributable to controlling interest | 165 | 218 | 183 | (53) | (24) | (18) | (10) | |||||||||||||||||||||||||||||||||||||

| Preferred stock dividends | 8 | 5 | 8 | 3 | 51 | — | — | |||||||||||||||||||||||||||||||||||||

| Net income available to common shareholders | $ | 158 | $ | 213 | $ | 175 | $ | (56) | (26) | % | $ | (18) | (10) | % | ||||||||||||||||||||||||||||||

Adjusted net income4 | $ | 240 | $ | 234 | $ | 191 | $ | 6 | 3 | % | $ | 50 | 26 | % | ||||||||||||||||||||||||||||||

Adjusted net income available to common shareholders4 | $ | 228 | $ | 224 | $ | 178 | $ | 4 | 2 | % | $ | 50 | 28 | % | ||||||||||||||||||||||||||||||

| Common stock information | ||||||||||||||||||||||||||||||||||||||||||||

| EPS | $ | 0.29 | $ | 0.40 | $ | 0.31 | $ | (0.11) | (26) | % | $ | (0.02) | (6) | % | ||||||||||||||||||||||||||||||

Adjusted EPS4 | $ | 0.43 | $ | 0.42 | $ | 0.32 | $ | 0.01 | 2 | % | $ | 0.11 | 35 | % | ||||||||||||||||||||||||||||||

Diluted shares8 | 534 | 538 | 561 | (4) | (1) | % | (27) | (5) | % | |||||||||||||||||||||||||||||||||||

| Key performance metrics | ||||||||||||||||||||||||||||||||||||||||||||

Net interest margin6 | 3.33 | % | 3.31 | % | 3.27 | % | 2 | bp | 6 | bp | ||||||||||||||||||||||||||||||||||

| Efficiency ratio | 61.98 | 61.89 | 71.14 | 9 | (916) | |||||||||||||||||||||||||||||||||||||||

Adjusted efficiency ratio4 | 61.43 | 59.86 | 62.84 | 157 | (141) | |||||||||||||||||||||||||||||||||||||||

| Effective income tax rate | 19.32 | 20.58 | (6.16) | (126) | NM | |||||||||||||||||||||||||||||||||||||||

| Return on average assets | 0.82 | 1.08 | 0.91 | (26) | (9) | |||||||||||||||||||||||||||||||||||||||

Adjusted return on average assets4 | 1.17 | 1.13 | 0.92 | 4 | 25 | |||||||||||||||||||||||||||||||||||||||

| Return on average common equity (“ROCE") | 7.4 | 10.1 | 8.6 | (272) | (122) | |||||||||||||||||||||||||||||||||||||||

Return on average tangible common equity (“ROTCE”)4 | 9.2 | 12.6 | 10.9 | (343) | (172) | |||||||||||||||||||||||||||||||||||||||

Adjusted ROTCE4 | 13.3 | 13.2 | 11.1 | 3 | 222 | |||||||||||||||||||||||||||||||||||||||

| Noninterest income as a % of total revenue | 23.20 | 24.06 | 23.33 | (86) | (13) | |||||||||||||||||||||||||||||||||||||||

Adjusted noninterest income as a % of total revenue4 | 23.10 | % | 23.95 | % | 22.32 | % | (85) | bp | 78 | bp | ||||||||||||||||||||||||||||||||||

| Balance Sheet (billions) | ||||||||||||||||||||||||||||||||||||||||||||

| Average loans | $ | 62.4 | $ | 62.4 | $ | 61.2 | $ | — | — | % | $ | 1.2 | 2 | % | ||||||||||||||||||||||||||||||

| Average deposits | 66.1 | 66.3 | 66.9 | (0.2) | — | (0.8) | (1) | |||||||||||||||||||||||||||||||||||||

| Average assets | 82.0 | 82.4 | 82.3 | (0.4) | (1) | (0.4) | — | |||||||||||||||||||||||||||||||||||||

| Average common equity | $ | 8.5 | $ | 8.4 | $ | 8.1 | $ | 0.1 | 1 | % | $ | 0.4 | 5 | % | ||||||||||||||||||||||||||||||

| Asset Quality Highlights | ||||||||||||||||||||||||||||||||||||||||||||

Allowance for credit losses to loans and leases4 | 1.43 | % | 1.44 | % | 1.40 | % | (1) | bp | 3 | bp | ||||||||||||||||||||||||||||||||||

| Nonperforming loan and leases ratio | 0.96 | % | 0.92 | % | 0.75 | % | 4 | bp | 21 | bp | ||||||||||||||||||||||||||||||||||

| Net charge-off ratio | 0.08 | % | 0.15 | % | 0.23 | % | (7) | bp | (15) | bp | ||||||||||||||||||||||||||||||||||

| Net charge-offs | $ | 13 | $ | 24 | $ | 36 | $ | (11) | (45) | % | $ | (23) | (63) | % | ||||||||||||||||||||||||||||||

| Capital Ratio Highlights (current quarter is an estimate) | ||||||||||||||||||||||||||||||||||||||||||||

| Common Equity Tier 1 | 11.2 | % | 11.2 | % | 11.4 | % | (3) | bp | (20) | bp | ||||||||||||||||||||||||||||||||||

| Tier 1 | 12.2 | 12.2 | 12.4 | (3) | (21) | |||||||||||||||||||||||||||||||||||||||

| Total Capital | 13.9 | 13.9 | 14.0 | (2) | (10) | |||||||||||||||||||||||||||||||||||||||

| Tier 1 leverage | 10.6 | % | 10.6 | % | 10.7 | % | (1) | bp | (5) | bp | ||||||||||||||||||||||||||||||||||

Numbers may not foot due to rounding.

See footnote disclosures on page 21.

5

Forward-Looking Statements

This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, with respect to FHN's beliefs, plans, goals, expectations, and estimates. Forward-looking statements are not a representation of historical information, but instead pertain to future operations, strategies, financial results, or other developments. Forward-looking statements often use words such as “believe,” “expect,” “anticipate,” “intend,” “estimate,” “should,” “is likely,” “will,” “going forward,” and other similar expressions that indicate future events and trends. Forward-looking statements are necessarily based upon estimates and assumptions that are inherently subject to significant business, operational, economic, and competitive uncertainties and contingencies, many of which are beyond FHN’s control, and many of which, with respect to future business decisions and actions (including acquisitions and divestitures), are subject to change and could cause FHN’s actual future results and outcomes to differ materially from those contemplated or implied by forward-looking statements or historical performance. While there is no assurance that any list of uncertainties and contingencies is complete, examples of factors which could cause actual results to differ from those contemplated by forward-looking statements or historical performance include those mentioned: in this document; in Items 2.02 and 7.01 of FHN’s Current Report on Form 8-K to which this document has been furnished as an exhibit; in the forepart, and in Items 1, 1A, and 7, of FHN’s most recent Annual Report on Form 10-K; and in the forepart, and in Item 1A of Part II, of FHN’s Quarterly Report(s) on Form 10-Q filed after that Annual Report. Any forward-looking statements made by or on behalf of FHN speak only as of the date they are made, and FHN assumes no obligation to update or revise any forward-looking statements that are made in this document or in any other statement, release, report, or filing from time to time. Actual results could differ and expectations could change, possibly materially, because of one or more factors, including those factors listed in this document or the documents mentioned above, and other factors not listed.

Throughout this document, numbers may not foot due to rounding, references to EPS are fully diluted, and capital ratios for the most recent quarter are estimates.

