Document 1

Morgan Stanley Fourth Quarter and Full Year 2024 Earnings Results

Morgan Stanley Reports Fourth Quarter Net Revenues of $16.2 Billion, EPS of $2.22 and ROTCE of 20.2%; Full Year Net Revenues of $61.8 Billion, EPS of $7.95 and ROTCE of 18.8%

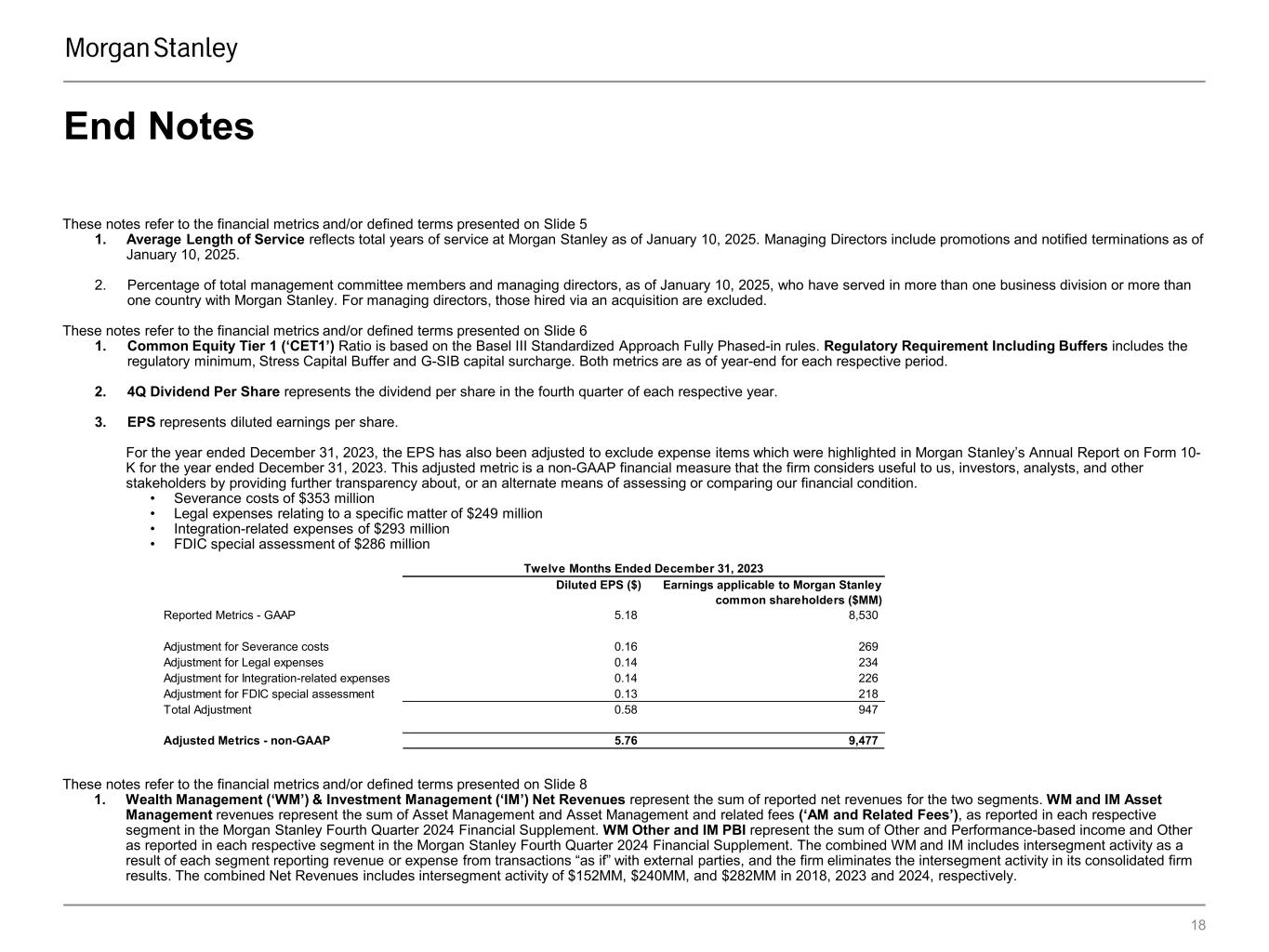

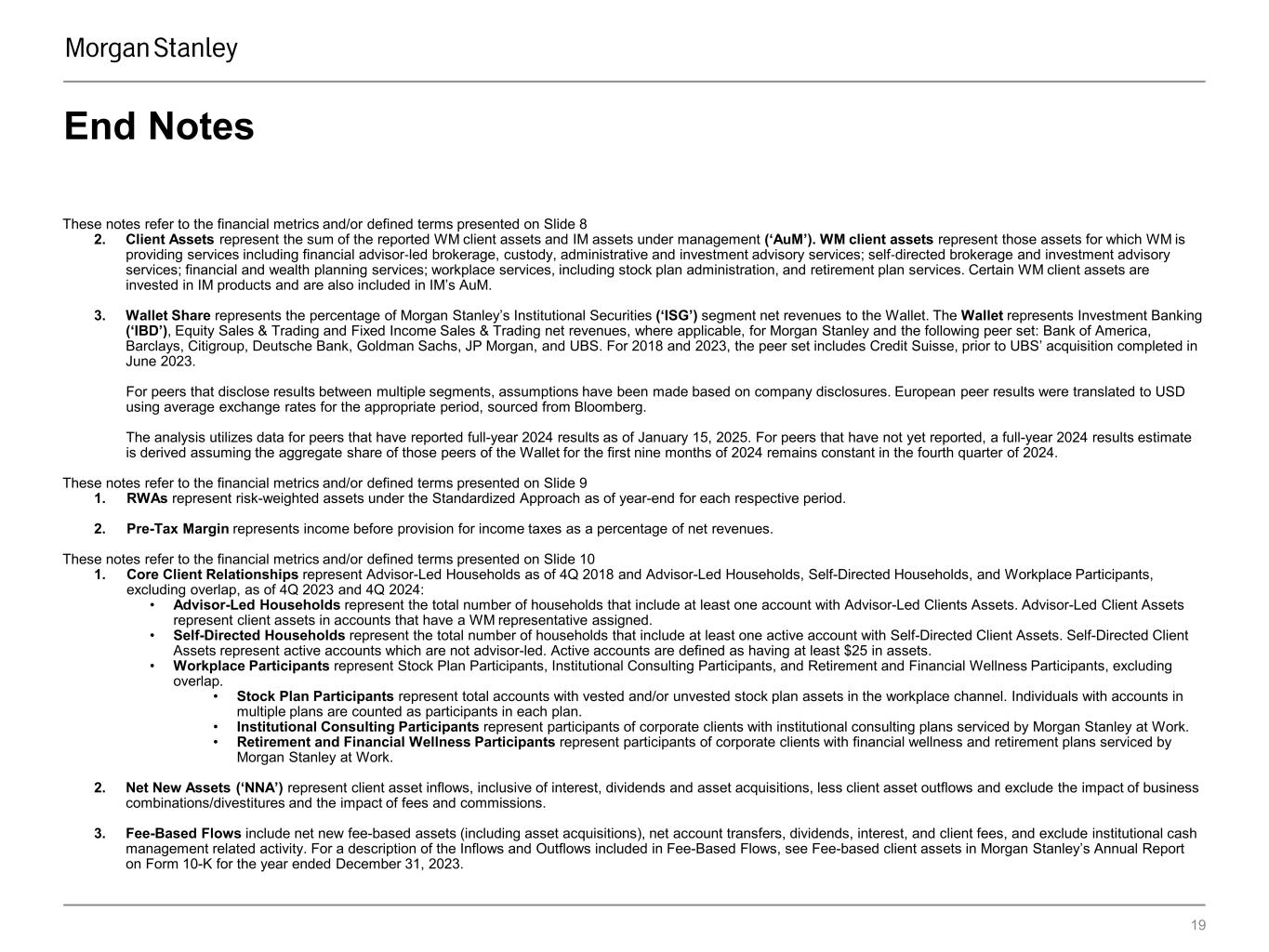

NEW YORK, January 16, 2025 – Morgan Stanley (NYSE: MS) today reported net revenues of $16.2 billion for the fourth quarter ended December 31, 2024 compared with $12.9 billion a year ago. Net income applicable to Morgan Stanley was $3.7 billion, or $2.22 per diluted share, compared with $1.5 billion, or $0.85 per diluted share, for the same period a year ago.1

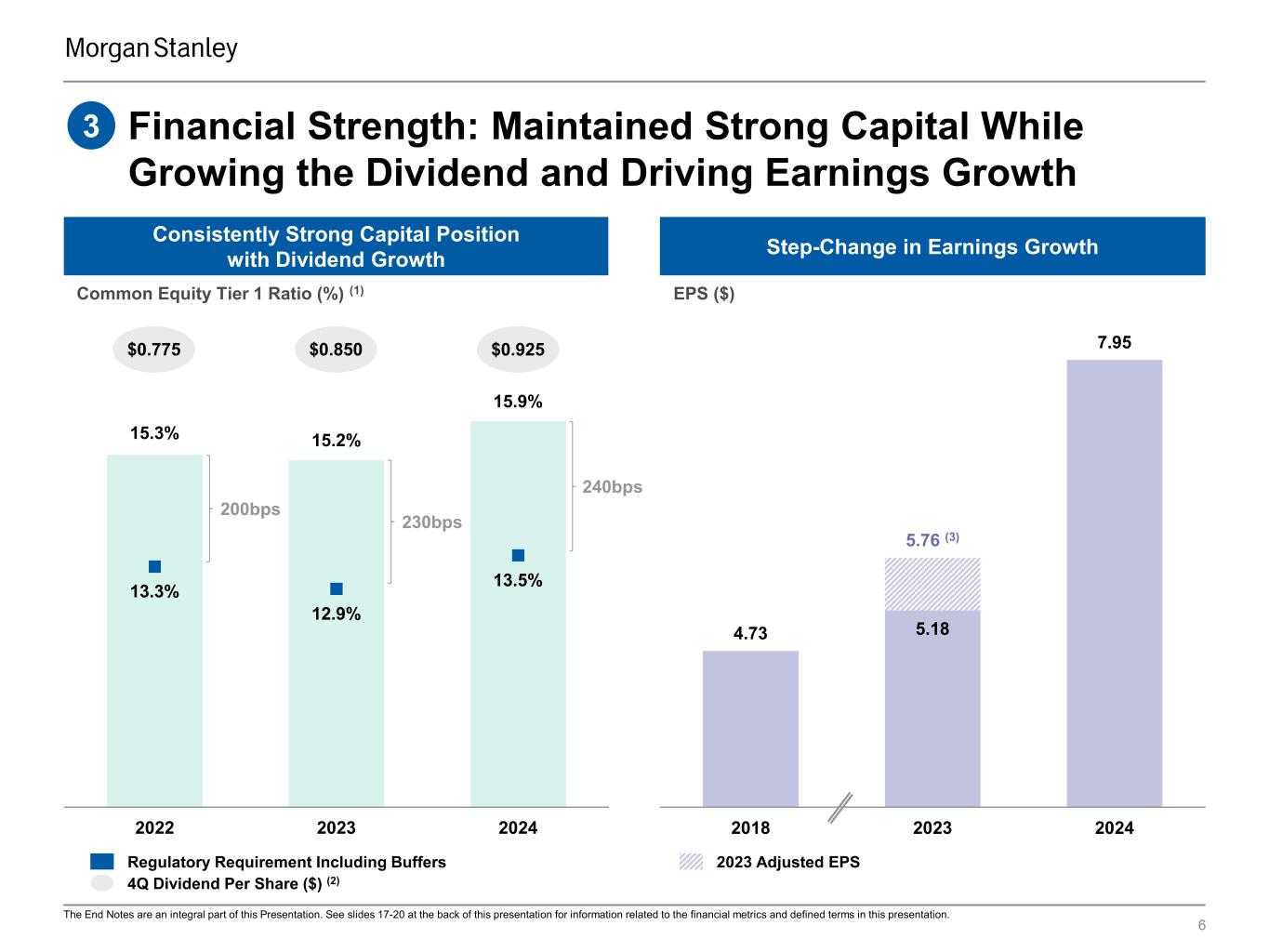

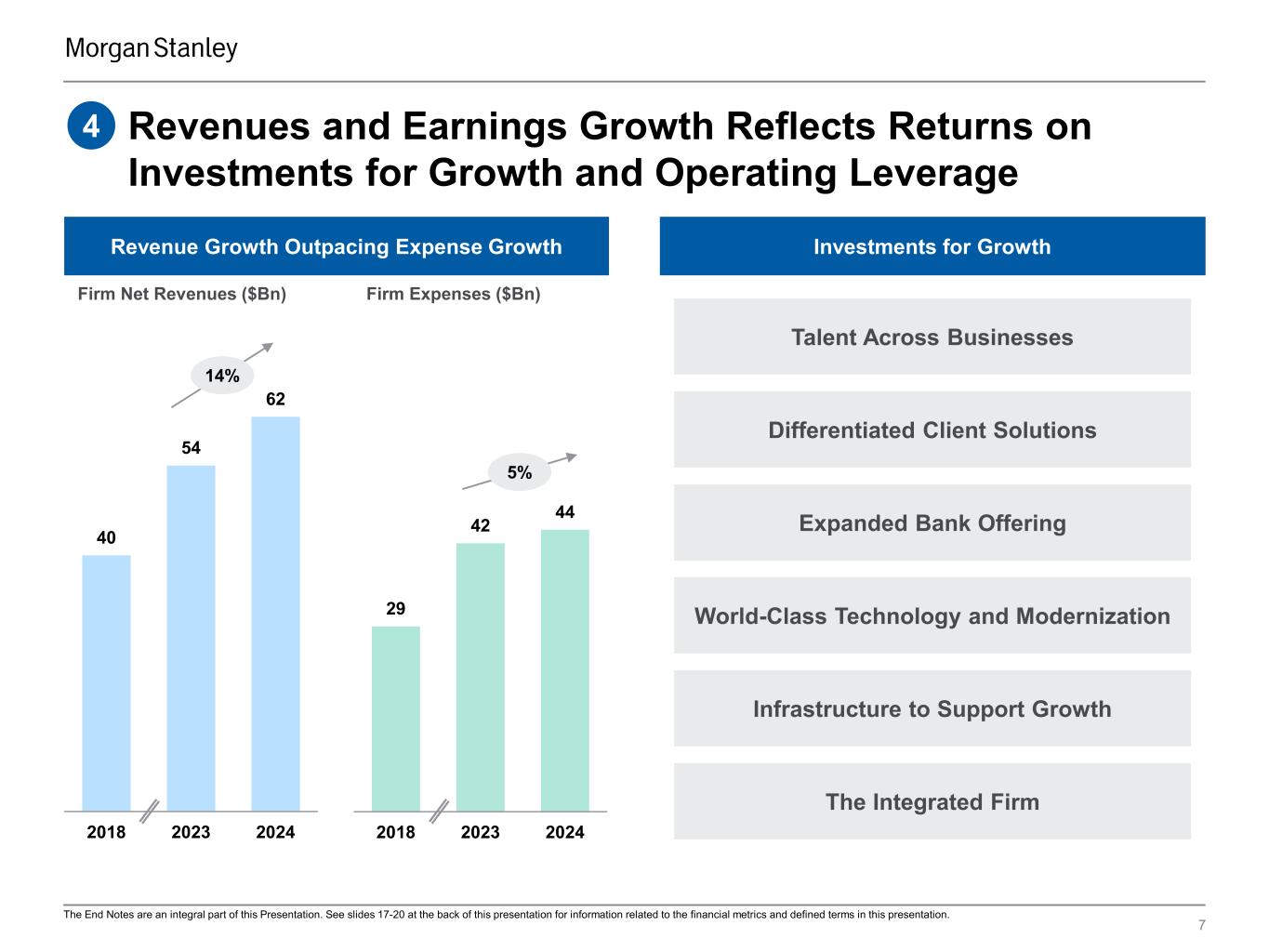

Full year net revenues were $61.8 billion compared with $54.1 billion a year ago. Net income applicable to Morgan Stanley was $13.4 billion, or $7.95 per diluted share, compared with $9.1 billion, or $5.18 per diluted share, a year ago.1

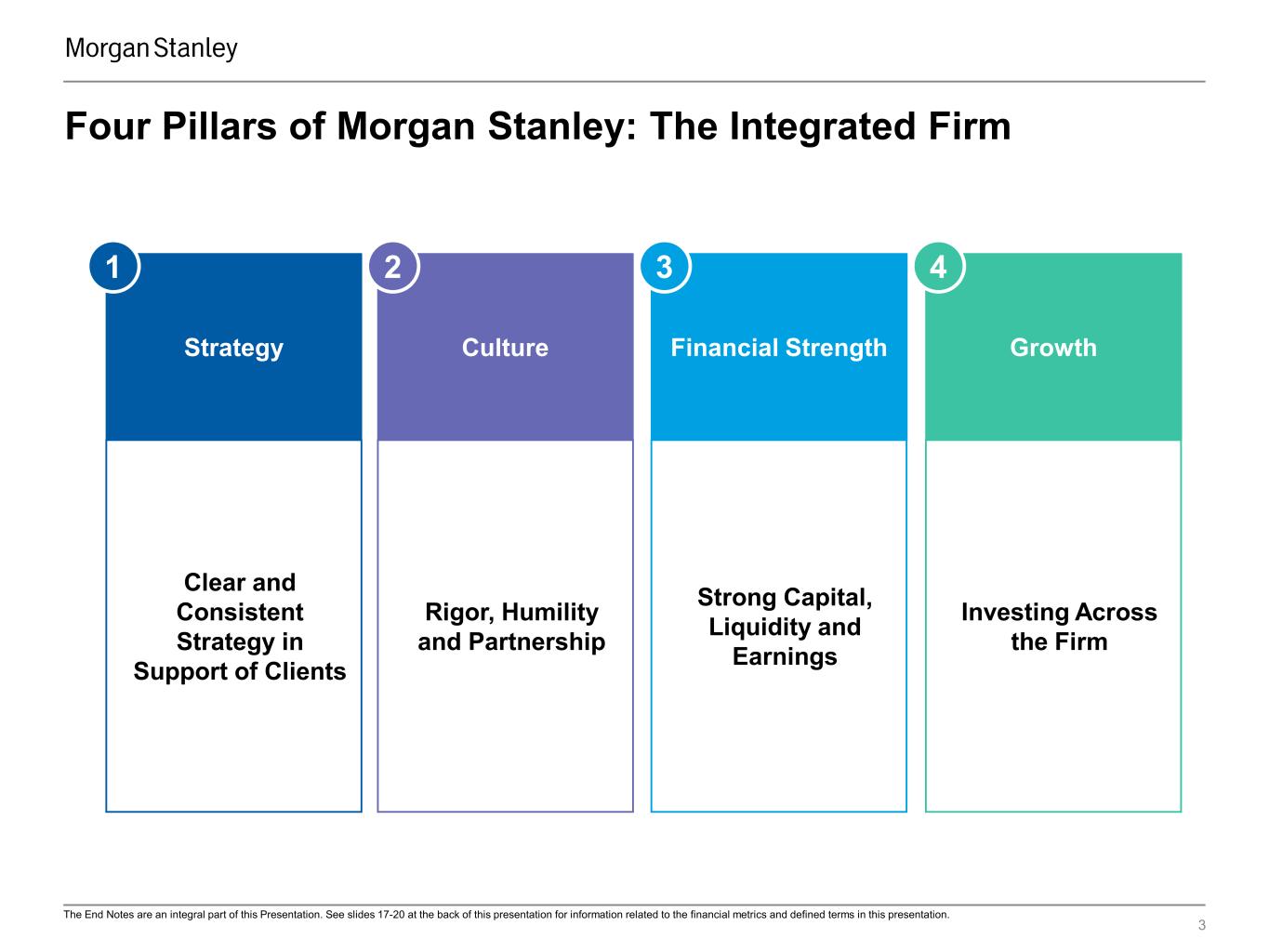

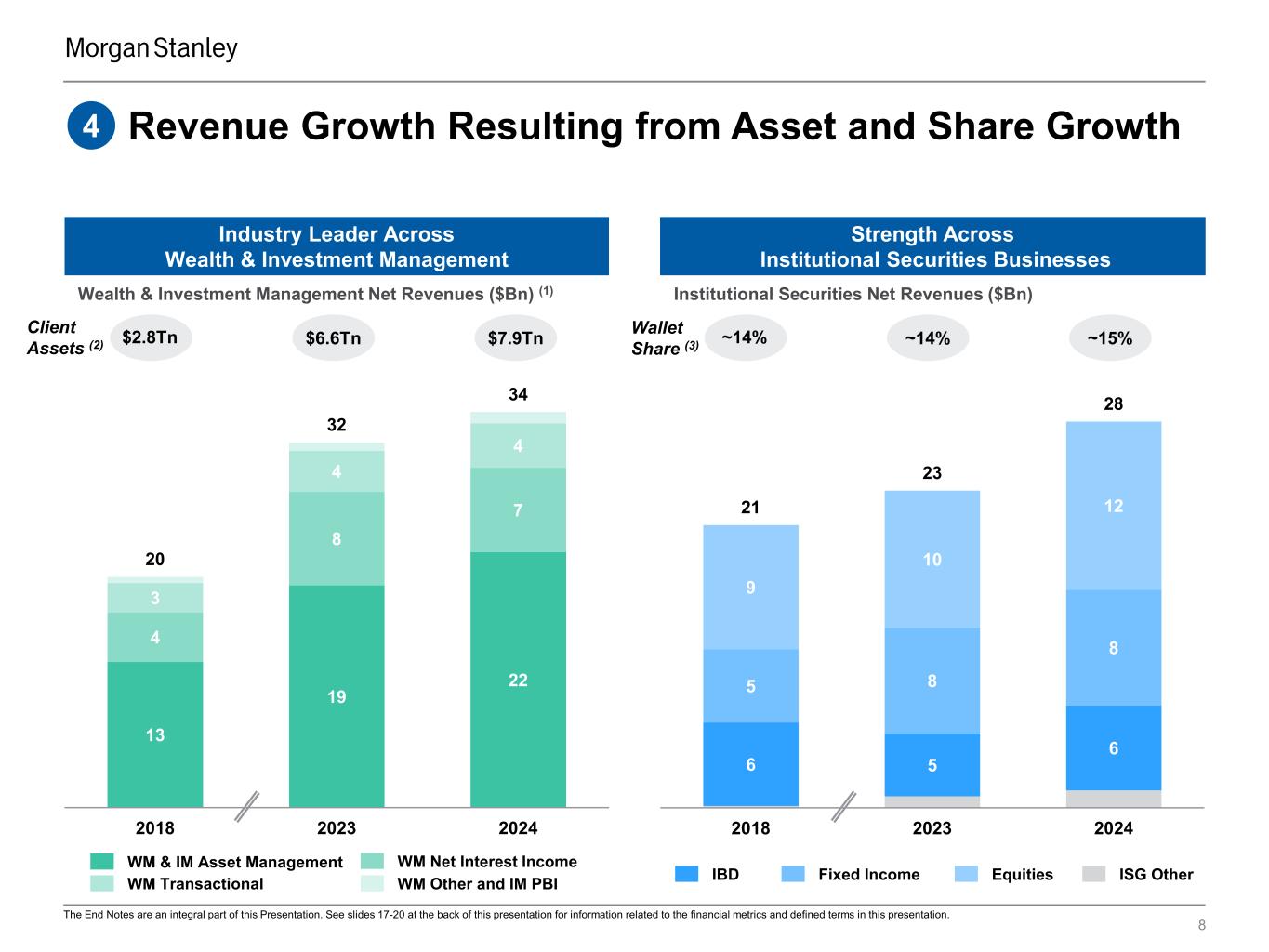

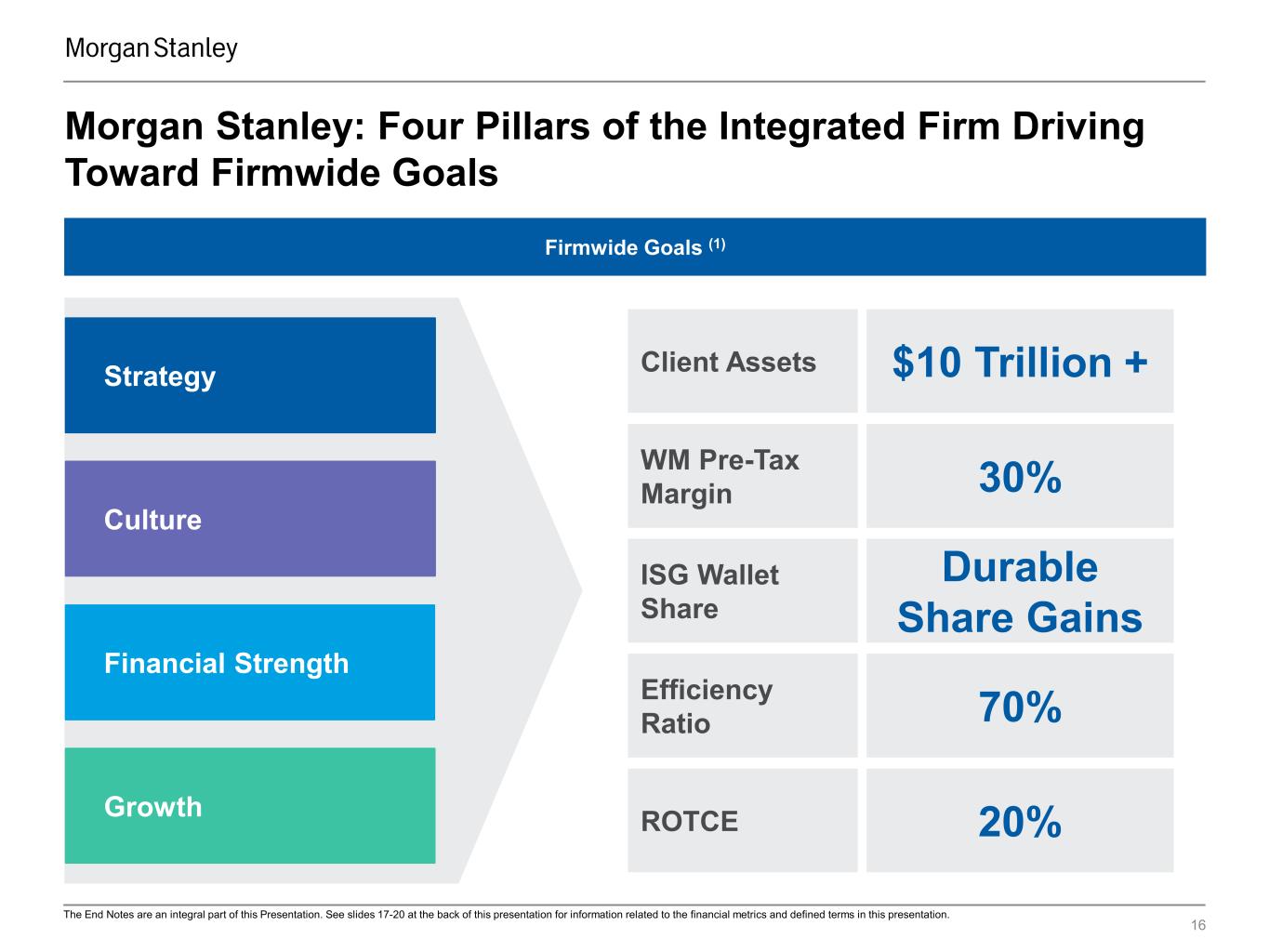

Ted Pick,Chairman and Chief Executive Officer, said, “An excellent fourth quarter with a 20% ROTCE followed three quarters of consistent execution for Morgan Stanley, capping off one of the strongest years in the Firm’s history. The Firm produced full year revenues of $61.8 billion, EPS of $7.95 and a ROTCE of 18.8%. Institutional Securities saw strength across markets and continued improvement in Investment Banking. Total client assets grew to $7.9 trillion across Wealth and Investment Management supported by markets and healthy net new assets. We are executing against four pillars – strategy, culture, financial strength and growth – that support our Integrated Firm, creating long-term value for our shareholders.” | ||

Financial Summary2,3 | |||||||||||||||||

Firm($MM, except per share data) | 4Q 2024 | 4Q 2023 | FY 2024 | FY 2023 | |||||||||||||

| Net revenues | $16,223 | $12,896 | $61,761 | $54,143 | |||||||||||||

| Provision for credit losses | $115 | $3 | $264 | $532 | |||||||||||||

| Compensation expense | $6,289 | $5,951 | $26,178 | $24,558 | |||||||||||||

| Non-compensation expenses | $4,913 | $4,846 | $17,723 | $17,240 | |||||||||||||

Pre-tax income6 | $4,906 | $2,096 | $17,596 | $11,813 | |||||||||||||

| Net income app. to MS | $3,714 | $1,517 | $13,390 | $9,087 | |||||||||||||

Expense efficiency ratio8 | 69 | % | 84 | % | 71 | % | 77 | % | |||||||||

Earnings per diluted share1 | $2.22 | $0.85 | $7.95 | $5.18 | |||||||||||||

| Book value per share | $58.98 | $55.50 | $58.98 | $55.50 | |||||||||||||

Tangible book value per share4 | $44.57 | $40.89 | $44.57 | $40.89 | |||||||||||||

| Return on equity | 15.2 | % | 6.2 | % | 14.0 | % | 9.4 | % | |||||||||

Return on tangible equity4 | 20.2 | % | 8.4 | % | 18.8 | % | 12.8 | % | |||||||||

| Institutional Securities | |||||||||||||||||

| Net revenues | $7,267 | $4,940 | $28,080 | $23,060 | |||||||||||||

| Investment Banking | $1,641 | $1,318 | $6,170 | $4,578 | |||||||||||||

| Equity | $3,325 | $2,202 | $12,230 | $9,986 | |||||||||||||

| Fixed Income | $1,931 | $1,434 | $8,418 | $7,673 | |||||||||||||

| Wealth Management | |||||||||||||||||

| Net revenues | $7,478 | $6,645 | $28,420 | $26,268 | |||||||||||||

Fee-based client assets ($Bn)9 | $2,347 | $1,983 | $2,347 | $1,983 | |||||||||||||

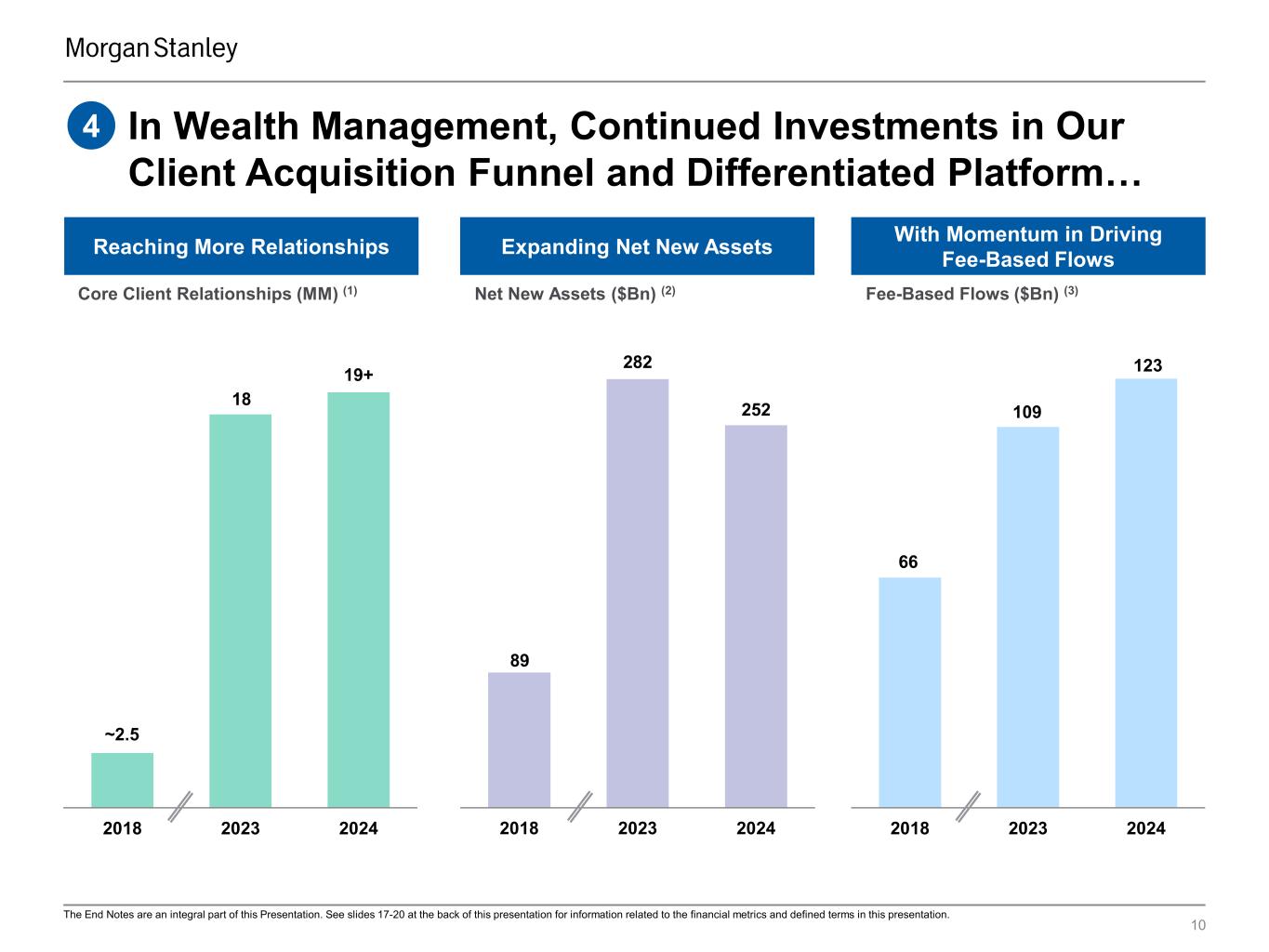

Fee-based asset flows ($Bn)10 | $35.2 | $41.6 | $123.1 | $109.2 | |||||||||||||

Net new assets ($Bn)11 | $56.5 | $47.5 | $251.7 | $282.3 | |||||||||||||

Loans ($Bn) | $159.5 | $146.5 | $159.5 | $146.5 | |||||||||||||

| Investment Management | |||||||||||||||||

| Net revenues | $1,643 | $1,464 | $5,861 | $5,370 | |||||||||||||

AUM ($Bn)12 | $1,666 | $1,459 | $1,666 | $1,459 | |||||||||||||

Long-term net flows ($Bn)13 | $4.3 | $(7.1) | $18.0 | $(15.2) | |||||||||||||

Full Year Highlights

•The Firm reported record net revenues of $61.8 billion with net income of $13.4 billion, demonstrating the strength of our Integrated Firm with strong results across our business segments.