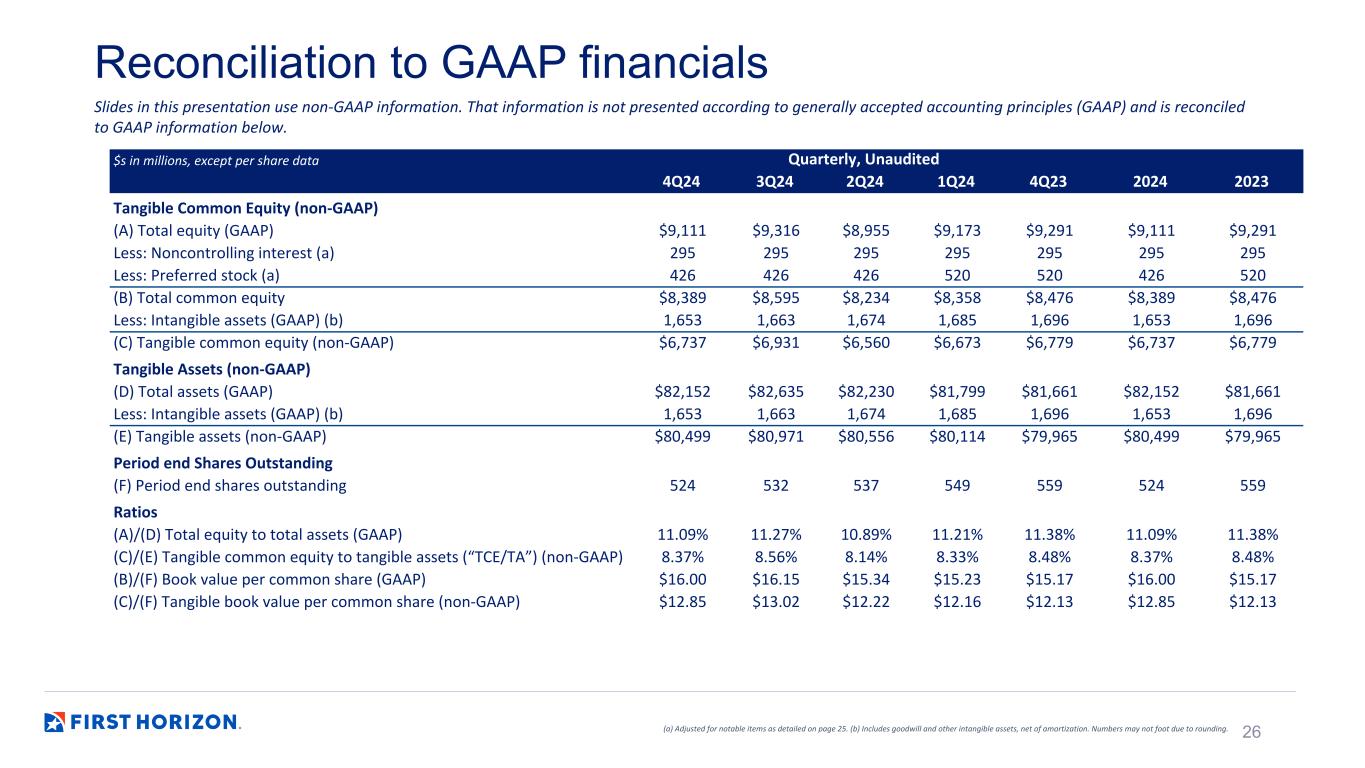

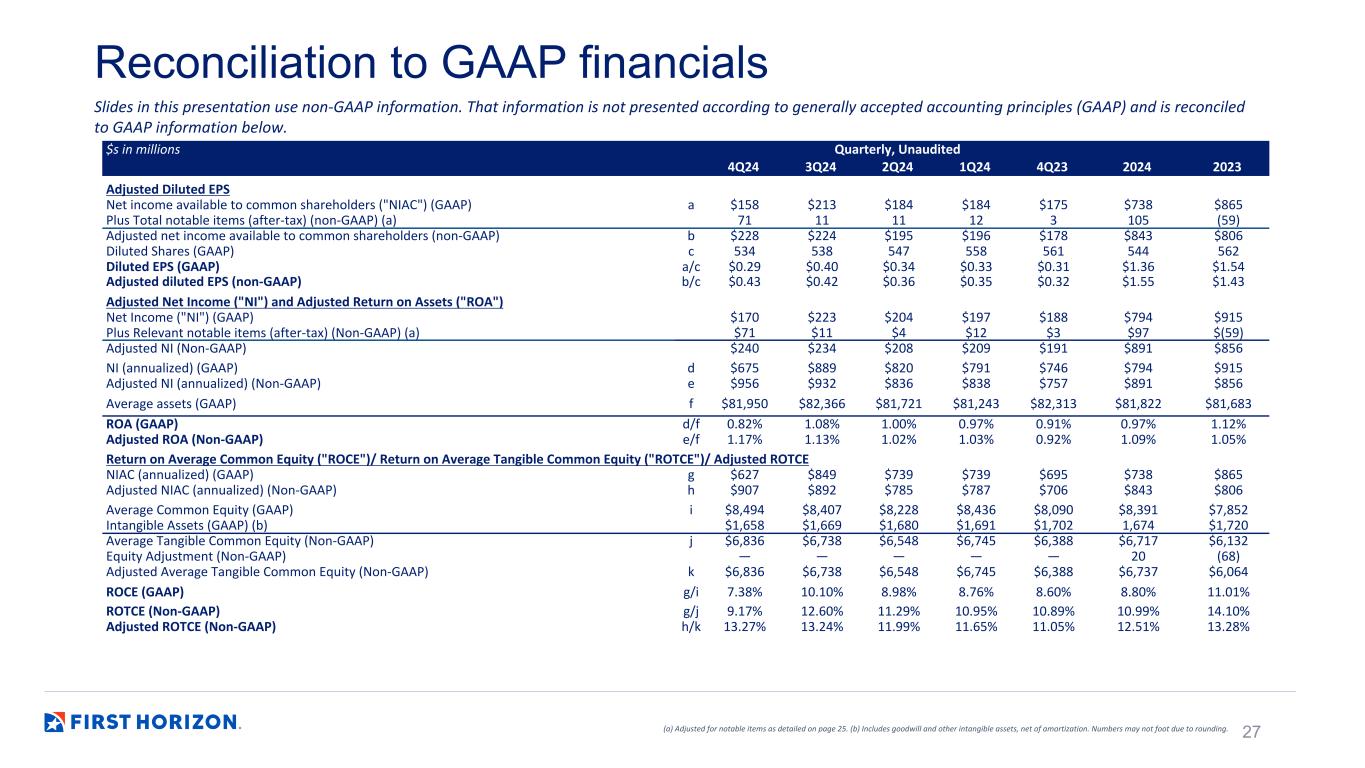

Use of non-GAAP Measures and Regulatory Measures that are not GAAP

Certain measures included in this report are “non-GAAP,” meaning they are not presented in accordance with generally accepted accounting principles in the U.S. and also are not codified in U.S. banking regulations currently applicable to FHN. Although other entities may use calculation methods that differ from those used by FHN for non-GAAP measures, FHN’s management believes such measures are relevant to understanding the financial condition, capital position, and financial results of FHN and its business segments. Non-GAAP measures are reported to FHN’s management and Board of Directors through various internal reports.

The non-GAAP measures presented in this earnings release are fully taxable equivalent measures, pre-provision net revenue ("PPNR"), return on average tangible common equity (“ROTCE”), tangible common equity (“TCE”) to tangible assets (“TA”), tangible book value ("TBV") per common share, and various consolidated and segment results and performance measures and ratios adjusted for notable items.

Presentation of regulatory measures, even those which are not GAAP, provides a meaningful base for comparability to other financial institutions subject to the same regulations as FHN, as demonstrated by their use by banking regulators in reviewing capital adequacy of financial institutions. Although not GAAP terms, these regulatory measures are not considered “non-GAAP” under U.S. financial reporting rules as long as their presentation conforms to regulatory standards. Regulatory measures used in this financial supplement include: common equity tier 1 capital ("CET1"), generally defined as common equity less goodwill, other intangibles, and certain other required regulatory deductions; tier 1 capital, generally defined as the sum of core capital (including common equity and instruments that cannot be redeemed at the option of the holder) adjusted for certain items under risk based capital regulations; and risk-weighted assets, which is a measure of total on- and off-balance sheet assets adjusted for credit and market risk, used to determine regulatory capital ratios.

Refer to the tabular reconciliation of non-GAAP to GAAP measures and presentation of the most comparable GAAP items, beginning on page 22.

6

Conference Call Information

Analysts, investors and interested parties may call toll-free starting at 8:15 a.m. CT on January 16, 2025 by dialing 1-833-470-1428 (if calling from the U.S.) or 404-975-4839 (if calling from outside the U.S) and entering access code 071092. The conference call will begin at 8:30 a.m. CT.

Participants can also opt to listen to the live audio webcast at https://ir.firsthorizon.com/events-and-presentations/default.aspx.