•The Firm delivered a strong ROTCE of 18.8%.2,4

•The Firm expense efficiency ratio was 71% compared to 77% a year ago, reflecting stronger revenues and expense discipline.8 The prior year was also negatively impacted by certain expense items.19

•The Firm accreted $5.6 billion of Common Equity Tier 1 capital while supporting our clients and returning capital to shareholders. The Standardized Common Equity Tier 1 capital ratio was 15.9% at year-end.16

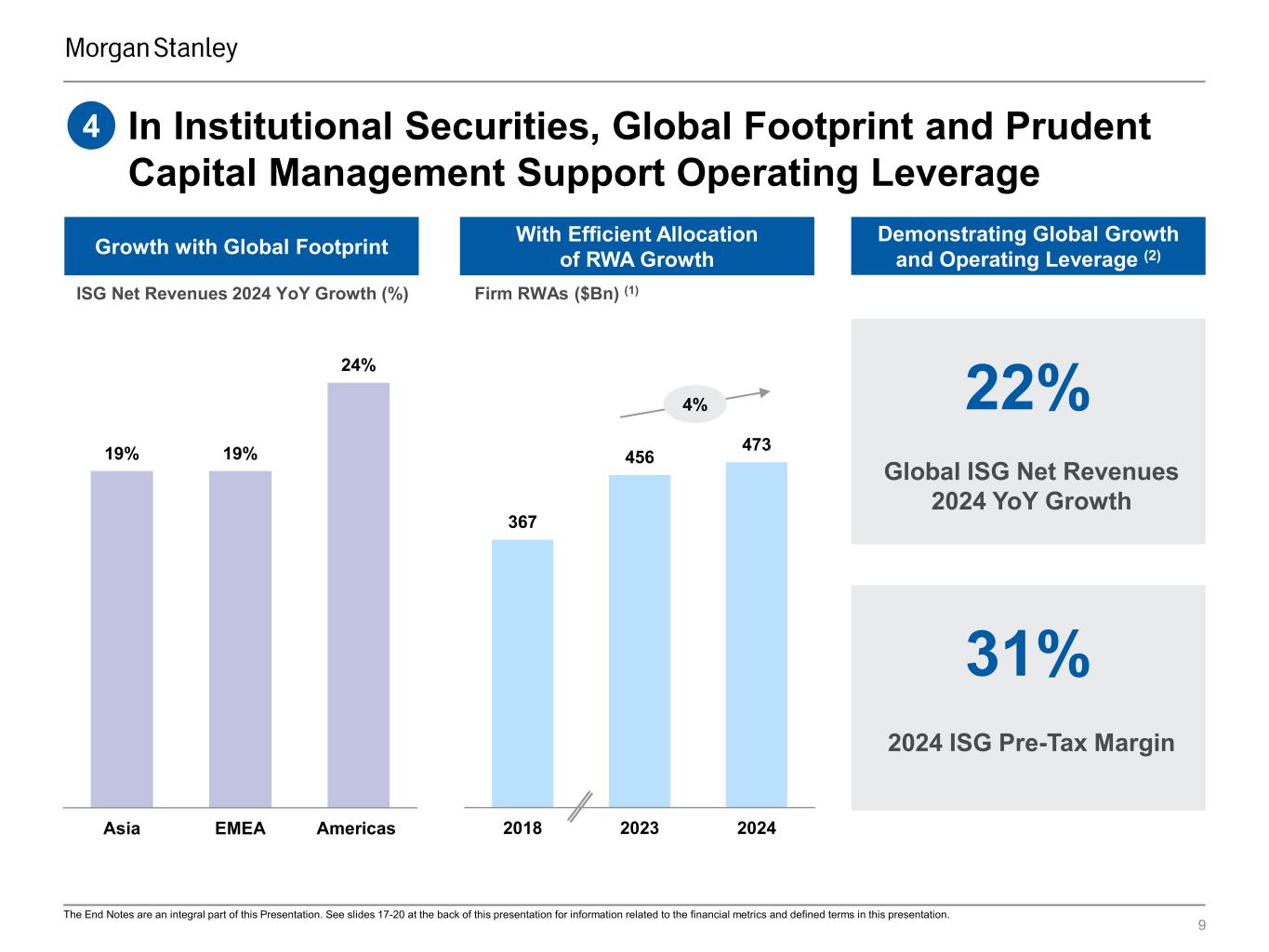

•Institutional Securities reported net revenues of $28.1 billion reflecting higher results across business lines and regions on strong client activity and improved market conditions.

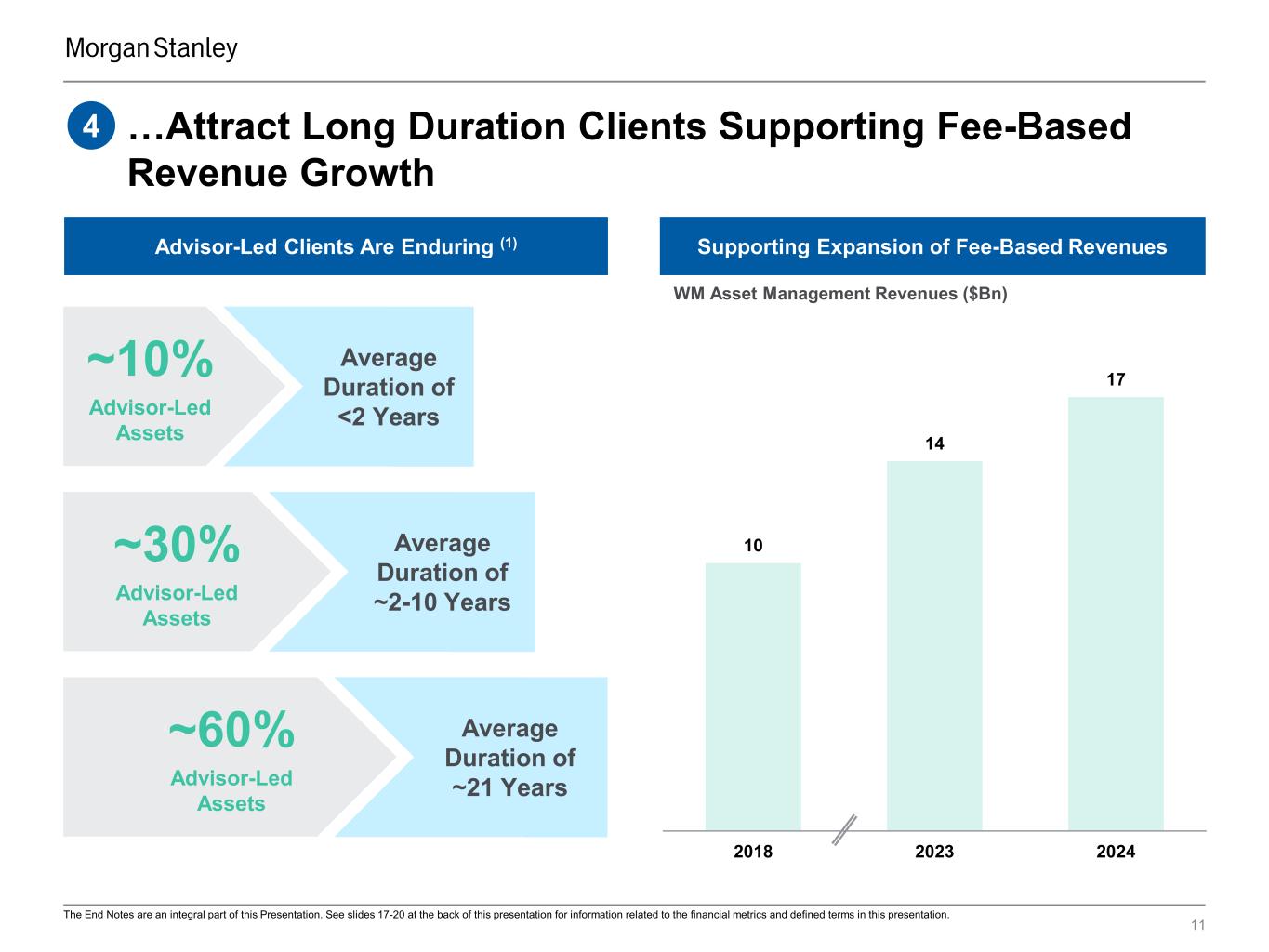

•Wealth Management delivered net revenues of $28.4 billion, reflecting strong asset management and transactional revenues.14 The pre-tax margin for the year was 27.2%.7 The business added fee-based flows of $123 billion and net new assets of $252 billion representing a full year 5% annualized growth rate from beginning period assets.10,11

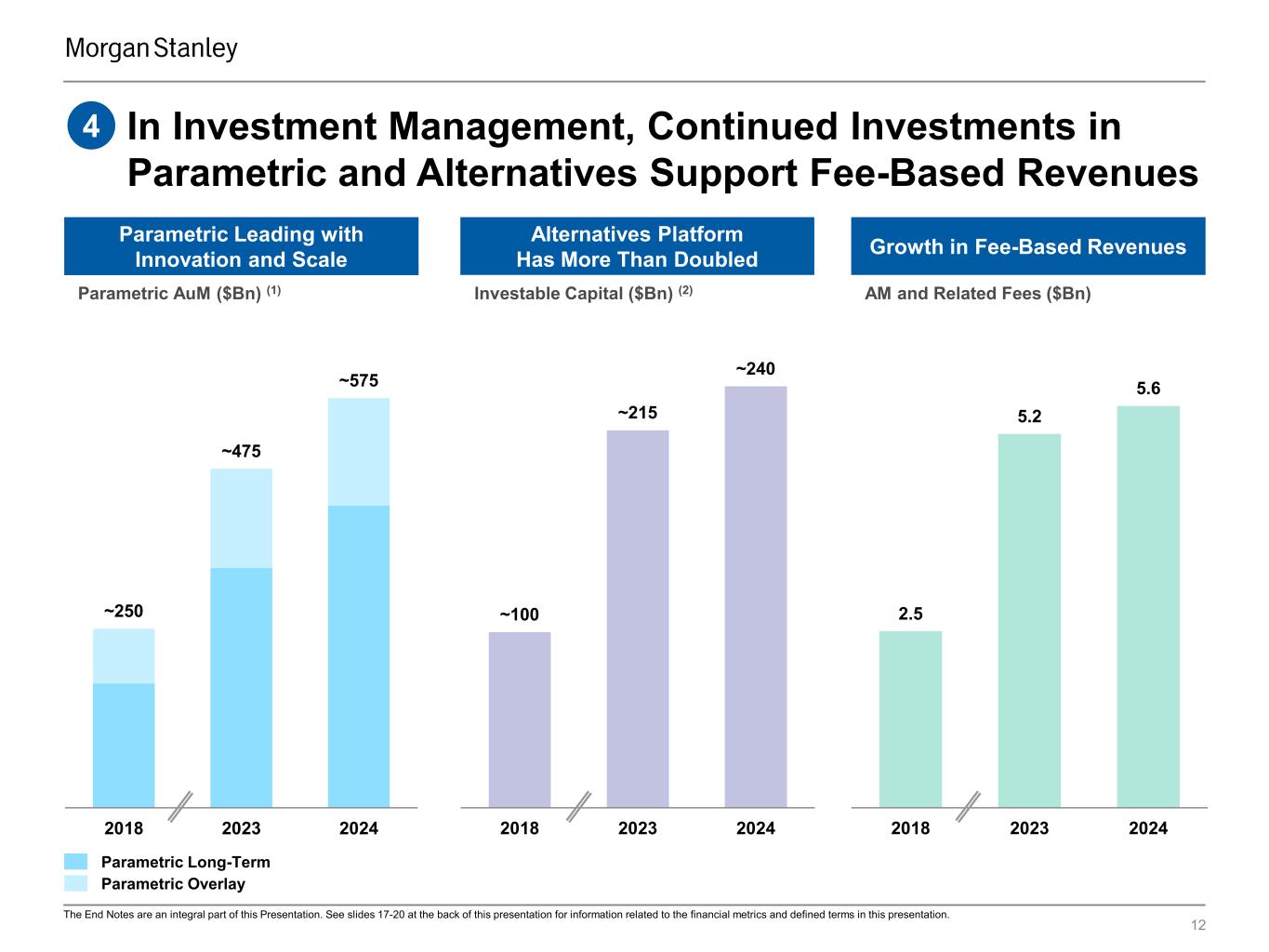

•Investment Management reported net revenues of $5.9 billion driven by asset management revenues on higher average AUM.12 The year included long-term net inflows of $18 billion.13

| Media Relations: Wesley McDade 212-761-2430 Investor Relations: Leslie Bazos 212-761-5352 | ||

Fourth Quarter Results

Institutional Securities

Institutional Securities reported net revenues for the current quarter of $7.3 billion compared with $4.9 billion a year ago. Pre-tax income was $2.4 billion compared with $408 million a year ago.6

Investment Banking revenues up 25%:

•Advisory revenues increased on higher completed M&A transactions.

•Equity underwriting revenues increased from a year ago driven by higher follow-ons and IPOs as clients strategically raised capital in a more constructive environment.

•Fixed income underwriting revenues were essentially unchanged from the prior year quarter as higher non-investment grade issuances offset lower investment grade issuances.

Equity net revenues up 51%:

•Equity net revenues increased across business lines and regions driven by increased client activity, with notable strength in Prime Brokerage and regional strength in Asia.

Fixed Income net revenues up 35%:

•Fixed Income net revenues reflect strong results in credit on higher lending and securitization activity and higher structured revenues in commodities.

Other:

•Other revenues increased from a year ago primarily driven by lower mark-to-market losses on corporate loans, inclusive of hedges.

| ($ millions) | 4Q 2024 | 4Q 2023 | ||||||||||||

| Net Revenues | $7,267 | $4,940 | ||||||||||||

| Investment Banking | $1,641 | $1,318 | ||||||||||||

| Advisory | $779 | $702 | ||||||||||||

| Equity underwriting | $455 | $225 | ||||||||||||

| Fixed income underwriting | $407 | $391 | ||||||||||||

| Equity | $3,325 | $2,202 | ||||||||||||

| Fixed Income | $1,931 | $1,434 | ||||||||||||

| Other | $370 | $(14) | ||||||||||||

| Provision for credit losses | $78 | $22 | ||||||||||||

Total Expenses | $4,748 | $4,510 | ||||||||||||

| Compensation | $1,764 | $1,732 | ||||||||||||

| Non-compensation | $2,984 | $2,778 | ||||||||||||

Provision for credit losses:

•Provision for credit losses increased from a year ago, primarily driven by growth in the corporate loan portfolio. The quarter included charge-offs of $62 million primarily related to the commercial real estate sector.

Total Expenses:

•Compensation expense increased from a year ago on higher revenues, partially offset by lower expenses related to DCP.5, 19

•Non-compensation expenses increased from a year ago on higher execution-related expenses, partially offset by lower legal costs and the absence of an FDIC special assessment.19

2 | ||

Wealth Management

Wealth Management reported net revenues of $7.5 billion in the current quarter compared with $6.6 billion a year ago. Pre-tax income of $2.1 billion in the current quarter resulted in a pre-tax margin of 27.5%.6, 7

Net revenues up 13%:

•Asset management revenues were a record on higher asset levels and the cumulative impact of positive fee-based flows.10

•Transactional revenues increased 18% excluding the impact of mark-to-market on investments associated with DCP.5,14 The increase was driven by higher levels of client activity.

•Net interest income was relatively unchanged as higher yields on the investment portfolio and lending growth offset lower average sweep deposits.

Provision for credit losses:

•Provision for credit losses increased from a year ago driven by higher individual assessments for certain loans.

Total Expenses:

•Compensation expense increased from a year ago on higher compensable revenues, partially offset by lower expenses related to DCP.5, 19

•Non-compensation expenses decreased from a year ago primarily due to the absence of an FDIC special assessment. 19

| ($ millions) | 4Q 2024 | 4Q 2023 | ||||||||||||

| Net Revenues | $7,478 | $6,645 | ||||||||||||

| Asset management | $4,417 | $3,556 | ||||||||||||

Transactional14 | $973 | $1,088 | ||||||||||||

| Net interest | $1,885 | $1,852 | ||||||||||||

| Other | $203 | $149 | ||||||||||||

| Provision for credit losses | $37 | $(19) | ||||||||||||

Total Expenses | $5,388 | $5,236 | ||||||||||||

| Compensation | $3,950 | $3,640 | ||||||||||||

| Non-compensation | $1,438 | $1,596 | ||||||||||||

Investment Management

Investment Management reported net revenues of $1.6 billion compared with $1.5 billion a year ago. Pre-tax income was $414 million compared with $265 million a year ago.6

Net revenues up 12%:

•Asset management and related fees increased from a year ago on higher average AUM primarily driven by higher market levels.12

•Performance-based income and other revenues increased from a year ago on higher mark-to-market gains and accrued carried interest in our private funds.

Total Expenses:

•Compensation expense decreased from a year ago due to lower expenses related to DCP, partially offset by higher compensation associated with carried interest.5, 19

•Non-compensation expenses increased from a year ago, primarily driven by higher distribution expenses on higher average AUM.19

| ($ millions) | 4Q 2024 | 4Q 2023 | ||||||||||||

| Net Revenues | $1,643 | $1,464 | ||||||||||||

| Asset management and related fees | $1,555 | $1,403 | ||||||||||||

| Performance-based income and other | $88 | $61 | ||||||||||||

| Total Expenses | $1,229 | $1,199 | ||||||||||||

| Compensation | $575 | $579 | ||||||||||||

| Non-compensation | $654 | $620 | ||||||||||||

3 | ||

Full Year Results

Institutional Securities

Institutional Securities reported net revenues of $28.1 billion compared with $23.1 billion a year ago. Pre-tax income was $8.7 billion compared with $4.5 billion a year ago.6

Investment Banking revenues up 35%:

•Advisory revenues increased on higher completed M&A transactions.

•Equity underwriting revenues increased on higher IPOs and follow-ons.

•Fixed income underwriting revenues increased from a year ago on higher bond and loan issuances.

Equity net revenues up 22%:

•Equity net revenues were a record on strong performance across all products and geographies as the business navigated improved market conditions, with notable strength in Asia and the Americas.

Fixed Income net revenues up 10%:

•Fixed Income net revenues increased from a year ago reflecting higher results across businesses, with notable strength in credit driven by lending and securitization activity.

Other:

•Other revenues increased from a year ago primarily driven by lower mark-to-market losses on corporate loans, inclusive of hedges, and higher net interest income and fees on corporate loans.

| ($ millions) | FY 2024 | FY 2023 | ||||||||||||

| Net Revenues | $28,080 | $23,060 | ||||||||||||

| Investment Banking | $6,170 | $4,578 | ||||||||||||

| Advisory | $2,378 | $2,244 | ||||||||||||

| Equity underwriting | $1,599 | $889 | ||||||||||||

| Fixed income underwriting | $2,193 | $1,445 | ||||||||||||

| Equity | $12,230 | $9,986 | ||||||||||||

| Fixed Income | $8,418 | $7,673 | ||||||||||||

| Other | $1,262 | $823 | ||||||||||||

| Provision for credit losses | $202 | $401 | ||||||||||||

Total Expenses | $19,129 | $18,183 | ||||||||||||

| Compensation | $8,669 | $8,369 | ||||||||||||

| Non-compensation | $10,460 | $9,814 | ||||||||||||

Provision for credit losses:

•Provision for credit losses decreased due to lower provisions for loans in the commercial real estate sector compared to a year ago, partially offset by growth in the corporate loan portfolio.

Total Expenses:

•Compensation expense increased from a year ago on higher revenues, partially offset by lower severance expenses.19

•Non-compensation expenses increased from a year ago on higher execution-related expenses, partially offset by lower legal costs and lower FDIC special assessments.19

4 | ||

Wealth Management

Wealth Management reported net revenues of $28.4 billion compared with $26.3 billion a year ago. Pre-tax income of $7.7 billion in the current year resulted in a pre-tax margin of 27.2%.6, 7

Net revenues up 8%:

•Asset management revenues increased from a year ago on higher asset levels and the cumulative impact of positive fee-based flows.10

•Transactional revenues increased 11% excluding the impact of mark-to-market on investments associated with DCP.5,14 The increase was driven by higher levels of client activity across product types.

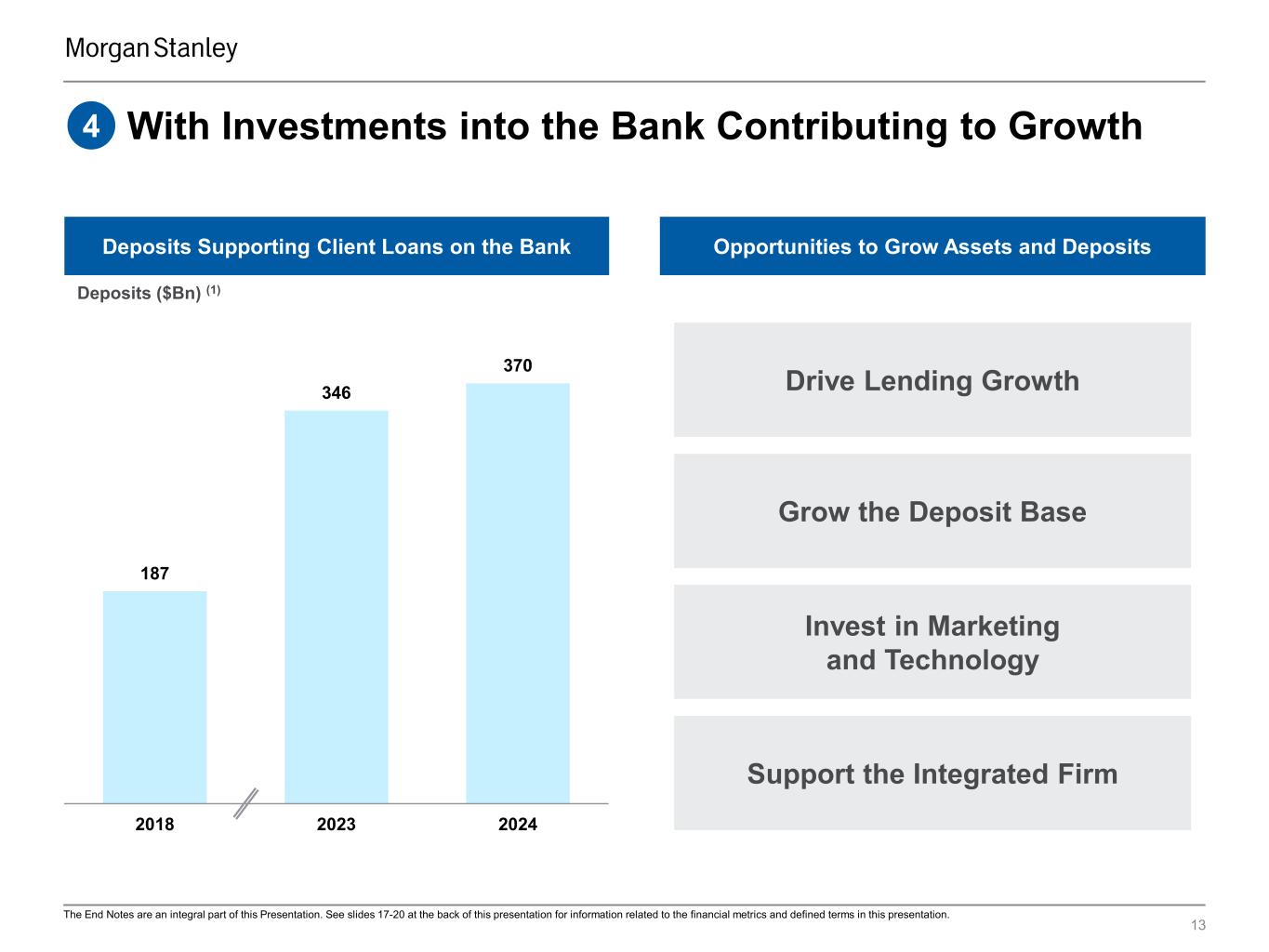

•Net interest income decreased from a year ago due to lower average sweep deposits, partially offset by higher yields on the investment portfolio and lending growth.

Provision for Credit Losses:

•Provision for credit losses decreased primarily due to lower provisions for loans in the commercial real estate sector.

| ($ millions) | FY 2024 | FY 2023 | ||||||||||||

| Net Revenues | $28,420 | $26,268 | ||||||||||||

| Asset management | $16,501 | $14,019 | ||||||||||||

Transactional 14 | $3,864 | $3,556 | ||||||||||||

| Net interest | $7,313 | $8,118 | ||||||||||||

| Other | $742 | $575 | ||||||||||||

| Provision for credit losses | $62 | $131 | ||||||||||||

Total Expenses | $20,618 | $19,607 | ||||||||||||

| Compensation | $15,207 | $13,972 | ||||||||||||

| Non-compensation | $5,411 | $5,635 | ||||||||||||

Total Expenses:

•Compensation expense increased from a year ago on higher compensable revenues.19

•Non-compensation expenses decreased primarily due to lower FDIC special assessments and lower professional services costs post-integration.19

Investment Management

Investment Management reported net revenues of $5.9 billion compared with $5.4 billion a year ago. Pre-tax income was $1.1 billion compared with $842 million a year ago.6

Net revenues up 9%:

•Asset management and related fees increased from a year ago on higher average AUM driven by higher market levels.12

•Performance-based income and other revenues increased from a year ago primarily driven by higher mark-to-market gains and accrued carried interest in our private funds.

Total Expenses:

•Compensation expense increased from a year ago on higher compensation associated with carried interest.19

| ($ millions) | FY 2024 | FY 2023 | ||||||||||||

| Net Revenues | $5,861 | $5,370 | ||||||||||||

| Asset management and related fees | $5,627 | $5,231 | ||||||||||||

| Performance-based income and other | $234 | $139 | ||||||||||||

| Total Expenses | $4,724 | $4,528 | ||||||||||||

| Compensation | $2,302 | $2,217 | ||||||||||||

| Non-compensation | $2,422 | $2,311 | ||||||||||||

•Non-compensation expenses increased primarily driven by higher distribution expenses on higher average AUM.19

5 | ||

Other Matters

•The Firm repurchased $0.8 billion of its outstanding common stock during the quarter and $3.3 billion during the year as part of its Share Repurchase Program.

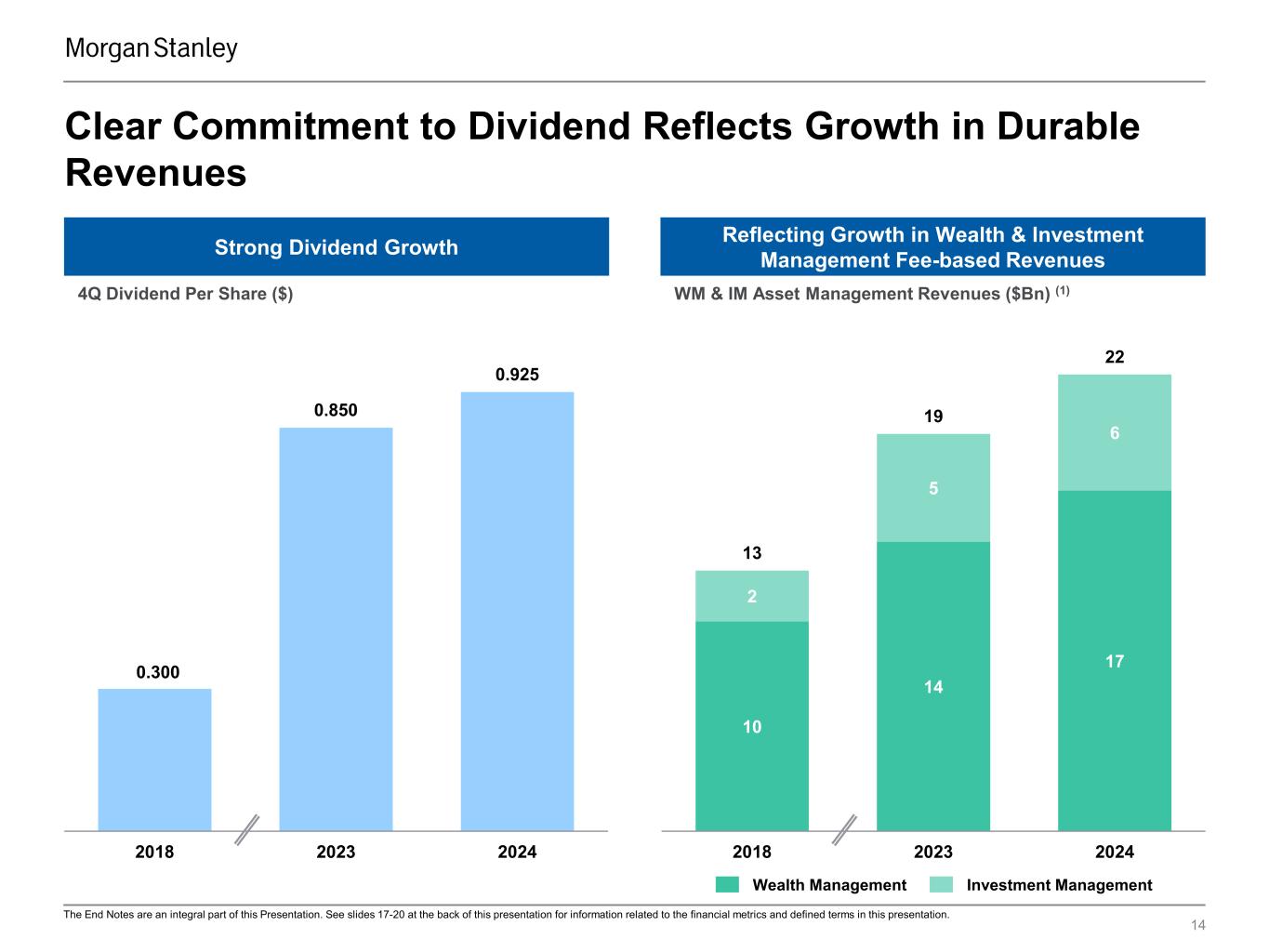

•The Board of Directors declared a $0.925quarterly dividend per share, payable on February 14, 2025 to common shareholders of record on January 31, 2025.