A replay of the call will be available beginning at noon CT on January 16 until midnight CT on January 30, 2025. To listen to the replay, dial 1-866-813-9403 (U.S. callers); the access code is 634828. A replay of the webcast will also be available on our website on January 16 and will be archived on the site for one year.

First Horizon Corp. (NYSE: FHN), with $82.2 billion in assets as of December 31, 2024, is a leading regional financial services company, dedicated to helping our clients, communities and associates unlock their full potential with capital and counsel. Headquartered in Memphis, TN, the banking subsidiary First Horizon Bank operates in 12 states across the southern U.S. The Company and its subsidiaries offer commercial, private banking, consumer, small business, wealth and trust management, retail brokerage, capital markets, fixed income, and mortgage banking services. First Horizon has been recognized as one of the nation's best employers by Fortune and Forbes magazines and a Top 10 Most Reputable U.S. Bank. More information is available at www.FirstHorizon.com.

Contact: Investor Relations - Tyler Craft - [email protected]

Media Relations - Beth Ardoin - [email protected]

7

| CONSOLIDATED INCOME STATEMENT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarterly, Unaudited | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4Q24 Change vs. | 2024 vs 2023 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($s in millions, except per share data) | 4Q24 | 3Q24 | 2Q24 | 1Q24 | 4Q23 | 3Q24 | 4Q23 | 2024 | 2023 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | % | $ | % | $ | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Interest income - taxable equivalent1 | $ | 1,071 | $ | 1,123 | $ | 1,097 | $ | 1,076 | $ | 1,090 | $ | (52) | (5) | % | $ | (19) | (2) | % | $ | 4,367 | $ | 4,115 | $ | 251 | 6 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

Interest expense- taxable equivalent1 | 438 | 491 | 464 | 448 | 469 | (54) | (11) | (31) | (7) | 1,841 | 1,560 | 281 | 18 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income- taxable equivalent | 634 | 631 | 633 | 628 | 621 | 2 | — | 13 | 2 | 2,526 | 2,556 | (29) | (1) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Less: Taxable-equivalent adjustment | 4 | 4 | 4 | 4 | 4 | — | (5) | — | (6) | 16 | 16 | — | (1) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | 630 | 627 | 629 | 625 | 617 | 2 | — | 13 | 2 | 2,511 | 2,540 | (29) | (1) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest income: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fixed income | 49 | 47 | 40 | 52 | 37 | 3 | 6 | 12 | 34 | 187 | 133 | 54 | 41 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mortgage banking | 8 | 9 | 10 | 9 | 5 | (1) | (16) | 3 | 55 | 35 | 23 | 12 | 51 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Brokerage, trust, and insurance | 41 | 39 | 38 | 36 | 36 | 1 | 3 | 4 | 12 | 154 | 139 | 15 | 11 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Service charges and fees | 53 | 59 | 58 | 57 | 59 | (6) | (10) | (6) | (11) | 227 | 233 | (6) | (3) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Card and digital banking fees | 19 | 19 | 20 | 19 | 16 | — | (2) | 3 | 18 | 77 | 77 | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deferred compensation income | 1 | 6 | 3 | 9 | 6 | (5) | (78) | (5) | (79) | 19 | 17 | 1 | 7 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gain on merger termination | — | — | — | — | — | — | NM | — | NM | — | 225 | (225) | (100) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Securities gains/(losses) | (91) | 1 | 1 | — | (5) | (93) | NM | (86) | NM | (89) | (4) | (85) | NM | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other noninterest income | 20 | 20 | 16 | 14 | 28 | — | (1) | (9) | (30) | 70 | 84 | (14) | (17) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total noninterest income | 99 | 200 | 186 | 194 | 183 | (101) | (51) | (84) | (46) | 679 | 927 | (248) | (27) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total revenue | 729 | 828 | 815 | 819 | 800 | (99) | (12) | (71) | (9) | 3,190 | 3,467 | (277) | (8) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest expense: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Personnel expense: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Salaries and benefits | 199 | 199 | 198 | 200 | 190 | — | — | 9 | 5 | 795 | 757 | 38 | 5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Incentives and commissions | 76 | 76 | 79 | 92 | 82 | — | (1) | (6) | (8) | 323 | 326 | (3) | (1) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deferred compensation expense | 1 | 6 | 3 | 9 | 7 | (5) | (78) | (5) | (79) | 20 | 17 | 3 | 15 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total personnel expense | 276 | 282 | 279 | 301 | 279 | (6) | (2) | (3) | (1) | 1,137 | 1,100 | 38 | 3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Occupancy and equipment2 | 76 | 73 | 72 | 72 | 71 | 3 | 4 | 6 | 8 | 293 | 276 | 17 | 6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Outside services | 72 | 74 | 78 | 65 | 84 | (2) | (3) | (13) | (15) | 289 | 291 | (2) | (1) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Amortization of intangible assets | 11 | 11 | 11 | 11 | 12 | — | (1) | (1) | (9) | 44 | 47 | (4) | (8) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other noninterest expense | 74 | 71 | 60 | 67 | 127 | 2 | 3 | (53) | (42) | 272 | 365 | (94) | (26) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total noninterest expense | 508 | 511 | 500 | 515 | 572 | (3) | (1) | (64) | (11) | 2,035 | 2,080 | (45) | (2) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Pre-provision net revenue3 | 220 | 316 | 315 | 304 | 227 | (96) | (30) | (7) | (3) | 1,155 | 1,388 | (232) | (17) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Provision for credit losses | 10 | 35 | 55 | 50 | 50 | (25) | (71) | (40) | (80) | 150 | 260 | (110) | (42) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Income before income taxes | 210 | 281 | 260 | 254 | 177 | (71) | (25) | 33 | 19 | 1,005 | 1,128 | (122) | (11) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Provision for income taxes | 41 | 58 | 56 | 57 | (11) | (17) | (30) | 52 | NM | 211 | 212 | (1) | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income | 170 | 223 | 204 | 197 | 188 | (54) | (24) | (18) | (10) | 794 | 915 | (122) | (13) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income attributable to noncontrolling interest | 4 | 5 | 5 | 5 | 5 | — | (10) | (1) | (11) | 19 | 19 | — | 2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income attributable to controlling interest | 165 | 218 | 199 | 192 | 183 | (53) | (24) | (18) | (10) | 775 | 897 | (122) | (14) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Preferred stock dividends | 8 | 5 | 15 | 8 | 8 | 3 | 51 | — | — | 36 | 32 | 4 | 13 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income available to common shareholders | $ | 158 | $ | 213 | $ | 184 | $ | 184 | $ | 175 | $ | (56) | (26) | % | $ | (18) | (10) | % | $ | 738 | $ | 865 | $ | (126) | (15) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Common Share Data | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| EPS | $ | 0.30 | $ | 0.40 | $ | 0.34 | $ | 0.33 | $ | 0.31 | $ | (0.10) | (25) | % | $ | (0.02) | (5) | % | $ | 1.37 | $ | 1.58 | $ | (0.21) | (13) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Basic shares | 528 | 534 | 544 | 555 | 559 | (6) | (1) | (30) | (5) | 540 | 548 | (8) | (1) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Diluted EPS | $ | 0.29 | $ | 0.40 | $ | 0.34 | $ | 0.33 | $ | 0.31 | $ | (0.11) | (26) | $ | (0.02) | (6) | $ | 1.36 | $ | 1.54 | $ | (0.18) | (12) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Diluted shares8 | 534 | 538 | 547 | 558 | 561 | (4) | (1) | % | (27) | (5) | % | 544 | 562 | (17) | (3) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Effective tax rate | 19.3 | % | 20.6 | % | 21.5 | % | 22.5 | % | (6.2) | % | 21.0 | % | 18.8 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Numbers may not foot due to rounding. See footnote disclosures on page 21.