•The effective tax rate for the current quarter was 24.1% and for the full year was 23.1%.

| 4Q 2024 | 4Q 2023 | FY 2024 | FY 2023 | |||||||||||||||||

| Common Stock Repurchases | ||||||||||||||||||||

Repurchases ($MM) | $750 | $1,300 | $3,250 | $5,300 | ||||||||||||||||

Number of Shares (MM) | 6 | 17 | 33 | 62 | ||||||||||||||||

| Average Price | $126.44 | $75.23 | $99.16 | $85.35 | ||||||||||||||||

Period End Shares (MM) | 1,607 | 1,627 | 1,607 | 1,627 | ||||||||||||||||

| Tax Rate | 24.1% | 26.5% | 23.1% | 21.9% | ||||||||||||||||

Capital15 | ||||||||||||||||||||

| Standardized Approach | ||||||||||||||||||||

CET1 capital16 | 15.9 | % | 15.2 | % | ||||||||||||||||

Tier 1 capital16 | 17.9 | % | 17.1 | % | ||||||||||||||||

| Advanced Approach | ||||||||||||||||||||

CET1 capital16 | 15.7 | % | 15.5 | % | ||||||||||||||||

Tier 1 capital16 | 17.7 | % | 17.4 | % | ||||||||||||||||

| Leverage-based capital | ||||||||||||||||||||

Tier 1 leverage17 | 6.9 | % | 6.7 | % | ||||||||||||||||

SLR18 | 5.6 | % | 5.5 | % | ||||||||||||||||

6 | ||

Morgan Stanley (NYSE: MS) is a leading global financial services firm providing a wide range of investment banking, securities, wealth management and investment management services. With offices in 42 countries, the Firm’s employees serve clients worldwide including corporations, governments, institutions and individuals. For further information about Morgan Stanley, please visit www.morganstanley.com.

A financial summary follows. Financial, statistical and business-related information, as well as information regarding business and segment trends, is included in the financial supplement. Both the earnings release and the financial supplement are available online in the Investor Relations section at www.morganstanley.com.

NOTICE:

The information provided herein and in the financial supplement, including information provided on the Firm’s earnings conference calls, may include certain non-GAAP financial measures. The definition of such measures or reconciliation of such measures to the comparable U.S. GAAP figures are included in this earnings release and the financial supplement, both of which are available on www.morganstanley.com.

This earnings release may contain forward-looking statements, including the attainment of certain financial and other targets, objectives and goals. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they are made, which reflect management’s current estimates, projections, expectations, assumptions, interpretations or beliefs and which are subject to risks and uncertainties that may cause actual results to differ materially. For a discussion of risks and uncertainties that may affect the future results of the Firm, please see “Forward-Looking Statements” preceding Part I, Item 1, “Competition” and “Supervision and Regulation” in Part I, Item 1, “Risk Factors” in Part I, Item 1A, “Legal Proceedings” in Part I, Item 3, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7 and “Quantitative and Qualitative Disclosures about Risk” in Part II, Item 7A in the Firm’s Annual Report on Form 10-K for the year ended December 31, 2023 and other items throughout the Form 10-K, the Firm’s Quarterly Reports on Form 10-Q and the Firm’s Current Reports on Form 8-K, including any amendments thereto.

7 | ||

1 Includes preferred dividends related to the calculation of earnings per share for the fourth quarter of 2024 and 2023 of approximately $150 million and $134 million, respectively, and for the years ended 2024 and 2023 of approximately $590 million and $557 million, respectively.

2 The Firm prepares its Consolidated Financial Statements using accounting principles generally accepted in the United States (U.S. GAAP). From time to time, Morgan Stanley may disclose certain “non-GAAP financial measures” in the course of its earnings releases, earnings conference calls, financial presentations and otherwise. The Securities and Exchange Commission defines a “non-GAAP financial measure” as a numerical measure of historical or future financial performance, financial position, or cash flows that is subject to adjustments that effectively exclude, or include amounts from the most directly comparable measure calculated and presented in accordance with U.S. GAAP. Non-GAAP financial measures disclosed by Morgan Stanley are provided as additional information to analysts, investors and other stakeholders in order to provide them with greater transparency about, or an alternative method for assessing our financial condition, operating results, or capital adequacy. These measures are not in accordance with, or a substitute for U.S. GAAP, and may be different from or inconsistent with non-GAAP financial measures used by other companies. Whenever we refer to a non-GAAP financial measure, we will also generally define it or present the most directly comparable financial measure calculated and presented in accordance with U.S. GAAP, along with a reconciliation of the differences between the non-GAAP financial measure we reference and such comparable U.S. GAAP financial measure.

3 Our earnings releases, earnings conference calls, financial presentations and other communications may also include certain metrics which we believe to be useful to us, analysts, investors, and other stakeholders by providing further transparency about, or an additional means of assessing, our financial condition and operating results.

4 Tangible common equity is a non-GAAP financial measure that the Firm considers useful for analysts, investors and other stakeholders to allow comparability of period-to-period operating performance and capital adequacy. Tangible common equity represents common equity less goodwill and intangible assets net of allowable mortgage servicing rights deduction. The calculation of return on average tangible common equity, also a non-GAAP financial measure, represents full year or annualized net income applicable to Morgan Stanley less preferred dividends as a percentage of average tangible common equity. The calculation of tangible book value per common share, also a non-GAAP financial measure, represents tangible common shareholder’s equity divided by common shares outstanding.

5 “DCP” refers to certain employee deferred cash-based compensation programs. Please refer to "Management’s Discussion and Analysis of Financial Condition and Results of Operations – Other Matters – Deferred Cash-Based Compensation” in the Firm’s Annual Report on Form 10-K for the year ended December 31, 2023.

6 Pre-tax income represents income before provision for income taxes.

7 Pre-tax margin represents income before provision for income taxes divided by net revenues.

8 The expense efficiency ratio represents total non-interest expenses as a percentage of net revenues.

9 Wealth Management fee-based client assets represent the amount of assets in client accounts where the basis of payment for services is a fee calculated on those assets.

10 Wealth Management fee-based asset flows include net new fee-based assets (including asset acquisitions), net account transfers, dividends, interest, and client fees, and exclude institutional cash management related activity.

11 Wealth Management net new assets represent client asset inflows, inclusive of interest, dividends and asset acquisitions, less client asset outflows, and exclude the impact of business combinations/divestitures and the impact of fees and commissions.

12 AUM is defined as assets under management or supervision.

13 Long-term net flows include the Equity, Fixed Income and Alternative and Solutions asset classes and excludes the Liquidity and Overlay Services asset class.

14 Transactional revenues include investment banking, trading, and commissions and fee revenues.

15 Capital ratios are estimates as of the press release date, January 16, 2025.

16 CET1 capital is defined as Common Equity Tier 1 capital. The Firm’s risk-based capital ratios are computed under each of the (i) standardized approaches for calculating credit risk and market risk risk‐weighted assets (RWAs) (the “Standardized Approach”) and (ii) applicable advanced approaches for calculating credit risk, market risk and operational risk RWAs (the “Advanced Approach”). For information on the calculation of regulatory capital and ratios, and associated regulatory requirements, please refer to "Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources – Regulatory Requirements" in the Firm’s Annual Report on Form 10-K for the year ended December 31, 2023.

8 | ||

17 The Tier 1 leverage ratio is a leverage-based capital requirement that measures the Firm’s leverage. Tier 1 leverage ratio utilizes Tier 1 capital as the numerator and average adjusted assets as the denominator.

18 The Firm’s supplementary leverage ratio (SLR) utilizes a Tier 1 capital numerator of approximately $84.8 billion and $78.2 billion, and supplementary leverage exposure denominator of approximately $1.52 trillion and $1.43 trillion, for the fourth quarter of 2024 and 2023, respectively.

19 The 2023 full year was negatively impacted by expenses related to severance costs of $353 million, an FDIC special assessment of $286 million, a $249 million legal charge related to a specific matter, and integration-related expenses of $293 million.

a) During the 2023 full year, Compensation and benefits expenses included severance costs of $353 million, associated with a specific reduction in workforce during the second quarter of 2023. The Firm recorded severance costs of $220 million in the Institutional Securities business segment, $105 million in the Wealth Management business segment, and $28 million in the Investment Management business segment for the prior year period. This specific reduction in workforce occurred across the Firm’s business segments and geographic regions, impacted approximately 4% of the Firm’s global workforce in 2023, and resulted from the Firm’s review of its global workforce, operating expenses and the business environment following the acquisitions of E*TRADE Financial Corporation (“E*TRADE”) and Eaton Vance Corp. (“Eaton Vance”), rather than a change in strategy or exit of businesses. These costs were primarily incurred in the Americas and EMEA, with the majority in the Americas.

b) For the quarter and twelve months ended December 31, 2023, Firm results included an FDIC Special Assessment of $286 million and was reported in the business segments' results as follows: Institutional Securities: 4Q23 and 4Q23 YTD: $121 million; Wealth Management: 4Q23 and 4Q23 YTD: $165 million. In 2024, the Firm recorded incremental estimated costs of $36 million based on subsequent notifications received from the FDIC which contained the revised estimated net losses from those bank failures. Expenses related to the FDIC Special Assessment in 2024 were reported in the business segments’ results as follows: Institutional Securities: 4Q24: $(2) million; 4Q24 YTD: $15 million; Wealth Management: 4Q24: $(2) million; 4Q24 YTD: $21 million.

c) For the quarter and twelve months ended December 31, 2023, Firm results included a litigation reserve of $249 million related to a specific legal matter, reported in the Institutional Securities business segment. For further information, please refer to Part II, Item 8, note 14, “Commitments, Guarantees and Contingencies” in the Firm’s Annual Report on Form 10-K for the year ended December 31, 2023.

d) For the quarter and twelve months ended December 31, 2023, Firm results included pre-tax integration-related expenses of $49 million and $293 million, respectively. These expenses related to the integration of E*TRADE within the Wealth Management business segment and the integration of Eaton Vance within the Investment Management business segment. Integration-related expenses primarily included non-compensation expenses such as information technology expense related to the consolidation of platforms, and professional fees related to changes in legal entity structures and the integration of clients, within both Wealth Management and Investment Management business segments. All integration-related activities were substantially completed as of December 31, 2023. The pre-tax integration-related expenses were reported in the business segments' results as follows: Wealth Management: 4Q23: $30 million, 4Q23 YTD: $201 million; Investment Management: 4Q23: $19 million, 4Q23 YTD: $92 million.

d) For the quarter and twelve months ended December 31, 2023, Firm results included pre-tax integration-related expenses of $49 million and $293 million, respectively. These expenses related to the integration of E*TRADE within the Wealth Management business segment and the integration of Eaton Vance within the Investment Management business segment. Integration-related expenses primarily included non-compensation expenses such as information technology expense related to the consolidation of platforms, and professional fees related to changes in legal entity structures and the integration of clients, within both Wealth Management and Investment Management business segments. All integration-related activities were substantially completed as of December 31, 2023. The pre-tax integration-related expenses were reported in the business segments' results as follows: Wealth Management: 4Q23: $30 million, 4Q23 YTD: $201 million; Investment Management: 4Q23: $19 million, 4Q23 YTD: $92 million.

9 | ||

| Consolidated Income Statement Information | |||||||||||||||||||||||||||||||||||||||||||||||

| (unaudited, dollars in millions) | |||||||||||||||||||||||||||||||||||||||||||||||

| Quarter Ended | Percentage Change From: | Twelve Months Ended | Percentage Change | ||||||||||||||||||||||||||||||||||||||||||||

| Dec 31, 2024 | Sep 30, 2024 | Dec 31, 2023 | Sep 30, 2024 | Dec 31, 2023 | Dec 31, 2024 | Dec 31, 2023 | |||||||||||||||||||||||||||||||||||||||||

| Revenues: | |||||||||||||||||||||||||||||||||||||||||||||||

| Investment banking | $ | 1,791 | $ | 1,590 | $ | 1,415 | 13 | % | 27 | % | $ | 6,705 | $ | 4,948 | 36 | % | |||||||||||||||||||||||||||||||

| Trading | 3,778 | 4,002 | 3,305 | (6 | %) | 14 | % | 16,763 | 15,263 | 10 | % | ||||||||||||||||||||||||||||||||||||

| Investments | 215 | 315 | 189 | (32 | %) | 14 | % | 824 | 573 | 44 | % | ||||||||||||||||||||||||||||||||||||

| Commissions and fees | 1,390 | 1,294 | 1,110 | 7 | % | 25 | % | 5,094 | 4,537 | 12 | % | ||||||||||||||||||||||||||||||||||||

| Asset management | 6,059 | 5,747 | 5,041 | 5 | % | 20 | % | 22,499 | 19,617 | 15 | % | ||||||||||||||||||||||||||||||||||||

| Other | 438 | 239 | (61) | 83 | % | * | 1,265 | 975 | 30 | % | |||||||||||||||||||||||||||||||||||||

| Total non-interest revenues | 13,671 | 13,187 | 10,999 | 4 | % | 24 | % | 53,150 | 45,913 | 16 | % | ||||||||||||||||||||||||||||||||||||

| Interest income | 13,491 | 14,185 | 12,830 | (5 | %) | 5 | % | 54,135 | 45,849 | 18 | % | ||||||||||||||||||||||||||||||||||||

| Interest expense | 10,939 | 11,989 | 10,933 | (9 | %) | — | % | 45,524 | 37,619 | 21 | % | ||||||||||||||||||||||||||||||||||||

| Net interest | 2,552 | 2,196 | 1,897 | 16 | % | 35 | % | 8,611 | 8,230 | 5 | % | ||||||||||||||||||||||||||||||||||||

| Net revenues | 16,223 | 15,383 | 12,896 | 5 | % | 26 | % | 61,761 | 54,143 | 14 | % | ||||||||||||||||||||||||||||||||||||

| Provision for credit losses | 115 | 79 | 3 | 46 | % | * | 264 | 532 | (50 | %) | |||||||||||||||||||||||||||||||||||||

| Non-interest expenses: | |||||||||||||||||||||||||||||||||||||||||||||||

| Compensation and benefits | 6,289 | 6,733 | 5,951 | (7 | %) | 6 | % | 26,178 | 24,558 | 7 | % | ||||||||||||||||||||||||||||||||||||

| Non-compensation expenses: | |||||||||||||||||||||||||||||||||||||||||||||||

| Brokerage, clearing and exchange fees | 1,180 | 1,044 | 865 | 13 | % | 36 | % | 4,140 | 3,476 | 19 | % | ||||||||||||||||||||||||||||||||||||

| Information processing and communications | 1,059 | 1,042 | 987 | 2 | % | 7 | % | 4,088 | 3,775 | 8 | % | ||||||||||||||||||||||||||||||||||||

| Professional services | 798 | 711 | 822 | 12 | % | (3 | %) | 2,901 | 3,058 | (5 | %) | ||||||||||||||||||||||||||||||||||||

| Occupancy and equipment | 527 | 473 | 528 | 11 | % | — | % | 1,905 | 1,895 | 1 | % | ||||||||||||||||||||||||||||||||||||

| Marketing and business development | 279 | 224 | 224 | 25 | % | 25 | % | 965 | 898 | 7 | % | ||||||||||||||||||||||||||||||||||||

| Other | 1,070 | 856 | 1,420 | 25 | % | (25 | %) | 3,724 | 4,138 | (10 | %) | ||||||||||||||||||||||||||||||||||||

| Total non-compensation expenses | 4,913 | 4,350 | 4,846 | 13 | % | 1 | % | 17,723 | 17,240 | 3 | % | ||||||||||||||||||||||||||||||||||||

| Total non-interest expenses | 11,202 | 11,083 | 10,797 | 1 | % | 4 | % | 43,901 | 41,798 | 5 | % | ||||||||||||||||||||||||||||||||||||

| Income before provision for income taxes | 4,906 | 4,221 | 2,096 | 16 | % | 134 | % | 17,596 | 11,813 | 49 | % | ||||||||||||||||||||||||||||||||||||

| Provision for income taxes | 1,182 | 995 | 555 | 19 | % | 113 | % | 4,067 | 2,583 | 57 | % | ||||||||||||||||||||||||||||||||||||

| Net income | $ | 3,724 | $ | 3,226 | $ | 1,541 | 15 | % | 142 | % | $ | 13,529 | $ | 9,230 | 47 | % | |||||||||||||||||||||||||||||||

| Net income applicable to nonredeemable noncontrolling interests | 10 | 38 | 24 | (74 | %) | (58 | %) | 139 | 143 | (3 | %) | ||||||||||||||||||||||||||||||||||||

| Net income applicable to Morgan Stanley | 3,714 | 3,188 | 1,517 | 16 | % | 145 | % | 13,390 | 9,087 | 47 | % | ||||||||||||||||||||||||||||||||||||

| Preferred stock dividend | 150 | 160 | 134 | (6 | %) | 12 | % | 590 | 557 | 6 | % | ||||||||||||||||||||||||||||||||||||

| Earnings applicable to Morgan Stanley common shareholders | $ | 3,564 | $ | 3,028 | $ | 1,383 | 18 | % | 158 | % | $ | 12,800 | $ | 8,530 | 50 | % | |||||||||||||||||||||||||||||||

Notes:

–In the first quarter of 2024, the Firm implemented certain presentation changes which resulted in a decrease to both interest income and interest expense of $1,228 million and $4,432 million for the three months and twelve months ended December 31, 2023, respectively and no effect on net interest income, with the entire impact to the Firm recorded within the Institutional Securities segment. These changes further aligned the accounting treatment between the balance sheet and the related interest income or expense, primarily by offsetting interest income and expense for certain prime brokerage-related customer receivables and payables that are currently accounted for as a single unit of account on the balance sheet. The current and previous presentation of these interest income and interest expense amounts are acceptable and the change does not represent a change in accounting principle. These changes were applied retrospectively to the consolidated income statement in 2023 and accordingly, prior period amounts were adjusted to conform with the current presentation.

–Firm net revenues excluding mark-to-market gains and losses on deferred cash-based compensation plans (DCP) were: 4Q24: $16,232 million, 3Q24: $15,144 million, 4Q23: $12,527 million, 4Q24 YTD: $61,398 million, 4Q23 YTD: $53,709 million.

–Firm compensation expenses excluding DCP were: 4Q24: $6,197 million, 3Q24: $6,457 million, 4Q23: $5,597 million, 4Q24 YTD: $25,506 million, 4Q23 YTD: $23,890 million.

–The End Notes are an integral part of this presentation. Refer to pages 12 - 17 of the Financial Supplement for Definition of U.S. GAAP to Non-GAAP Measures, Definitions of Performance Metrics and Terms, Supplemental Quantitative Details and Calculations, and Legal Notice.

10

| Consolidated Financial Metrics, Ratios and Statistical Data | ||||||||||||||||||||||||||||||||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter Ended | Percentage Change From: | Twelve Months Ended | Percentage Change | |||||||||||||||||||||||||||||||||||||||||||||||

| Dec 31, 2024 | Sep 30, 2024 | Dec 31, 2023 | Sep 30, 2024 | Dec 31, 2023 | Dec 31, 2024 | Dec 31, 2023 | ||||||||||||||||||||||||||||||||||||||||||||

| Financial Metrics: | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Earnings per basic share | $ | 2.25 | $ | 1.91 | $ | 0.86 | 18 | % | 162 | % | $ | 8.04 | $ | 5.24 | 53 | % | ||||||||||||||||||||||||||||||||||

| Earnings per diluted share | $ | 2.22 | $ | 1.88 | $ | 0.85 | 18 | % | 161 | % | $ | 7.95 | $ | 5.18 | 53 | % | ||||||||||||||||||||||||||||||||||

| Return on average common equity | 15.2 | % | 13.1 | % | 6.2 | % | 14.0 | % | 9.4 | % | ||||||||||||||||||||||||||||||||||||||||

| Return on average tangible common equity | 20.2 | % | 17.5 | % | 8.4 | % | 18.8 | % | 12.8 | % | ||||||||||||||||||||||||||||||||||||||||

| Book value per common share | $ | 58.98 | $ | 58.25 | $ | 55.50 | $ | 58.98 | $ | 55.50 | ||||||||||||||||||||||||||||||||||||||||

| Tangible book value per common share | $ | 44.57 | $ | 43.76 | $ | 40.89 | $ | 44.57 | $ | 40.89 | ||||||||||||||||||||||||||||||||||||||||

| Financial Ratios: | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Pre-tax margin | 30 | % | 27 | % | 16 | % | 28 | % | 22 | % | ||||||||||||||||||||||||||||||||||||||||

| Compensation and benefits as a % of net revenues | 39 | % | 44 | % | 46 | % | 42 | % | 45 | % | ||||||||||||||||||||||||||||||||||||||||

| Non-compensation expenses as a % of net revenues | 30 | % | 28 | % | 38 | % | 29 | % | 32 | % | ||||||||||||||||||||||||||||||||||||||||

| Firm expense efficiency ratio | 69 | % | 72 | % | 84 | % | 71 | % | 77 | % | ||||||||||||||||||||||||||||||||||||||||

| Effective tax rate | 24.1 | % | 23.6 | % | 26.5 | % | 23.1 | % | 21.9 | % | ||||||||||||||||||||||||||||||||||||||||

| Statistical Data: | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Period end common shares outstanding (millions) | 1,607 | 1,612 | 1,627 | — | % | (1 | %) | |||||||||||||||||||||||||||||||||||||||||||

| Average common shares outstanding (millions) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Basic | 1,583 | 1,588 | 1,606 | — | % | (1 | %) | 1,591 | 1,628 | (2 | %) | |||||||||||||||||||||||||||||||||||||||

| Diluted | 1,608 | 1,609 | 1,627 | — | % | (1 | %) | 1,611 | 1,646 | (2 | %) | |||||||||||||||||||||||||||||||||||||||

| Worldwide employees | 80,478 | 80,205 | 80,006 | — | % | 1 | % | |||||||||||||||||||||||||||||||||||||||||||

The End Notes are an integral part of this presentation. Refer to pages 12 - 17 of the Financial Supplement for Definition of U.S. GAAP to Non-GAAP Measures, Definitions of Performance Metrics and Terms, Supplemental Quantitative Details and Calculations, and Legal Notice.

11

Document 1

| Fourth Quarter 2024 Earnings Results | |||||

| Quarterly Financial Supplement | Page | ||||

| Consolidated Financial Summary | 1 | ||||

| Consolidated Financial Metrics, Ratios and Statistical Data | 2 | ||||

| Consolidated and U.S. Bank Supplemental Financial Information | 3 | ||||

| Consolidated Average Common Equity and Regulatory Capital Information | 4 | ||||

| Institutional Securities Income Statement Information, Financial Metrics and Ratios | 5 | ||||

| Wealth Management Income Statement Information, Financial Metrics and Ratios | 6 | ||||

| Wealth Management Financial Information and Statistical Data | 7 | ||||

| Investment Management Income Statement Information, Financial Metrics and Ratios | 8 | ||||

| Investment Management Financial Information and Statistical Data | 9 | ||||

| Consolidated Loans and Lending Commitments | 10 | ||||

| Consolidated Loans and Lending Commitments Allowance for Credit Losses | 11 | ||||

| Definition of U.S. GAAP to Non-GAAP Measures | 12 | ||||

| Definitions of Performance Metrics and Terms | 13 - 14 | ||||

| Supplemental Quantitative Details and Calculations | 15 - 16 | ||||

| Legal Notice | 17 | ||||

| Consolidated Financial Summary | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| (unaudited, dollars in millions) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter Ended | Percentage Change From: | Twelve Months Ended | Percentage | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Dec 31, 2024 | Sep 30, 2024 | Dec 31, 2023 | Sep 30, 2024 | Dec 31, 2023 | Dec 31, 2024 | Dec 31, 2023 | Change | ||||||||||||||||||||||||||||||||||||||||||||||

| Net revenues | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Institutional Securities | $ | 7,267 | $ | 6,815 | $ | 4,940 | 7 | % | 47 | % | $ | 28,080 | $ | 23,060 | 22 | % | |||||||||||||||||||||||||||||||||||||

| Wealth Management | 7,478 | 7,270 | 6,645 | 3 | % | 13 | % | 28,420 | 26,268 | 8 | % | ||||||||||||||||||||||||||||||||||||||||||

| Investment Management | 1,643 | 1,455 | 1,464 | 13 | % | 12 | % | 5,861 | 5,370 | 9 | % | ||||||||||||||||||||||||||||||||||||||||||

| Intersegment Eliminations | (165) | (157) | (153) | (5 | %) | (8 | %) | (600) | (555) | (8 | %) | ||||||||||||||||||||||||||||||||||||||||||

Net revenues (1) | $ | 16,223 | $ | 15,383 | $ | 12,896 | 5 | % | 26 | % | $ | 61,761 | $ | 54,143 | 14 | % | |||||||||||||||||||||||||||||||||||||

| Provision for credit losses | $ | 115 | $ | 79 | $ | 3 | 46 | % | * | $ | 264 | $ | 532 | (50 | %) | ||||||||||||||||||||||||||||||||||||||

| Non-interest expenses | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Institutional Securities | $ | 4,748 | $ | 4,836 | $ | 4,510 | (2 | %) | 5 | % | $ | 19,129 | $ | 18,183 | 5 | % | |||||||||||||||||||||||||||||||||||||

| Wealth Management | 5,388 | 5,199 | 5,236 | 4 | % | 3 | % | 20,618 | 19,607 | 5 | % | ||||||||||||||||||||||||||||||||||||||||||

| Investment Management | 1,229 | 1,195 | 1,199 | 3 | % | 3 | % | 4,724 | 4,528 | 4 | % | ||||||||||||||||||||||||||||||||||||||||||

| Intersegment Eliminations | (163) | (147) | (148) | (11 | %) | (10 | %) | (570) | (520) | (10 | %) | ||||||||||||||||||||||||||||||||||||||||||

Non-interest expenses (1)(2) | $ | 11,202 | $ | 11,083 | $ | 10,797 | 1 | % | 4 | % | $ | 43,901 | $ | 41,798 | 5 | % | |||||||||||||||||||||||||||||||||||||

| Income before provision for income taxes | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Institutional Securities | $ | 2,441 | $ | 1,911 | $ | 408 | 28 | % | * | $ | 8,749 | $ | 4,476 | 95 | % | ||||||||||||||||||||||||||||||||||||||

| Wealth Management | 2,053 | 2,060 | 1,428 | — | % | 44 | % | 7,740 | 6,530 | 19 | % | ||||||||||||||||||||||||||||||||||||||||||

| Investment Management | 414 | 260 | 265 | 59 | % | 56 | % | 1,137 | 842 | 35 | % | ||||||||||||||||||||||||||||||||||||||||||

| Intersegment Eliminations | (2) | (10) | (5) | 80 | % | 60 | % | (30) | (35) | 14 | % | ||||||||||||||||||||||||||||||||||||||||||

| Income before provision for income taxes | $ | 4,906 | $ | 4,221 | $ | 2,096 | 16 | % | 134 | % | $ | 17,596 | $ | 11,813 | 49 | % | |||||||||||||||||||||||||||||||||||||

| Net Income applicable to Morgan Stanley | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Institutional Securities | $ | 1,891 | $ | 1,436 | $ | 304 | 32 | % | * | $ | 6,666 | $ | 3,453 | 93 | % | ||||||||||||||||||||||||||||||||||||||

| Wealth Management | 1,514 | 1,568 | 1,018 | (3 | %) | 49 | % | 5,888 | 5,022 | 17 | % | ||||||||||||||||||||||||||||||||||||||||||

| Investment Management | 310 | 192 | 199 | 61 | % | 56 | % | 859 | 639 | 34 | % | ||||||||||||||||||||||||||||||||||||||||||

| Intersegment Eliminations | (1) | (8) | (4) | 88 | % | 75 | % | (23) | (27) | 15 | % | ||||||||||||||||||||||||||||||||||||||||||

| Net Income applicable to Morgan Stanley | $ | 3,714 | $ | 3,188 | $ | 1,517 | 16 | % | 145 | % | $ | 13,390 | $ | 9,087 | 47 | % | |||||||||||||||||||||||||||||||||||||

| Earnings applicable to Morgan Stanley common shareholders | $ | 3,564 | $ | 3,028 | $ | 1,383 | 18 | % | 158 | % | $ | 12,800 | $ | 8,530 | 50 | % | |||||||||||||||||||||||||||||||||||||

| Notes: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| - | Firm net revenues excluding mark‐to‐market gains and losses on deferred cash‐based compensation plans (DCP) were: 4Q24: $16,232 million, 3Q24: $15,144 million, 4Q23: $12,527 million, 4Q24 YTD: $61,398 million, 4Q23 YTD: $53,709 million. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| - | Firm compensation expenses excluding DCP were: 4Q24: $6,197 million, 3Q24: $6,457 million, 4Q23: $5,597 million, 4Q24 YTD: $25,506 million, 4Q23 YTD: $23,890 million. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| - | The End Notes are an integral part of this presentation. See pages 12 - 17 for Definition of U.S. GAAP to Non-GAAP Measures, Definitions of Performance Metrics and Terms, Supplemental Quantitative Details and Calculations, and Legal Notice. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

1

| Consolidated Financial Metrics, Ratios and Statistical Data | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| (unaudited) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter Ended | Percentage Change From: | Twelve Months Ended | Percentage | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Dec 31, 2024 | Sep 30, 2024 | Dec 31, 2023 | Sep 30, 2024 | Dec 31, 2023 | Dec 31, 2024 | Dec 31, 2023 | Change | ||||||||||||||||||||||||||||||||||||||||||||||

| Financial Metrics: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Earnings per basic share | $ | 2.25 | $ | 1.91 | $ | 0.86 | 18 | % | 162 | % | $ | 8.04 | $ | 5.24 | 53 | % | |||||||||||||||||||||||||||||||||||||

| Earnings per diluted share | $ | 2.22 | $ | 1.88 | $ | 0.85 | 18 | % | 161 | % | $ | 7.95 | $ | 5.18 | 53 | % | |||||||||||||||||||||||||||||||||||||

| Return on average common equity | 15.2 | % | 13.1 | % | 6.2 | % | 14.0 | % | 9.4 | % | |||||||||||||||||||||||||||||||||||||||||||

| Return on average tangible common equity | 20.2 | % | 17.5 | % | 8.4 | % | 18.8 | % | 12.8 | % | |||||||||||||||||||||||||||||||||||||||||||

| Book value per common share | $ | 58.98 | $ | 58.25 | $ | 55.50 | $ | 58.98 | $ | 55.50 | |||||||||||||||||||||||||||||||||||||||||||

| Tangible book value per common share | $ | 44.57 | $ | 43.76 | $ | 40.89 | $ | 44.57 | $ | 40.89 | |||||||||||||||||||||||||||||||||||||||||||

| Financial Ratios: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pre-tax margin | 30 | % | 27 | % | 16 | % | 28 | % | 22 | % | |||||||||||||||||||||||||||||||||||||||||||

| Compensation and benefits as a % of net revenues | 39 | % | 44 | % | 46 | % | 42 | % | 45 | % | |||||||||||||||||||||||||||||||||||||||||||

| Non-compensation expenses as a % of net revenues | 30 | % | 28 | % | 38 | % | 29 | % | 32 | % | |||||||||||||||||||||||||||||||||||||||||||

Firm expense efficiency ratio (1) | 69 | % | 72 | % | 84 | % | 71 | % | 77 | % | |||||||||||||||||||||||||||||||||||||||||||

Effective tax rate (2) | 24.1 | % | 23.6 | % | 26.5 | % | 23.1 | % | 21.9 | % | |||||||||||||||||||||||||||||||||||||||||||

| Statistical Data: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Period end common shares outstanding (millions) | 1,607 | 1,612 | 1,627 | — | % | (1 | %) | ||||||||||||||||||||||||||||||||||||||||||||||

| Average common shares outstanding (millions) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Basic | 1,583 | 1,588 | 1,606 | — | % | (1 | %) | 1,591 | 1,628 | (2 | %) | ||||||||||||||||||||||||||||||||||||||||||

| Diluted | 1,608 | 1,609 | 1,627 | — | % | (1 | %) | 1,611 | 1,646 | (2 | %) | ||||||||||||||||||||||||||||||||||||||||||

| Worldwide employees | 80,478 | 80,205 | 80,006 | — | % | 1 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| The End Notes are an integral part of this presentation. See pages 12 - 17 for Definition of U.S. GAAP to Non-GAAP Measures, Definitions of Performance Metrics and Terms, Supplemental Quantitative Details and Calculations, and Legal Notice. | |||||||||||||||||||||||||||||||||||||||||||||||||||||

2

| Consolidated and U.S. Bank Supplemental Financial Information | ||||||||||||||||||||||||||||||||||||||||||||||||||

| (unaudited, dollars in millions) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter Ended | Percentage Change From: | Twelve Months Ended | Percentage | |||||||||||||||||||||||||||||||||||||||||||||||

| Dec 31, 2024 | Sep 30, 2024 | Dec 31, 2023 | Sep 30, 2024 | Dec 31, 2023 | Dec 31, 2024 | Dec 31, 2023 | Change | |||||||||||||||||||||||||||||||||||||||||||

| Consolidated Balance sheet | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 1,215,071 | $ | 1,258,027 | $ | 1,193,693 | (3 | %) | 2 | % | ||||||||||||||||||||||||||||||||||||||||