8

ADJUSTED4 FINANCIAL DATA - SEE NOTABLE ITEMS ON PAGE 10 | ||

| Quarterly, Unaudited | ||

| 4Q24 Change vs. | 2024 vs 2023 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($s in millions, except per share data) | 4Q24 | 3Q24 | 2Q24 | 1Q24 | 4Q23 | 3Q24 | 4Q23 | 2024 | 2023 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | % | $ | % | $ | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Net interest income (FTE)1 | $ | 634 | $ | 631 | $ | 633 | $ | 628 | $ | 621 | $ | 2 | — | % | $ | 13 | 2 | % | $ | 2,526 | $ | 2,556 | $ | (29) | (1) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted noninterest income: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fixed income | 49 | 47 | 40 | 52 | 37 | 3 | 6 | 12 | 34 | 187 | 133 | 54 | 41 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mortgage banking | 8 | 9 | 10 | 9 | 5 | (1) | (16) | 3 | 55 | 35 | 23 | 12 | 51 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Brokerage, trust, and insurance | 41 | 39 | 38 | 36 | 36 | 1 | 3 | 4 | 12 | 154 | 139 | 15 | 11 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Service charges and fees | 53 | 59 | 58 | 57 | 59 | (6) | (10) | (6) | (11) | 227 | 233 | (6) | (3) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Card and digital banking fees | 19 | 19 | 20 | 19 | 16 | — | (2) | 3 | 18 | 77 | 77 | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deferred compensation income | 1 | 6 | 3 | 9 | 6 | (5) | (78) | (5) | (79) | 19 | 17 | 1 | 7 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gain on merger termination | — | — | — | — | — | — | NM | — | NM | — | — | — | NM | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Securities gains/(losses) | — | 1 | 1 | — | 1 | (1) | (98) | % | (1) | (96) | % | 2 | 2 | 1 | 32 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted other noninterest income | 20 | 20 | 16 | 14 | 19 | — | (1) | 1 | 5 | 70 | 75 | (5) | (6) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted total noninterest income | $ | 190 | $ | 200 | $ | 186 | $ | 194 | $ | 179 | $ | (10) | (5) | % | $ | 11 | 6 | % | $ | 771 | $ | 699 | $ | 72 | 10 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

Total revenue (FTE)1 | $ | 824 | $ | 832 | $ | 819 | $ | 823 | $ | 800 | $ | (8) | (1) | % | $ | 24 | 3 | % | $ | 3,297 | $ | 3,254 | $ | 43 | 1 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted noninterest expense: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted personnel expense: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted salaries and benefits | $ | 199 | $ | 199 | $ | 198 | $ | 199 | $ | 190 | $ | — | — | % | $ | 9 | 5 | % | $ | 795 | $ | 753 | $ | 42 | 6 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted Incentives and commissions | 73 | 76 | 78 | 87 | 80 | (2) | (3) | (6) | (8) | 314 | 278 | 37 | 13 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deferred compensation expense | 1 | 6 | 3 | 9 | 7 | (5) | (78) | (5) | (79) | 20 | 17 | 3 | 15 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted total personnel expense | 274 | 281 | 279 | 295 | 277 | (7) | (3) | (3) | (1) | 1,129 | 1,048 | 81 | 8 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Adjusted occupancy and equipment2 | 76 | 73 | 72 | 72 | 71 | 3 | 4 | 6 | 7 | 293 | 276 | 17 | 6 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted outside services | 71 | 73 | 75 | 65 | 84 | (2) | (3) | (13) | (16) | 285 | 284 | — | — | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Amortization of intangible assets | 11 | 11 | 11 | 11 | 12 | — | (1) | (1) | (9) | 44 | 47 | (4) | (8) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted other noninterest expense | 74 | 59 | 58 | 57 | 59 | 16 | 27 | 16 | 27 | 248 | 229 | 18 | 8 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted total noninterest expense | $ | 506 | $ | 497 | $ | 495 | $ | 500 | $ | 502 | $ | 9 | 2 | % | $ | 4 | 1 | % | $ | 1,998 | $ | 1,884 | $ | 114 | 6 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

Adjusted pre-provision net revenue4 | $ | 318 | $ | 335 | $ | 324 | $ | 323 | $ | 298 | $ | (17) | (5) | % | $ | 20 | 7 | % | $ | 1,299 | $ | 1,370 | $ | (71) | (5) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Provision for credit losses | $ | 10 | $ | 35 | $ | 55 | $ | 50 | $ | 50 | $ | (25) | (71) | % | $ | (40) | (80) | % | $ | 150 | $ | 260 | $ | (110) | (42) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted net income available to common shareholders | $ | 228 | $ | 224 | $ | 195 | $ | 195 | $ | 178 | $ | 4 | 2 | % | $ | 50 | 28 | % | $ | 843 | $ | 806 | $ | 37 | 5 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted Common Share Data | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted diluted EPS | $ | 0.43 | $ | 0.42 | $ | 0.36 | $ | 0.35 | $ | 0.32 | $ | 0.01 | 2 | % | $ | 0.11 | 35 | % | $ | 1.55 | $ | 1.43 | $ | 0.12 | 8 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

Diluted shares8 | 534 | 538 | 547 | 558 | 561 | (4) | (1) | % | (27) | (5) | % | 544 | 562 | (17) | (3) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted effective tax rate | 21.0 | % | 20.8 | % | 21.5 | % | 22.5 | % | 21.7 | % | 21.4 | % | 21.8 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted ROTCE | 13.3 | % | 13.2 | % | 12.0 | % | 11.6 | % | 11.1 | % | 12.5 | % | 13.3 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted efficiency ratio | 61.4 | % | 59.9 | % | 60.5 | % | 60.8 | % | 62.8 | % | 60.6 | % | 57.9 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Numbers may not foot due to rounding.

See footnote disclosures on page 21.

9

| NOTABLE ITEMS | ||

| Quarterly, Unaudited | ||

| (In millions) | 4Q24 | 3Q24 | 2Q24 | 1Q24 | 4Q23 | 2024 | 2023 | ||||||||||||||||||||||||||||||||||

| Summary of Notable Items: | |||||||||||||||||||||||||||||||||||||||||

| Gain on merger termination | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 225 | |||||||||||||||||||||||||||

| Net merger/acquisition/transaction-related items | — | — | — | — | — | — | (51) | ||||||||||||||||||||||||||||||||||

| Loss on AFS portfolio restructuring | (91) | — | — | — | — | (91) | — | ||||||||||||||||||||||||||||||||||

| Gain/(loss) related to equity securities investments (other noninterest income) | — | — | — | — | (6) | — | (6) | ||||||||||||||||||||||||||||||||||

| Net gain on asset disposition (other noninterest income less incentives) | — | — | — | — | 7 | — | 7 | ||||||||||||||||||||||||||||||||||

| FDIC special assessment (other noninterest expense) | 1 | 2 | (2) | (10) | (68) | (9) | (68) | ||||||||||||||||||||||||||||||||||

| Other notable expenses * | (3) | (17) | (3) | (5) | — | (29) | (75) | ||||||||||||||||||||||||||||||||||

| Total notable items (pre-tax) | $ | (94) | $ | (14) | $ | (5) | $ | (15) | $ | (67) | $ | (129) | $ | 33 | |||||||||||||||||||||||||||

| Tax-related notable items ** | $ | — | $ | — | $ | — | $ | — | $ | 48 | $ | — | $ | 35 | |||||||||||||||||||||||||||

| Preferred Stock Dividend *** | $ | — | $ | — | $ | (7) | $ | — | $ | — | $ | (7) | $ | — | |||||||||||||||||||||||||||

Numbers may not foot due to rounding

* 4Q24, 3Q24, 2Q24, 1Q24 and 3Q23 include $3 million, $2 million, $3 million, $5 million and $10 million of restructuring expenses; 3Q24 and 2Q23 each include $15 million of Visa derivative valuation expenses and 2Q23 includes a $50 million contribution to First Horizon Foundation.

** 4Q23 and 2023 include a $48 million after-tax benefit primarily from the resolution of IBERIABANK merger-related tax items; 2023 also includes after-tax notable items of $24 million related to the surrender of approximately $214 million in book value of bank owned life insurance policies, partially offset by an $11 million benefit from merger-related tax items.