Loans (1) | $ | 246,814 | $ | 239,760 | $ | 226,828 | 3 | % | 9 | % | ||||||||||||||||||||||||||||||||||||||||

| Deposits | $ | 376,007 | $ | 363,722 | $ | 351,804 | 3 | % | 7 | % | ||||||||||||||||||||||||||||||||||||||||

| Long-term debt outstanding | $ | 284,307 | $ | 291,224 | $ | 260,544 | (2 | %) | 9 | % | ||||||||||||||||||||||||||||||||||||||||

| Maturities of long-term debt outstanding (next 12 months) | $ | 21,924 | $ | 25,097 | $ | 20,151 | (13 | %) | 9 | % | ||||||||||||||||||||||||||||||||||||||||

| Average liquidity resources | $ | 345,440 | $ | 342,620 | $ | 314,504 | 1 | % | 10 | % | ||||||||||||||||||||||||||||||||||||||||

| Common equity | $ | 94,761 | $ | 93,897 | $ | 90,288 | 1 | % | 5 | % | ||||||||||||||||||||||||||||||||||||||||

| Less: Goodwill and intangible assets | (23,157) | (23,354) | (23,761) | (1 | %) | (3 | %) | |||||||||||||||||||||||||||||||||||||||||||

| Tangible common equity | $ | 71,604 | $ | 70,543 | $ | 66,527 | 2 | % | 8 | % | ||||||||||||||||||||||||||||||||||||||||

| Preferred equity | $ | 9,750 | $ | 9,750 | $ | 8,750 | — | % | 11 | % | ||||||||||||||||||||||||||||||||||||||||

| U.S. Bank Supplemental Financial Information | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 434,812 | $ | 420,923 | $ | 396,111 | 3 | % | 10 | % | ||||||||||||||||||||||||||||||||||||||||

| Loans | $ | 232,903 | $ | 224,276 | $ | 212,207 | 4 | % | 10 | % | ||||||||||||||||||||||||||||||||||||||||

Investment securities portfolio (2) | $ | 124,343 | $ | 124,551 | $ | 118,008 | — | % | 5 | % | ||||||||||||||||||||||||||||||||||||||||

| Deposits | $ | 369,730 | $ | 357,548 | $ | 346,103 | 3 | % | 7 | % | ||||||||||||||||||||||||||||||||||||||||

| Regional revenues | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Americas | $ | 12,537 | $ | 11,557 | $ | 10,198 | 8 | % | 23 | % | $ | 46,929 | $ | 41,651 | 13 | % | ||||||||||||||||||||||||||||||||||

| EMEA (Europe, Middle East, Africa) | 1,672 | 1,828 | 1,342 | (9 | %) | 25 | % | 7,197 | 6,058 | 19 | % | |||||||||||||||||||||||||||||||||||||||

| Asia | 2,014 | 1,998 | 1,356 | 1 | % | 49 | % | 7,635 | 6,434 | 19 | % | |||||||||||||||||||||||||||||||||||||||

| Consolidated net revenues | $ | 16,223 | $ | 15,383 | $ | 12,896 | 5 | % | 26 | % | $ | 61,761 | $ | 54,143 | 14 | % | ||||||||||||||||||||||||||||||||||

| The End Notes are an integral part of this presentation. See pages 12 - 17 for Definition of U.S. GAAP to Non-GAAP Measures, Definitions of Performance Metrics and Terms, Supplemental Quantitative Details and Calculations, and Legal Notice. | ||||||||||||||||||||||||||||||||||||||||||||||||||

3

| Consolidated Average Common Equity and Regulatory Capital Information | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| (unaudited, dollars in billions) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter Ended | Percentage Change From: | Twelve Months Ended | Percentage | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Dec 31, 2024 | Sep 30, 2024 | Dec 31, 2023 | Sep 30, 2024 | Dec 31, 2023 | Dec 31, 2024 | Dec 31, 2023 | Change | ||||||||||||||||||||||||||||||||||||||||||||||

| Average Common Equity | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Institutional Securities | $ | 45.0 | $ | 45.0 | $ | 45.6 | — | % | (1 | %) | $ | 45.0 | $ | 45.6 | (1 | %) | |||||||||||||||||||||||||||||||||||||

| Wealth Management | 29.1 | 29.1 | 28.8 | — | % | 1 | % | 29.1 | 28.8 | 1 | % | ||||||||||||||||||||||||||||||||||||||||||

| Investment Management | 10.8 | 10.8 | 10.4 | — | % | 4 | % | 10.8 | 10.4 | 4 | % | ||||||||||||||||||||||||||||||||||||||||||

| Parent Company | 9.0 | 7.8 | 5.1 | 15 | % | 76 | % | 6.8 | 6.0 | 13 | % | ||||||||||||||||||||||||||||||||||||||||||

| Firm | $ | 93.9 | $ | 92.7 | $ | 89.9 | 1 | % | 4 | % | $ | 91.7 | $ | 90.8 | 1 | % | |||||||||||||||||||||||||||||||||||||

| Regulatory Capital | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common Equity Tier 1 capital | $ | 75.1 | $ | 73.9 | $ | 69.4 | 2 | % | 8 | % | |||||||||||||||||||||||||||||||||||||||||||

| Tier 1 capital | $ | 84.8 | $ | 83.7 | $ | 78.2 | 1 | % | 8 | % | |||||||||||||||||||||||||||||||||||||||||||

| Standardized Approach | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Risk-weighted assets | $ | 473.5 | $ | 490.3 | $ | 456.1 | (3 | %) | 4 | % | |||||||||||||||||||||||||||||||||||||||||||

| Common Equity Tier 1 capital ratio | 15.9 | % | 15.1 | % | 15.2 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Tier 1 capital ratio | 17.9 | % | 17.1 | % | 17.1 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Advanced Approach | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Risk-weighted assets | $ | 479.3 | $ | 495.0 | $ | 448.2 | (3 | %) | 7 | % | |||||||||||||||||||||||||||||||||||||||||||

| Common Equity Tier 1 capital ratio | 15.7 | % | 14.9 | % | 15.5 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Tier 1 capital ratio | 17.7 | % | 16.9 | % | 17.4 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Leverage-based capital | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tier 1 leverage ratio | 6.9 | % | 6.9 | % | 6.7 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Supplementary Leverage Ratio | 5.6 | % | 5.5 | % | 5.5 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| The End Notes are an integral part of this presentation. See pages 12 - 17 for Definition of U.S. GAAP to Non-GAAP Measures, Definitions of Performance Metrics and Terms, Supplemental Quantitative Details and Calculations, and Legal Notice. | |||||||||||||||||||||||||||||||||||||||||||||||||||||

4

| Institutional Securities | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Income Statement Information, Financial Metrics and Ratios | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| (unaudited, dollars in millions) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter Ended | Percentage Change From: | Twelve Months Ended | Percentage | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Dec 31, 2024 | Sep 30, 2024 | Dec 31, 2023 | Sep 30, 2024 | Dec 31, 2023 | Dec 31, 2024 | Dec 31, 2023 | Change | ||||||||||||||||||||||||||||||||||||||||||||||

| Revenues: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Advisory | $ | 779 | $ | 546 | $ | 702 | 43 | % | 11 | % | $ | 2,378 | $ | 2,244 | 6 | % | |||||||||||||||||||||||||||||||||||||

| Equity | 455 | 362 | 225 | 26 | % | 102 | % | 1,599 | 889 | 80 | % | ||||||||||||||||||||||||||||||||||||||||||

| Fixed income | 407 | 555 | 391 | (27 | %) | 4 | % | 2,193 | 1,445 | 52 | % | ||||||||||||||||||||||||||||||||||||||||||

| Underwriting | 862 | 917 | 616 | (6 | %) | 40 | % | 3,792 | 2,334 | 62 | % | ||||||||||||||||||||||||||||||||||||||||||

| Investment banking | 1,641 | 1,463 | 1,318 | 12 | % | 25 | % | 6,170 | 4,578 | 35 | % | ||||||||||||||||||||||||||||||||||||||||||

| Equity | 3,325 | 3,045 | 2,202 | 9 | % | 51 | % | 12,230 | 9,986 | 22 | % | ||||||||||||||||||||||||||||||||||||||||||

| Fixed income | 1,931 | 2,003 | 1,434 | (4 | %) | 35 | % | 8,418 | 7,673 | 10 | % | ||||||||||||||||||||||||||||||||||||||||||

| Other | 370 | 304 | (14) | 22 | % | * | 1,262 | 823 | 53 | % | |||||||||||||||||||||||||||||||||||||||||||

| Net revenues | 7,267 | 6,815 | 4,940 | 7 | % | 47 | % | 28,080 | 23,060 | 22 | % | ||||||||||||||||||||||||||||||||||||||||||

| Provision for credit losses | 78 | 68 | 22 | 15 | % | * | 202 | 401 | (50 | %) | |||||||||||||||||||||||||||||||||||||||||||

| Compensation and benefits | 1,764 | 2,271 | 1,732 | (22 | %) | 2 | % | 8,669 | 8,369 | 4 | % | ||||||||||||||||||||||||||||||||||||||||||

| Non-compensation expenses | 2,984 | 2,565 | 2,778 | 16 | % | 7 | % | 10,460 | 9,814 | 7 | % | ||||||||||||||||||||||||||||||||||||||||||

| Total non-interest expenses | 4,748 | 4,836 | 4,510 | (2 | %) | 5 | % | 19,129 | 18,183 | 5 | % | ||||||||||||||||||||||||||||||||||||||||||

| Income before provision for income taxes | 2,441 | 1,911 | 408 | 28 | % | * | 8,749 | 4,476 | 95 | % | |||||||||||||||||||||||||||||||||||||||||||

| Net income applicable to Morgan Stanley | $ | 1,891 | $ | 1,436 | $ | 304 | 32 | % | * | $ | 6,666 | $ | 3,453 | 93 | % | ||||||||||||||||||||||||||||||||||||||

| Pre-tax margin | 34 | % | 28 | % | 8 | % | 31 | % | 19 | % | |||||||||||||||||||||||||||||||||||||||||||

| Compensation and benefits as a % of net revenues | 24 | % | 33 | % | 35 | % | 31 | % | 36 | % | |||||||||||||||||||||||||||||||||||||||||||

| Non-compensation expenses as a % of net revenues | 41 | % | 38 | % | 56 | % | 37 | % | 43 | % | |||||||||||||||||||||||||||||||||||||||||||

| Return on Average Common Equity | 16 | % | 12 | % | 2 | % | 14 | % | 7 | % | |||||||||||||||||||||||||||||||||||||||||||

Return on Average Tangible Common Equity (1) | 16 | % | 12 | % | 2 | % | 14 | % | 7 | % | |||||||||||||||||||||||||||||||||||||||||||

| Trading VaR (Average Daily 95% / One-Day VaR) | $ | 46 | $ | 46 | $ | 46 | |||||||||||||||||||||||||||||||||||||||||||||||

| The End Notes are an integral part of this presentation. See pages 12 - 17 for Definition of U.S. GAAP to Non-GAAP Measures, Definitions of Performance Metrics and Terms, Supplemental Quantitative Details and Calculations, and Legal Notice. | |||||||||||||||||||||||||||||||||||||||||||||||||||||

5

| Wealth Management | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Income Statement Information, Financial Metrics and Ratios | ||||||||||||||||||||||||||||||||||||||||||||||||||

| (unaudited, dollars in millions) | ||||||||||||||||||||||||||||||||||||||||||||||||||

Quarter Ended | Percentage Change From: | Twelve Months Ended | Percentage | |||||||||||||||||||||||||||||||||||||||||||||||

| Dec 31, 2024 | Sep 30, 2024 | Dec 31, 2023 | Sep 30, 2024 | Dec 31, 2023 | Dec 31, 2024 | Dec 31, 2023 | Change | |||||||||||||||||||||||||||||||||||||||||||

| Revenues: | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Asset management | $ | 4,417 | $ | 4,266 | $ | 3,556 | 4 | % | 24 | % | $ | 16,501 | $ | 14,019 | 18 | % | ||||||||||||||||||||||||||||||||||

| Transactional | 973 | 1,076 | 1,088 | (10 | %) | (11 | %) | 3,864 | 3,556 | 9 | % | |||||||||||||||||||||||||||||||||||||||

| Net interest income | 1,885 | 1,774 | 1,852 | 6 | % | 2 | % | 7,313 | 8,118 | (10 | %) | |||||||||||||||||||||||||||||||||||||||

| Other | 203 | 154 | 149 | 32 | % | 36 | % | 742 | 575 | 29 | % | |||||||||||||||||||||||||||||||||||||||

Net revenues (1) | 7,478 | 7,270 | 6,645 | 3 | % | 13 | % | 28,420 | 26,268 | 8 | % | |||||||||||||||||||||||||||||||||||||||

| Provision for credit losses | 37 | 11 | (19) | * | * | 62 | 131 | (53 | %) | |||||||||||||||||||||||||||||||||||||||||

Compensation and benefits (1) | 3,950 | 3,868 | 3,640 | 2 | % | 9 | % | 15,207 | 13,972 | 9 | % | |||||||||||||||||||||||||||||||||||||||

| Non-compensation expenses | 1,438 | 1,331 | 1,596 | 8 | % | (10 | %) | 5,411 | 5,635 | (4 | %) | |||||||||||||||||||||||||||||||||||||||

| Total non-interest expenses | 5,388 | 5,199 | 5,236 | 4 | % | 3 | % | 20,618 | 19,607 | 5 | % | |||||||||||||||||||||||||||||||||||||||

| Income before provision for income taxes | 2,053 | 2,060 | 1,428 | — | % | 44 | % | 7,740 | 6,530 | 19 | % | |||||||||||||||||||||||||||||||||||||||

| Net income applicable to Morgan Stanley | $ | 1,514 | $ | 1,568 | $ | 1,018 | (3 | %) | 49 | % | $ | 5,888 | $ | 5,022 | 17 | % | ||||||||||||||||||||||||||||||||||

| Pre-tax margin | 27 | % | 28 | % | 21 | % | 27 | % | 25 | % | ||||||||||||||||||||||||||||||||||||||||

| Compensation and benefits as a % of net revenues | 53 | % | 53 | % | 55 | % | 54 | % | 53 | % | ||||||||||||||||||||||||||||||||||||||||

| Non-compensation expenses as a % of net revenues | 19 | % | 18 | % | 24 | % | 19 | % | 21 | % | ||||||||||||||||||||||||||||||||||||||||

| Return on Average Common Equity | 20 | % | 21 | % | 14 | % | 20 | % | 17 | % | ||||||||||||||||||||||||||||||||||||||||

Return on Average Tangible Common Equity (2) | 38 | % | 39 | % | 27 | % | 37 | % | 33 | % | ||||||||||||||||||||||||||||||||||||||||

| Notes: | ||||||||||||||||||||||||||||||||||||||||||||||||||

| - | Wealth Management net revenues excluding DCP were: 4Q24: $7,504 million, 3Q24: $7,100 million, 4Q23: $6,403 million, 4Q24 YTD: $28,181 million, 4Q23 YTD: $25,986 million. | |||||||||||||||||||||||||||||||||||||||||||||||||

| - | Wealth Management compensation expenses excluding DCP were: 4Q24: $3,892 million, 3Q24: $3,684 million, 4Q23: $3,406 million, 4Q24 YTD: $14,776 million, 4Q23 YTD: $13,560 million. | |||||||||||||||||||||||||||||||||||||||||||||||||

| - | The End Notes are an integral part of this presentation. See pages 12 - 17 for Definition of U.S. GAAP to Non-GAAP Measures, Definitions of Performance Metrics and Terms, Supplemental Quantitative Details and Calculations, and Legal Notice. | |||||||||||||||||||||||||||||||||||||||||||||||||