*** 2Q24 and 2024 include $7 million deemed dividends on the redemption of $100 million par value of Series D Preferred Stock.

| IMPACT OF NOTABLE ITEMS: | ||

| Quarterly, Unaudited | ||

| (In millions) | 4Q24 | 3Q24 | 2Q24 | 1Q24 | 4Q23 | 2024 | 2023 | ||||||||||||||||||||||||||||||||||

| Impacts of Notable Items: | |||||||||||||||||||||||||||||||||||||||||

| Noninterest income: | |||||||||||||||||||||||||||||||||||||||||

| Gain on merger termination | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | (225) | |||||||||||||||||||||||||||

| Securities (gains)/losses | 91 | — | — | — | 6 | 91 | 6 | ||||||||||||||||||||||||||||||||||

| Other noninterest income | — | — | — | — | (9) | — | (9) | ||||||||||||||||||||||||||||||||||

| Total noninterest income | $ | 91 | $ | — | $ | — | $ | — | $ | (4) | $ | 91 | $ | (229) | |||||||||||||||||||||||||||

| Noninterest expense: | |||||||||||||||||||||||||||||||||||||||||

| Personnel expenses: | |||||||||||||||||||||||||||||||||||||||||

| Salaries and benefits | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | (4) | |||||||||||||||||||||||||||

| Incentives and commissions | (2) | — | (1) | (5) | (2) | (8) | (49) | ||||||||||||||||||||||||||||||||||

| Total personnel expenses | (2) | (1) | (1) | (5) | (2) | (9) | (52) | ||||||||||||||||||||||||||||||||||

| Outside services | (1) | (1) | (3) | — | — | (5) | (7) | ||||||||||||||||||||||||||||||||||

| Other noninterest expense | 1 | (13) | (2) | (10) | (68) | (24) | (136) | ||||||||||||||||||||||||||||||||||

| Total noninterest expense | $ | (2) | $ | (14) | $ | (5) | $ | (15) | $ | (70) | $ | (37) | $ | (196) | |||||||||||||||||||||||||||

| Income before income taxes | $ | 94 | $ | 14 | $ | 5 | $ | 15 | $ | 67 | $ | 129 | $ | (33) | |||||||||||||||||||||||||||

| Provision for income taxes * | 23 | 4 | 1 | 3 | 64 | 32 | 26 | ||||||||||||||||||||||||||||||||||

| Preferred stock dividends ** | — | — | (7) | — | — | (7) | — | ||||||||||||||||||||||||||||||||||

| Net income/(loss) available to common shareholders | $ | 71 | $ | 11 | $ | 11 | $ | 12 | $ | 3 | $ | 105 | $ | (59) | |||||||||||||||||||||||||||

| EPS impact of notable items | $ | 0.13 | $ | 0.02 | $ | 0.02 | $ | 0.02 | $ | 0.01 | $ | 0.19 | $ | (0.11) | |||||||||||||||||||||||||||

Numbers may not foot due to rounding.

* 4Q23 and 2023 include a $48 million after-tax benefit primarily from the resolution of IBERIABANK merger-related tax items; 2023 also includes after-tax notable items of $24 million related to the surrender of approximately $214 million in book value of bank owned life insurance policies, partially offset by an $11 million benefit from merger-related tax items.

** 2Q24 and 2024 include $7 million deemed dividends on the redemption of $100 million par value of Series D Preferred Stock.

10

| FINANCIAL RATIOS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarterly, Unaudited | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4Q24 Change vs. | 2024 vs.2023 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4Q24 | 3Q24 | 2Q24 | 1Q24 | 4Q23 | 3Q24 | 4Q23 | 2024 | 2023 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FINANCIAL RATIOS | $/bp | % | $/bp | % | $/bp | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Net interest margin6 | 3.33 | % | 3.31 | % | 3.38 | % | 3.37 | % | 3.27 | % | 2 | bp | 6 | bp | 3.35 | % | 3.42 | % | (7) | bp | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Return on average assets | 0.82 | % | 1.08 | % | 1.00 | % | 0.97 | % | 0.91 | % | (26) | (9) | 0.97 | % | 1.12 | % | (15) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Adjusted return on average assets4 | 1.17 | % | 1.13 | % | 1.02 | % | 1.03 | % | 0.92 | % | 4 | 25 | 1.09 | % | 1.05 | % | 4 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Return on average common equity (“ROCE”) | 7.38 | % | 10.10 | % | 8.98 | % | 8.76 | % | 8.60 | % | (272) | (122) | 8.80 | % | 11.01 | % | (221) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Return on average tangible common equity (“ROTCE”)4 | 9.17 | % | 12.60 | % | 11.29 | % | 10.95 | % | 10.89 | % | (343) | (172) | 10.99 | % | 14.10 | % | (311) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Adjusted ROTCE4 | 13.27 | % | 13.24 | % | 11.99 | % | 11.65 | % | 11.05 | % | 3 | 222 | 12.51 | % | 13.28 | % | (77) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest income as a % of total revenue | 23.20 | % | 24.06 | % | 22.75 | % | 23.72 | % | 23.33 | % | (86) | (13) | 23.44 | % | 26.83 | % | (339) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Adjusted noninterest income as a % of total revenue4 | 23.10 | % | 23.95 | % | 22.64 | % | 23.61 | % | 22.32 | % | (85) | 78 | 23.33 | % | 21.43 | % | 190 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Efficiency ratio | 61.98 | % | 61.89 | % | 61.44 | % | 62.92 | % | 71.14 | % | 9 | (916) | 62.06 | % | 59.91 | % | 215 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Adjusted efficiency ratio4 | 61.43 | % | 59.86 | % | 60.47 | % | 60.78 | % | 62.84 | % | 157 | (141) | 60.64 | % | 57.93 | % | 271 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Allowance for credit losses to loans and leases4 | 1.43 | % | 1.44 | % | 1.41 | % | 1.40 | % | 1.40 | % | (1) | 3 | 1.43 | % | 1.40 | % | 3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CAPITAL DATA | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

CET1 capital ratio* | 11.2 | % | 11.2 | % | 11.0 | % | 11.3 | % | 11.4 | % | (3) | bp | (20) | bp | 11.2 | % | 11.4 | % | (20) | bp | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tier 1 capital ratio* | 12.2 | % | 12.2 | % | 12.1 | % | 12.3 | % | 12.4 | % | (3) | bp | (21) | bp | 12.2 | % | 12.4 | % | (21) | bp | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total capital ratio* | 13.9 | % | 13.9 | % | 13.7 | % | 13.9 | % | 14.0 | % | (2) | bp | (10) | bp | 13.9 | % | 14.0 | % | (10) | bp | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tier 1 leverage ratio* | 10.6 | % | 10.6 | % | 10.6 | % | 10.8 | % | 10.7 | % | (1) | bp | (5) | bp | 10.6 | % | 10.7 | % | (5) | bp | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Risk-weighted assets (“RWA”) (billions)* | $ | 71.2 | $ | 71.5 | $ | 71.9 | $ | 71.1 | $ | 71.1 | $ | (0.3) | — | % | $ | 0.1 | — | % | $ | 71.2 | $ | 71.1 | $ | 0.1 | — | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Total equity to total assets | 11.09 | % | 11.27 | % | 10.89 | % | 11.21 | % | 11.38 | % | (18) | bp | (29) | bp | 11.09 | % | 11.38 | % | (29) | bp | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Tangible common equity/tangible assets (“TCE/TA”)4 | 8.37 | % | 8.56 | % | 8.14 | % | 8.33 | % | 8.48 | % | (19) | bp | (11) | bp | 8.37 | % | 8.48 | % | (11) | bp | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Period-end shares outstanding (millions)8 | 524 | 532 | 537 | 549 | 559 | (8) | (2) | % | (35) | (6) | % | 524 | 559 | (35) | (6) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash dividends declared per common share | $ | 0.15 | $ | 0.15 | $ | 0.15 | $ | 0.15 | $ | 0.15 | $ | — | — | % | $ | — | — | % | $ | 0.60 | $ | 0.60 | $ | — | — | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Book value per common share | $ | 16.00 | $ | 16.15 | $ | 15.34 | $ | 15.23 | $ | 15.17 | $ | (0.15) | (1) | % | $ | 0.84 | 5 | % | $ | 16.00 | $ | 15.17 | $ | 0.84 | 5 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

Tangible book value per common share4 | $ | 12.85 | $ | 13.02 | $ | 12.22 | $ | 12.16 | $ | 12.13 | $ | (0.17) | (1) | % | $ | 0.72 | 6 | % | $ | 12.85 | $ | 12.13 | $ | 0.72 | 6 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| SELECTED BALANCE SHEET DATA | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans-to-deposit ratio (period-end balances) | 95.40 | % | 93.80 | % | 96.89 | % | 93.93 | % | 93.18 | % | 160 | bp | 222 | bp | 95.40 | % | 93.18 | % | 222 | bp | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans-to-deposit ratio (average balances) | 94.44 | % | 94.19 | % | 95.49 | % | 93.54 | % | 91.53 | % | 25 | bp | 291 | bp | 94.41 | % | 93.60 | % | 81 | bp | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Full-time equivalent associates | 7,158 | 7,186 | 7,297 | 7,327 | 7,277 | (28) | — | % | (119) | (2) | % | 7,242 | 7,306 | (64) | (1) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

*Current quarter is an estimate.

See footnote disclosures on page 21.

11

CONSOLIDATED PERIOD-END BALANCE SHEET

Quarterly, Unaudited

| 4Q24 Change vs. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (In millions) | 4Q24 | 3Q24 | 2Q24 | 1Q24 | 4Q23 | 3Q24 | 4Q23 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Assets: | $ | % | $ | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans and leases: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial, financial, and industrial (C&I) | $ | 33,428 | $ | 33,092 | $ | 33,452 | $ | 32,911 | $ | 32,632 | $ | 336 | 1 | % | $ | 795 | 2 | % | ||||||||||||||||||||||||||||||||||||||

| Commercial real estate | 14,421 | 14,705 | 14,669 | 14,426 | 14,216 | (284) | (2) | 205 | 1 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total Commercial | 47,849 | 47,797 | 48,121 | 47,337 | 46,849 | 52 | — | 1,000 | 2 | |||||||||||||||||||||||||||||||||||||||||||||||

| Consumer real estate | 14,047 | 13,961 | 13,909 | 13,645 | 13,650 | 86 | 1 | 397 | 3 | |||||||||||||||||||||||||||||||||||||||||||||||

Credit card and other5 | 670 | 688 | 751 | 771 | 793 | (18) | (3) | (123) | (16) | |||||||||||||||||||||||||||||||||||||||||||||||

| Total Consumer | 14,716 | 14,648 | 14,660 | 14,416 | 14,443 | 68 | — | 274 | 2 | |||||||||||||||||||||||||||||||||||||||||||||||

| Loans and leases, net of unearned income | 62,565 | 62,445 | 62,781 | 61,753 | 61,292 | 120 | — | 1,274 | 2 | |||||||||||||||||||||||||||||||||||||||||||||||

| Loans held for sale | 551 | 494 | 471 | 395 | 502 | 57 | 11 | 48 | 10 | |||||||||||||||||||||||||||||||||||||||||||||||

| Investment securities | 9,166 | 9,530 | 9,221 | 9,460 | 9,714 | (363) | (4) | (547) | (6) | |||||||||||||||||||||||||||||||||||||||||||||||

| Trading securities | 1,387 | 1,549 | 1,249 | 1,161 | 1,412 | (162) | (10) | (25) | (2) | |||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits with banks | 1,538 | 1,286 | 1,452 | 1,885 | 1,328 | 252 | 20 | 209 | 16 | |||||||||||||||||||||||||||||||||||||||||||||||

| Federal funds sold and securities purchased under agreements to resell | 631 | 1,008 | 487 | 817 | 719 | (376) | (37) | (88) | (12) | |||||||||||||||||||||||||||||||||||||||||||||||

| Total interest earning assets | 75,838 | 76,311 | 75,662 | 75,470 | 74,967 | (473) | (1) | 872 | 1 | |||||||||||||||||||||||||||||||||||||||||||||||

| Cash and due from banks | 906 | 1,028 | 969 | 749 | 1,012 | (122) | (12) | (106) | (10) | |||||||||||||||||||||||||||||||||||||||||||||||

| Goodwill and other intangible assets, net | 1,653 | 1,663 | 1,674 | 1,685 | 1,696 | (11) | (1) | (44) | (3) | |||||||||||||||||||||||||||||||||||||||||||||||

| Premises and equipment, net | 574 | 572 | 584 | 586 | 590 | 3 | — | (16) | (3) | |||||||||||||||||||||||||||||||||||||||||||||||

| Allowance for loan and lease losses | (815) | (823) | (821) | (787) | (773) | 7 | 1 | (42) | (5) | |||||||||||||||||||||||||||||||||||||||||||||||

| Other assets | 3,996 | 3,883 | 4,162 | 4,094 | 4,169 | 113 | 3 | (173) | (4) | |||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 82,152 | $ | 82,635 | $ | 82,230 | $ | 81,799 | $ | 81,661 | $ | (483) | (1) | % | $ | 491 | 1 | % | ||||||||||||||||||||||||||||||||||||||

| Liabilities and Shareholders' Equity: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deposits: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Savings | $ | 26,695 | $ | 26,634 | $ | 25,437 | $ | 25,847 | $ | 25,082 | $ | 62 | — | % | $ | 1,613 | 6 | % | ||||||||||||||||||||||||||||||||||||||

| Time deposits | 6,613 | 8,326 | 7,163 | 6,297 | 6,804 | (1,713) | (21) | (192) | (3) | |||||||||||||||||||||||||||||||||||||||||||||||

| Other interest-bearing deposits | 16,252 | 15,403 | 15,845 | 17,186 | 16,689 | 849 | 6 | (437) | (3) | |||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing deposits | 49,560 | 50,363 | 48,446 | 49,331 | 48,576 | (803) | (2) | 984 | 2 | |||||||||||||||||||||||||||||||||||||||||||||||

| Trading liabilities | 550 | 767 | 423 | 467 | 509 | (217) | (28) | 41 | 8 | |||||||||||||||||||||||||||||||||||||||||||||||

| Federal funds purchased and securities sold under agreements to repurchase | 2,355 | 1,910 | 2,572 | 2,137 | 2,223 | 444 | 23 | 132 | 6 | |||||||||||||||||||||||||||||||||||||||||||||||

| Short-term borrowings | 1,045 | 675 | 1,943 | 566 | 326 | 370 | 55 | 719 | NM | |||||||||||||||||||||||||||||||||||||||||||||||

| Term borrowings | 1,195 | 1,202 | 1,175 | 1,165 | 1,150 | (7) | (1) | 45 | 4 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 54,705 | 54,918 | 54,559 | 53,665 | 52,783 | (213) | — | 1,922 | 4 | |||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest-bearing deposits | 16,021 | 16,212 | 16,348 | 16,410 | 17,204 | (191) | (1) | (1,183) | (7) | |||||||||||||||||||||||||||||||||||||||||||||||

| Other liabilities | 2,315 | 2,189 | 2,368 | 2,550 | 2,383 | 126 | 6 | (68) | (3) | |||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities | 73,041 | 73,318 | 73,275 | 72,626 | 72,370 | (278) | — | 670 | 1 | |||||||||||||||||||||||||||||||||||||||||||||||

| Shareholders' Equity: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Preferred stock | 426 | 426 | 426 | 520 | 520 | — | — | (94) | (18) | |||||||||||||||||||||||||||||||||||||||||||||||

| Common stock | 328 | 333 | 336 | 343 | 349 | (5) | (1) | (22) | (6) | |||||||||||||||||||||||||||||||||||||||||||||||

| Capital surplus | 4,809 | 4,947 | 5,007 | 5,214 | 5,351 | (138) | (3) | (542) | (10) | |||||||||||||||||||||||||||||||||||||||||||||||

| Retained earnings | 4,382 | 4,304 | 4,172 | 4,072 | 3,964 | 77 | 2 | 418 | 11 | |||||||||||||||||||||||||||||||||||||||||||||||

| Accumulated other comprehensive loss, net | (1,128) | (989) | (1,281) | (1,271) | (1,188) | (139) | (14) | 60 | 5 | |||||||||||||||||||||||||||||||||||||||||||||||

| Combined shareholders' equity | 8,816 | 9,021 | 8,660 | 8,878 | 8,996 | (205) | (2) | (180) | (2) | |||||||||||||||||||||||||||||||||||||||||||||||