6

| Wealth Management | |||||||||||||||||||||||||||||||||||

| Financial Information and Statistical Data | |||||||||||||||||||||||||||||||||||

| (unaudited, dollars in billions) | |||||||||||||||||||||||||||||||||||

| Quarter Ended | Percentage Change From: | ||||||||||||||||||||||||||||||||||

| Dec 31, 2024 | Sep 30, 2024 | Dec 31, 2023 | Sep 30, 2024 | Dec 31, 2023 | |||||||||||||||||||||||||||||||

| Wealth Management Metrics | |||||||||||||||||||||||||||||||||||

| Total client assets | $ | 6,194 | $ | 5,974 | $ | 5,129 | 4 | % | 21 | % | |||||||||||||||||||||||||

| Net new assets | $ | 56.5 | $ | 63.9 | $ | 47.5 | (12 | %) | 19 | % | |||||||||||||||||||||||||

| U.S. Bank loans | $ | 159.5 | $ | 155.2 | $ | 146.5 | 3 | % | 9 | % | |||||||||||||||||||||||||

Margin and other lending (1) | $ | 28.3 | $ | 25.7 | $ | 21.4 | 10 | % | 32 | % | |||||||||||||||||||||||||

Deposits (2) | $ | 370 | $ | 358 | $ | 346 | 3 | % | 7 | % | |||||||||||||||||||||||||

| Annualized weighted average cost of deposits | |||||||||||||||||||||||||||||||||||

| Period end | 2.73 | % | 2.99 | % | 2.92 | % | |||||||||||||||||||||||||||||

| Period average | 2.94 | % | 3.19 | % | 2.86 | % | |||||||||||||||||||||||||||||

| Advisor-led channel | |||||||||||||||||||||||||||||||||||

| Advisor-led client assets | $ | 4,758 | $ | 4,647 | $ | 3,979 | 2 | % | 20 | % | |||||||||||||||||||||||||

| Fee-based client assets | $ | 2,347 | $ | 2,302 | $ | 1,983 | 2 | % | 18 | % | |||||||||||||||||||||||||

| Fee-based asset flows | $ | 35.2 | $ | 35.7 | $ | 41.6 | (1 | %) | (15 | %) | |||||||||||||||||||||||||

| Fee-based assets as a % of advisor-led client assets | 49 | % | 50 | % | 50 | % | |||||||||||||||||||||||||||||

| Self-directed channel | |||||||||||||||||||||||||||||||||||

| Self-directed client assets | $ | 1,437 | $ | 1,327 | $ | 1,150 | 8 | % | 25 | % | |||||||||||||||||||||||||

| Daily average revenue trades (000's) | 911 | 815 | 705 | 12 | % | 29 | % | ||||||||||||||||||||||||||||

| Self-directed households (millions) | 8.3 | 8.2 | 8.1 | 1 | % | 2 | % | ||||||||||||||||||||||||||||

| Workplace channel | |||||||||||||||||||||||||||||||||||

| Stock plan unvested assets | $ | 475 | $ | 461 | $ | 416 | 3 | % | 14 | % | |||||||||||||||||||||||||

| Number of stock plan participants (millions) | 6.6 | 6.7 | 6.6 | (1 | %) | — | % | ||||||||||||||||||||||||||||

| The End Notes are an integral part of this presentation. See pages 12 - 17 for Definition of U.S. GAAP to Non-GAAP Measures, Definitions of Performance Metrics and Terms, Supplemental Quantitative Details and Calculations, and Legal Notice. | |||||||||||||||||||||||||||||||||||

7

| Investment Management | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Income Statement Information, Financial Metrics and Ratios | ||||||||||||||||||||||||||||||||||||||||||||||||||

| (unaudited, dollars in millions) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter Ended | Percentage Change From: | Twelve Months Ended | Percentage | |||||||||||||||||||||||||||||||||||||||||||||||

| Dec 31, 2024 | Sep 30, 2024 | Dec 31, 2023 | Sep 30, 2024 | Dec 31, 2023 | Dec 31, 2024 | Dec 31, 2023 | Change | |||||||||||||||||||||||||||||||||||||||||||

| Revenues: | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Asset management and related fees | $ | 1,555 | $ | 1,384 | $ | 1,403 | 12 | % | 11 | % | $ | 5,627 | $ | 5,231 | 8 | % | ||||||||||||||||||||||||||||||||||

| Performance-based income and other | 88 | 71 | 61 | 24 | % | 44 | % | 234 | 139 | 68 | % | |||||||||||||||||||||||||||||||||||||||

| Net revenues | 1,643 | 1,455 | 1,464 | 13 | % | 12 | % | 5,861 | 5,370 | 9 | % | |||||||||||||||||||||||||||||||||||||||

| Compensation and benefits | 575 | 594 | 579 | (3 | %) | (1 | %) | 2,302 | 2,217 | 4 | % | |||||||||||||||||||||||||||||||||||||||

| Non-compensation expenses | 654 | 601 | 620 | 9 | % | 5 | % | 2,422 | 2,311 | 5 | % | |||||||||||||||||||||||||||||||||||||||

| Total non-interest expenses | 1,229 | 1,195 | 1,199 | 3 | % | 3 | % | 4,724 | 4,528 | 4 | % | |||||||||||||||||||||||||||||||||||||||

| Income before provision for income taxes | 414 | 260 | 265 | 59 | % | 56 | % | 1,137 | 842 | 35 | % | |||||||||||||||||||||||||||||||||||||||

| Net income applicable to Morgan Stanley | $ | 310 | $ | 192 | $ | 199 | 61 | % | 56 | % | $ | 859 | $ | 639 | 34 | % | ||||||||||||||||||||||||||||||||||

| Pre-tax margin | 25 | % | 18 | % | 18 | % | 19 | % | 16 | % | ||||||||||||||||||||||||||||||||||||||||

| Compensation and benefits as a % of net revenues | 35 | % | 41 | % | 40 | % | 39 | % | 41 | % | ||||||||||||||||||||||||||||||||||||||||

| Non-compensation expenses as a % of net revenues | 40 | % | 41 | % | 42 | % | 41 | % | 43 | % | ||||||||||||||||||||||||||||||||||||||||

| Return on Average Common Equity | 11 | % | 7 | % | 8 | % | 8 | % | 6 | % | ||||||||||||||||||||||||||||||||||||||||

Return on Average Tangible Common Equity (1) | 109 | % | 68 | % | 110 | % | 76 | % | 88 | % | ||||||||||||||||||||||||||||||||||||||||

| The End Notes are an integral part of this presentation. See pages 12 - 17 for Definition of U.S. GAAP to Non-GAAP Measures, Definitions of Performance Metrics and Terms, Supplemental Quantitative Details and Calculations, and Legal Notice. | ||||||||||||||||||||||||||||||||||||||||||||||||||

8

| Investment Management | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Financial Information and Statistical Data | ||||||||||||||||||||||||||||||||||||||||||||||||||

| (unaudited, dollars in billions) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter Ended | Percentage Change From: | Twelve Months Ended | Percentage | |||||||||||||||||||||||||||||||||||||||||||||||

| Dec 31, 2024 | Sep 30, 2024 | Dec 31, 2023 | Sep 30, 2024 | Dec 31, 2023 | Dec 31, 2024 | Dec 31, 2023 | Change | |||||||||||||||||||||||||||||||||||||||||||

| Assets Under Management or Supervision (AUM) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Net Flows by Asset Class | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Equity | $ | (6.7) | $ | (5.6) | $ | (6.5) | (20 | %) | (3 | %) | $ | (27.0) | $ | (19.4) | (39 | %) | ||||||||||||||||||||||||||||||||||

| Fixed Income | 8.0 | 4.4 | (0.2) | 82 | % | * | 16.2 | (9.3) | * | |||||||||||||||||||||||||||||||||||||||||

| Alternatives and Solutions | 3.0 | 8.5 | (0.4) | (65 | %) | * | 28.8 | 13.5 | 113 | % | ||||||||||||||||||||||||||||||||||||||||

| Long-Term Net Flows | 4.3 | 7.3 | (7.1) | (41 | %) | * | $ | 18.0 | $ | (15.2) | * | |||||||||||||||||||||||||||||||||||||||

| Liquidity and Overlay Services | 66.8 | 9.3 | (6.6) | * | * | 64.5 | 22.7 | 184 | % | |||||||||||||||||||||||||||||||||||||||||

| Total Net Flows | $ | 71.1 | $ | 16.6 | $ | (13.7) | * | * | $ | 82.5 | $ | 7.5 | * | |||||||||||||||||||||||||||||||||||||

| Assets Under Management or Supervision by Asset Class | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Equity | $ | 312 | $ | 316 | $ | 295 | (1 | %) | 6 | % | ||||||||||||||||||||||||||||||||||||||||

| Fixed Income | 192 | 188 | 171 | 2 | % | 12 | % | |||||||||||||||||||||||||||||||||||||||||||

| Alternatives and Solutions | 593 | 591 | 508 | — | % | 17 | % | |||||||||||||||||||||||||||||||||||||||||||

| Long‐Term Assets Under Management or Supervision | 1,097 | 1,095 | 974 | — | % | 13 | % | |||||||||||||||||||||||||||||||||||||||||||

| Liquidity and Overlay Services | 569 | 503 | 485 | 13 | % | 17 | % | |||||||||||||||||||||||||||||||||||||||||||

| Total Assets Under Management or Supervision | $ | 1,666 | $ | 1,598 | $ | 1,459 | 4 | % | 14 | % | ||||||||||||||||||||||||||||||||||||||||

| The End Notes are an integral part of this presentation. See pages 12 - 17 for Definition of U.S. GAAP to Non-GAAP Measures, Definitions of Performance Metrics and Terms, Supplemental Quantitative Details and Calculations, and Legal Notice. | ||||||||||||||||||||||||||||||||||||||||||||||||||

9

| Consolidated Loans and Lending Commitments | ||||||||||||||||||||||||||||||||

| (unaudited, dollars in billions) | ||||||||||||||||||||||||||||||||

| Quarter Ended | Percentage Change From: | |||||||||||||||||||||||||||||||

| Dec 31, 2024 | Sep 30, 2024 | Dec 31, 2023 | Sep 30, 2024 | Dec 31, 2023 | ||||||||||||||||||||||||||||

| Institutional Securities | ||||||||||||||||||||||||||||||||

| Loans: | ||||||||||||||||||||||||||||||||

| Corporate | $ | 15.9 | $ | 15.2 | $ | 18.4 | 5 | % | (14 | %) | ||||||||||||||||||||||

| Secured lending facilities | 51.2 | 49.2 | 42.5 | 4 | % | 20 | % | |||||||||||||||||||||||||

| Commercial and residential real estate | 11.1 | 11.8 | 11.7 | (6 | %) | (5 | %) | |||||||||||||||||||||||||

| Securities-based lending and other | 8.9 | 7.8 | 7.2 | 14 | % | 24 | % | |||||||||||||||||||||||||

| Total Loans | 87.1 | 84.0 | 79.8 | 4 | % | 9 | % | |||||||||||||||||||||||||

| Lending Commitments | 156.9 | 151.9 | 130.4 | 3 | % | 20 | % | |||||||||||||||||||||||||

| Institutional Securities Loans and Lending Commitments | $ | 244.0 | $ | 235.9 | $ | 210.2 | 3 | % | 16 | % | ||||||||||||||||||||||

| Wealth Management | ||||||||||||||||||||||||||||||||

| Loans: | ||||||||||||||||||||||||||||||||

| Securities-based lending and other | $ | 92.9 | $ | 90.4 | $ | 86.2 | 3 | % | 8 | % | ||||||||||||||||||||||

| Residential real estate | 66.6 | 64.9 | 60.3 | 3 | % | 10 | % | |||||||||||||||||||||||||

| Total Loans | 159.5 | 155.3 | 146.5 | 3 | % | 9 | % | |||||||||||||||||||||||||

| Lending Commitments | 19.3 | 18.4 | 19.6 | 5 | % | (2 | %) | |||||||||||||||||||||||||

| Wealth Management Loans and Lending Commitments | $ | 178.8 | $ | 173.7 | $ | 166.1 | 3 | % | 8 | % | ||||||||||||||||||||||

Consolidated Loans and Lending Commitments (1) | $ | 422.8 | $ | 409.6 | $ | 376.3 | 3 | % | 12 | % | ||||||||||||||||||||||

| The End Notes are an integral part of this presentation. See pages 12 - 17 for Definition of U.S. GAAP to Non-GAAP Measures, Definitions of Performance Metrics and Terms, Supplemental Quantitative Details and Calculations, and Legal Notice. | ||||||||||||||||||||||||||||||||

10

| Consolidated Loans and Lending Commitments | |||||||||||||||||||||||||||||

| Allowance for Credit Losses (ACL) as of December 31, 2024 | |||||||||||||||||||||||||||||

| (unaudited, dollars in millions) | |||||||||||||||||||||||||||||

| Loans and Lending Commitments | ACL (1) | ACL % | Q4 Provision | ||||||||||||||||||||||||||

| (Gross) | |||||||||||||||||||||||||||||

| Loans: | |||||||||||||||||||||||||||||

| Held For Investment (HFI) | |||||||||||||||||||||||||||||

| Corporate | $ | 6,889 | $ | 200 | 2.9 | % | $ | (22) | |||||||||||||||||||||

| Secured lending facilities | 48,842 | 140 | 0.3 | % | 13 | ||||||||||||||||||||||||

| Commercial and residential real estate | 8,412 | 373 | 4.4 | % | 33 | ||||||||||||||||||||||||

| Other | 2,876 | 17 | 0.6 | % | 3 | ||||||||||||||||||||||||

| Institutional Securities - HFI | $ | 67,019 | $ | 730 | 1.1 | % | $ | 27 | |||||||||||||||||||||

| Wealth Management - HFI | 159,877 | 336 | 0.2 | % | 38 | ||||||||||||||||||||||||

| Held For Investment | $ | 226,896 | $ | 1,066 | 0.5 | % | $ | 65 | |||||||||||||||||||||

| Held For Sale | 12,319 | ||||||||||||||||||||||||||||

| Fair Value | 8,461 | ||||||||||||||||||||||||||||

| Total Loans | 247,676 | 1,066 | 65 | ||||||||||||||||||||||||||

| Lending Commitments | 176,206 | 656 | 0.4 | % | 50 | ||||||||||||||||||||||||

| Consolidated Loans and Lending Commitments | $ | 423,882 | $ | 1,722 | $ | 115 | |||||||||||||||||||||||

| The End Notes are an integral part of this presentation. See pages 12 - 17 for Definition of U.S. GAAP to Non-GAAP Measures, Definitions of Performance Metrics and Terms, Supplemental Quantitative Details and Calculations, and Legal Notice. | |||||||||||||||||||||||||||||

11

| Definition of U.S. GAAP to Non-GAAP Measures | ||||||||

| (a) | We prepare our financial statements using U.S. GAAP. From time to time, we may disclose certain “non‐GAAP financial measures” in this document or in the course of our earnings releases, earnings and other conference calls, financial presentations, definitive proxy statements and other public disclosures. A “non‐GAAP financial measure” excludes, or includes, amounts from the most directly comparable measure calculated and presented in accordance with U.S. GAAP. We consider the non‐GAAP financial measures we disclose to be useful to us, investors, analysts and other stakeholders by providing further transparency about, or an alternate means of assessing or comparing our financial condition, operating results and capital adequacy. These measures are not in accordance with, or a substitute for, U.S. GAAP and may be different from or inconsistent with non‐GAAP financial measures used by other companies. Whenever we refer to a non‐GAAP financial measure, we will also generally define it or present the most directly comparable financial measure calculated and presented in accordance with U.S. GAAP, along with a reconciliation of the differences between the U.S. GAAP financial measure and the non‐GAAP financial measure. We present certain non‐GAAP financial measures that exclude the impact of mark‐to-market gains and losses on DCP investments from net revenues and compensation expenses. The impact of DCP is primarily reflected in our Wealth Management business segment results. These measures allow for better comparability of period‐to‐period underlying operating performance and revenue trends, especially in our Wealth Management business segment. By excluding the impact of these items, we are better able to describe the business drivers and resulting impact to net revenues and corresponding change to the associated compensation expenses. For more information, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Executive Summary” in the 2023 Form 10‐K. | |||||||

| (b) | The following are considered non‐GAAP financial measures: | |||||||

| - | Tangible common equity represents common shareholders’ equity less goodwill and intangible assets net of allowable mortgage servicing rights deduction. In addition, we believe that certain ratios that utilize tangible common equity, such as return on average tangible common equity (“ROTCE”) and tangible book value per common share, also non‐GAAP financial measures, are useful for evaluating the operating performance and capital adequacy of the business period‐to‐period, respectively. | |||||||

| - | ROTCE represents annualized earnings applicable to Morgan Stanley common shareholders as a percentage of average tangible common equity. | |||||||

| - | Tangible book value per common share represents tangible common equity divided by common shares outstanding. | |||||||