| Noncontrolling interest | 295 | 295 | 295 | 295 | 295 | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Total shareholders' equity | 9,111 | 9,316 | 8,955 | 9,173 | 9,291 | (205) | (2) | (180) | (2) | |||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities and shareholders' equity | $ | 82,152 | $ | 82,635 | $ | 82,230 | $ | 81,799 | $ | 81,661 | $ | (483) | (1) | % | $ | 491 | 1 | % | ||||||||||||||||||||||||||||||||||||||

| Memo: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total deposits | $ | 65,581 | $ | 66,575 | $ | 64,794 | $ | 65,741 | $ | 65,780 | $ | (994) | (1) | % | $ | (199) | — | % | ||||||||||||||||||||||||||||||||||||||

| Loans to mortgage companies | $ | 3,471 | $ | 3,244 | $ | 2,934 | $ | 2,366 | $ | 2,024 | $ | 227 | 7 | % | $ | 1,446 | 71 | % | ||||||||||||||||||||||||||||||||||||||

| Unfunded Loan Commitments: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial | $ | 17,863 | $ | 18,180 | $ | 18,781 | $ | 19,996 | $ | 21,328 | $ | (317) | (2) | % | $ | (3,465) | (16) | % | ||||||||||||||||||||||||||||||||||||||

| Consumer | $ | 4,203 | $ | 4,281 | $ | 4,334 | $ | 4,383 | $ | 4,401 | $ | (78) | (2) | % | $ | (198) | (5) | % | ||||||||||||||||||||||||||||||||||||||

Numbers may not foot due to rounding. See footnote disclosures on page 21.

12

CONSOLIDATED AVERAGE BALANCE SHEET

Quarterly, Unaudited

| 4Q24 Change vs. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (In millions) | 4Q24 | 3Q24 | 2Q24 | 1Q24 | 4Q23 | 3Q24 | 4Q23 | 2024 | 2023 | 2024 vs 2023 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Assets: | $ | % | $ | % | $ | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans and leases: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial, financial, and industrial (C&I) | $ | 33,107 | $ | 33,074 | $ | 32,909 | $ | 32,389 | $ | 32,520 | $ | 34 | — | % | $ | 587 | 2 | % | $ | 32,871 | $ | 32,390 | $ | 481 | 1 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial real estate | 14,601 | 14,684 | 14,576 | 14,367 | 14,210 | (83) | (1) | 391 | 3 | 14,558 | 13,785 | 773 | 6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Commercial | 47,709 | 47,758 | 47,485 | 46,756 | 46,730 | (49) | — | 978 | 2 | 47,429 | 46,175 | 1,254 | 3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consumer real estate | 14,008 | 13,935 | 13,783 | 13,615 | 13,664 | 73 | 1 | 344 | 3 | 13,836 | 13,179 | 657 | 5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Credit card and other5 | 701 | 720 | 761 | 781 | 802 | (19) | (3) | (101) | (13) | 740 | 814 | (74) | (9) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Consumer | 14,709 | 14,654 | 14,544 | 14,396 | 14,466 | 55 | — | 243 | 2 | 14,577 | 13,994 | 583 | 4 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans and leases, net of unearned income | 62,418 | 62,413 | 62,029 | 61,152 | 61,197 | 5 | — | 1,221 | 2 | 62,005 | 60,169 | 1,837 | 3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans held-for-sale | 482 | 491 | 462 | 454 | 547 | (9) | (2) | (64) | (12) | 472 | 664 | (192) | (29) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment securities | 9,295 | 9,400 | 9,261 | 9,590 | 9,394 | (105) | (1) | (99) | (1) | 9,386 | 9,912 | (526) | (5) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trading securities | 1,515 | 1,469 | 1,367 | 1,245 | 1,225 | 45 | 3 | 290 | 24 | 1,399 | 1,179 | 220 | 19 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits with banks | 1,438 | 1,741 | 1,449 | 1,793 | 2,556 | (304) | (17) | (1,118) | (44) | 1,605 | 2,504 | (899) | (36) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Federal funds sold and securities purchased under agreements to resell | 594 | 607 | 676 | 544 | 529 | (13) | (2) | 65 | 12 | 605 | 379 | 226 | 60 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest earning assets | 75,742 | 76,121 | 75,243 | 74,778 | 75,448 | (379) | — | 294 | — | 75,473 | 74,807 | 666 | 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash and due from banks | 911 | 905 | 904 | 948 | 994 | 6 | 1 | (83) | (8) | 917 | 1,012 | (96) | (9) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Goodwill and other intangibles assets, net | 1,658 | 1,669 | 1,680 | 1,691 | 1,702 | (11) | (1) | (45) | (3) | 1,674 | 1,720 | (46) | (3) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Premises and equipment, net | 571 | 578 | 585 | 587 | 589 | (7) | (1) | (18) | (3) | 580 | 596 | (16) | (3) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Allowances for loan and lease losses | (821) | (827) | (810) | (789) | (772) | 6 | 1 | (49) | (6) | (812) | (740) | (72) | (10) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other assets | 3,889 | 3,921 | 4,120 | 4,028 | 4,352 | (32) | (1) | (462) | (11) | 3,989 | 4,287 | (298) | (7) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 81,950 | $ | 82,366 | $ | 81,721 | $ | 81,243 | $ | 82,313 | $ | (416) | (1) | % | $ | (363) | — | % | $ | 81,822 | $ | 81,683 | $ | 139 | — | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Liabilities and shareholders' equity: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deposits: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Savings | $ | 26,836 | $ | 26,062 | $ | 25,462 | $ | 25,390 | $ | 25,799 | $ | 774 | 3 | % | $ | 1,037 | 4 | % | $ | 25,941 | $ | 23,547 | $ | 2,393 | 10 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Time deposits | 7,407 | 8,167 | 6,683 | 6,628 | 7,372 | (760) | (9) | 35 | — | 7,224 | 6,095 | 1,129 | 19 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other interest-bearing deposits | 15,726 | 15,923 | 16,484 | 16,735 | 16,344 | (198) | (1) | (618) | (4) | 16,215 | 15,300 | 915 | 6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing deposits | 49,969 | 50,153 | 48,629 | 48,753 | 49,515 | (184) | — | 454 | 1 | 49,379 | 44,942 | 4,437 | 10 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trading liabilities | 578 | 576 | 605 | 462 | 386 | 2 | — | 192 | 50 | 555 | 300 | 255 | 85 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Federal funds purchased and securities sold under agreements to repurchase | 2,205 | 2,132 | 2,208 | 2,014 | 1,982 | 73 | 3 | 222 | 11 | 2,140 | 1,775 | 365 | 21 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Short-term borrowings | 441 | 884 | 1,267 | 537 | 437 | (443) | (50) | 4 | 1 | 781 | 2,688 | (1,906) | (71) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Term borrowings | 1,206 | 1,188 | 1,170 | 1,156 | 1,156 | 19 | 2 | 50 | 4 | 1,180 | 1,335 | (155) | (12) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 54,398 | 54,931 | 53,879 | 52,921 | 53,475 | (533) | (1) | 923 | 2 | 54,036 | 51,040 | 2,996 | 6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest-bearing deposits | 16,123 | 16,111 | 16,332 | 16,626 | 17,347 | 12 | — | (1,224) | (7) | 16,297 | 19,341 | (3,044) | (16) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other liabilities | 2,213 | 2,196 | 2,561 | 2,445 | 2,585 | 17 | 1 | (372) | (14) | 2,353 | 2,397 | (44) | (2) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities | 72,735 | 73,238 | 72,772 | 71,992 | 73,407 | (504) | (1) | (673) | (1) | 72,686 | 72,778 | (92) | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholders' Equity: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Preferred stock | 426 | 426 | 426 | 520 | 520 | — | — | (94) | (18) | 450 | 758 | (308) | (41) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common stock | 330 | 334 | 340 | 347 | 349 | (4) | (1) | (19) | (5) | 338 | 343 | (5) | (2) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Capital surplus | 4,881 | 4,973 | 5,127 | 5,301 | 5,343 | (92) | (2) | (462) | (9) | 5,070 | 5,106 | (36) | (1) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Retained earnings | 4,382 | 4,254 | 4,122 | 4,028 | 3,935 | 128 | 3 | 446 | 11 | 4,197 | 3,770 | 427 | 11 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Accumulated other comprehensive loss, net | (1,099) | (1,154) | (1,361) | (1,240) | (1,538) | 55 | 5 | 439 | 29 | (1,213) | (1,367) | 154 | 11 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Combined shareholders' equity | 8,920 | 8,833 | 8,654 | 8,956 | 8,610 | 87 | 1 | 310 | 4 | 8,841 | 8,610 | 231 | 3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noncontrolling interest | 295 | 295 | 295 | 295 | 295 | — | — | — | — | 295 | 295 | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total shareholders' equity | 9,216 | 9,128 | 8,949 | 9,251 | 8,905 | 87 | 1 | 310 | 3 | 9,136 | 8,905 | 231 | 3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities and shareholders' equity | $ | 81,950 | $ | 82,366 | $ | 81,721 | $ | 81,243 | $ | 82,313 | $ | (416) | (1) | % | $ | (363) | — | % | $ | 81,822 | $ | 81,683 | $ | 139 | — | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Memo: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total deposits | $ | 66,092 | $ | 66,263 | $ | 64,960 | $ | 65,379 | $ | 66,862 | $ | (171) | — | % | $ | (770) | (1) | % | $ | 65,676 | $ | 64,283 | $ | 1,394 | 2 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans to mortgage companies | $ | 3,283 | $ | 2,875 | $ | 2,440 | $ | 1,847 | $ | 1,948 | $ | 408 | 14 | % | $ | 1,335 | 69 | % | $ | 2,614 | $ | 2,110 | $ | 503 | 24 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

Numbers may not foot due to rounding. See footnote disclosures on page 21.

13

| CONSOLIDATED NET INTEREST INCOME AND AVERAGE BALANCE SHEET: YIELDS AND RATES | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarterly, Unaudited | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4Q24 Change vs. | 2024 vs 2023 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4Q24 | 3Q24 | 2Q24 | 1Q24 | 4Q23 | 3Q24 | 4Q23 | 2024 | 2023 | 2023 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (In millions, except rates) | Income/Expense | Rate | Income/Expense | Rate | Income/Expense | Rate | Income/Expense | Rate | Income/Expense | Rate | Income/Expense | Income/Expense | Income/Expense | Rate | Income/Expense | Rate | Income/Expense | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $/bp | % | $/bp | % | $ | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest earning assets/Interest income: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans and leases, net of unearned income: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial | $ | 771 | 6.43 | % | $ | 813 | 6.78 | % | $ | 800 | 6.78 | % | $ | 782 | 6.73 | % | $ | 783 | 6.65 | % | $ | (42) | (5) | % | $ | (12) | (2) | % | $ | 3,166 | 6.68 | % | $ | 2,957 | 6.41 | % | $ | 209 | 7 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Consumer | 183 | 4.97 | 186 | 5.05 | 179 | 4.91 | 173 | 4.80 | 171 | 4.71 | (2) | (1) | 12 | 7 | 720 | 4.93 | 630 | 4.48 | 91 | 14 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans and leases, net of unearned income | 954 | 6.09 | 999 | 6.37 | 978 | 6.34 | 955 | 6.28 | 954 | 6.19 | (45) | (4) | — | — | 3,886 | 6.27 | 3,587 | 5.96 | 299 | 8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans held-for-sale | 9 | 7.38 | 10 | 7.77 | 9 | 7.50 | 9 | 7.80 | 11 | 8.34 | (1) | (7) | (3) | (22) | 36 | 7.61 | 51 | 7.71 | (15) | (30) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment securities | 62 | 2.69 | 61 | 2.58 | 60 | 2.58 | 61 | 2.54 | 61 | 2.62 | 2 | 3 | 1 | 2 | 244 | 2.60 | 250 | 2.52 | (6) | (3) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trading securities | 22 | 5.74 | 22 | 6.05 | 22 | 6.30 | 20 | 6.48 | 20 | 6.63 | — | (2) | 1 | 7 | 86 | 6.12 | 78 | 6.62 | 8 | 10 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits with banks | 17 | 4.77 | 24 | 5.40 | 20 | 5.46 | 24 | 5.46 | 35 | 5.46 | (6) | (27) | (18) | (51) | 85 | 5.29 | 130 | 5.20 | (45) | (35) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Federal funds sold and securities purchased under agreements | 7 | 4.46 | 8 | 5.23 | 9 | 5.31 | 7 | 5.16 | 7 | 5.32 | (1) | (16) | — | (6) | 31 | 5.05 | 19 | 4.93 | 12 | 63 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest income | $ | 1,071 | 5.63 | % | $ | 1,123 | 5.88 | % | $ | 1,097 | 5.86 | % | $ | 1,076 | 5.78 | % | $ | 1,089 | 5.74 | % | $ | (52) | (5) | % | $ | (18) | (2) | % | $ | 4,367 | 5.79 | $ | 4,115 | 5.50 | $ | 251 | 6 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest bearing liabilities/Interest expense: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Savings | $ | 210 | 3.11 | % | $ | 225 | 3.43 | % | $ | 208 | 3.29 | % | $ | 206 | 3.27 | % | $ | 222 | 3.42 | % | $ | (15) | (7) | % | $ | (13) | (6) | % | $ | 849 | 3.27 | % | $ | 679 | 2.88 | % | $ | 170 | 25 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Time deposits | 81 | 4.35 | 95 | 4.63 | 74 | 4.45 | 73 | 4.42 | 82 | 4.42 | (14) | (15) | (1) | (1) | 323 | 4.47 | 236 | 3.87 | 87 | 37 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other interest-bearing deposits | 99 | 2.49 | 114 | 2.85 | 117 | 2.86 | 119 | 2.86 | 116 | 2.81 | (16) | (14) | (17) | (15) | 449 | 2.77 | 351 | 2.30 | 98 | 28 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing deposits | 389 | 3.10 | 434 | 3.44 | 399 | 3.30 | 398 | 3.28 | 420 | 3.37 | (45) | (10) | (31) | (7) | 1,620 | 3.28 | 1,266 | 2.82 | 355 | 28 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trading liabilities | 6 | 4.01 | 6 | 4.13 | 7 | 4.46 | 5 | 4.31 | 4 | 4.59 | — | (3) | 1 | 31 | 23 | 4.22 | 13 | 4.16 | 11 | 88 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Federal funds purchased and securities sold under agreements to repurchase | 21 | 3.72 | 23 | 4.20 | 24 | 4.36 | 21 | 4.24 | 22 | 4.35 | (2) | (9) | (1) | (5) | 88 | 4.13 | 70 | 3.95 | 18 | 26 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Short-term borrowings | 5 | 4.75 | 12 | 5.52 | 17 | 5.48 | 7 | 5.43 | 6 | 5.41 | (7) | (57) | (1) | (12) | 42 | 5.38 | 140 | 5.19 | (98) | (70) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Term borrowings | 17 | 5.52 | 17 | 5.64 | 17 | 5.64 | 17 | 5.71 | 17 | 5.75 | — | (1) | — | — | 66 | 5.63 | 72 | 5.39 | (6) | (8) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest expense | 438 | 3.20 | 491 | 3.56 | 464 | 3.46 | 448 | 3.40 | 469 | 3.48 | (54) | (11) | (31) | (7) | 1,841 | 3.41 | 1,560 | 3.06 | 281 | 18 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income - tax equivalent basis | 634 | 2.43 | 631 | 2.32 | 633 | 2.40 | 628 | 2.38 | 621 | 2.26 | 2 | — | 13 | 2 | 2,526 | 2.38 | 2,556 | 2.44 | (29) | (1) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fully taxable equivalent adjustment | (4) | 0.90 | (4) | 0.99 | (4) | 0.98 | (4) | 0.99 | (4) | 1.01 | — | 5 | — | 6 | (16) | 0.97 | (16) | 0.98 | — | 1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 630 | 3.33 | % | $ | 627 | 3.31 | % | $ | 629 | 3.38 | % | $ | 625 | 3.37 | % | $ | 617 | 3.27 | % | $ | 2 | — | % | $ | 13 | 2 | % | $ | 2,511 | 3.35 | % | $ | 2,540 | 3.42 | % | $ | (29) | (1) | % | |||||||||||||||||||||||||||||||||||||||||||||||||